Nghe An Finance Industry: A year of spectacular completion

(Baonghean.vn) - In 2020, Nghe An Finance sector contributed with the whole province to implement the socio-economic development plan in the context of facing many difficulties and challenges...

Initial results

In 2020,budget revenue estimatesState (NSNN) assigned by the Provincial People's Council

15,216 billion VND. Budget revenue in the province in 2020 reached 17,128 billion VND. Domestic revenue reached 16,001 billion VND, equal to 119.3% of the Provincial People's Council's estimate, 116.3% of the adjusted estimate and 110% over the same period.

Revenue from import and export activities is estimated at more than 1,100 billion VND, equal to 66.7% of the adjusted provincial People's Council estimate and 70.6% compared to the same period in 2019. This is considered a "spectacular" result in an extremely difficult context.

|

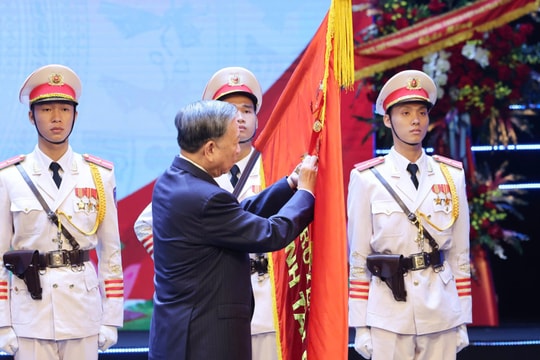

| Provincial Party Secretary Thai Thanh Quy and his delegation presented flowers to congratulate the Department of Finance on the occasion of the New Year 2021. Photo: Thanh Duy |

Assessment of the State budget revenue results in 2020 shows that: The State budget revenue results from import and export activities in 2020 were low, the collection progress was slow and decreased sharply compared to the same period in 2019. State budget revenue from items with large tax revenues accounting for 60-70% of total import and export revenue all decreased sharply. The reason is that the actual import and export activities were affected by the Covid-19 epidemic.

Although all levels and sectors have made great efforts in budget collection, the impact of the Covid-19 epidemic has resulted in the estimated domestic revenue (excluding land use fees and lottery revenue) and import and export revenue in 2020 not reaching the adjusted estimate of the Provincial People's Council.

Regarding budget expenditure, in 2020 it is estimated to reach 29,688 billion VND, reaching 108.1% of the adjusted provincial People's Council estimate.

In 2020, Nghe An Finance sector has done a good job of advising on budget revenue and expenditure in the area, effectively supporting the leadership, direction and operation of political tasks and socio-economic development of the province.

The industry has also builtincome and expenditure scenarioState budget in 2020 according to the situations and developments of the Covid-19 pandemic. Review and adjust the 3-year financial budget plan (2020 - 2022) according to regulations. Develop the 2021 State budget estimate and the 3-year financial budget plan (2021 - 2023) to work with the Ministry of Finance. Based on the data discussed on the 2021 State budget estimate and the 3-year financial budget plan (2021 - 2023) with the Ministry of Finance, develop the 2021 State budget revenue and expenditure estimate, the 3-year financial budget plan (2021 - 2023), the 5-year financial plan (2021 - 2025) of the province...

|

| Some key projects in Nghe An province. Photo: PV |

Arrange funding for site clearance for key projects, funding for prevention and control of African swine fever; funding for implementing policies on streamlining payrolls, and allocating sources to increase provincial budget revenue in 2019.

The industry has advised on allocating funds for Covid-19 prevention and control according to Resolution No. 37/NQ-CP of the Government, amounting to VND 140.3 billion. At the same time, it has advised on providing 7 direct support packages from the State budget for those affected by the Covid-19 epidemic according to Resolution No. 42/2020 of the Government with VND 621 billion.

Focus on solutions to collect budget in 2021

To successfully carry out the financial and budgetary tasks in 2021, the Finance sector advises on the following solutions: Thoroughly grasp the orientations and policies in the spirit of the 19th Provincial Party Congress, the 5-year socio-economic development plan (2021-2025) and continue to effectively organize and implement the Resolutions of the Provincial Party Committee and Provincial People's Council.

In particular, focusing on directing the budget collection work from the first months of 2021, urging the completion of the target of collecting business license fees. Strive to achieve the highest collection level compared to the estimate assigned by the Provincial People's Council.

|

| Cua Lo Town Electricity urgently receives applications for customers to receive electricity price reduction support due to the impact of the Covid-19 epidemic. |

During the year-end visit to the Finance sector, Provincial Party Secretary Thai Thanh Quy assessed that in 2020, the Department of Finance was very proactive and flexible in its operations; not being confused or passive, but taking control of the financial and budget situation of the province.

In 2020, the industry focused on improvingbusiness investment environment; Strengthen revenue management, prevent revenue loss to ensure correct, sufficient and timely collection of taxes, fees, charges and other revenues to the State budget. Strictly manage State budget expenditures right from the budget preparation stage to implementation. Strictly implement regulations on strengthening thrift practice and preventing waste. Prioritize resources for implementing social security policies, ensuring security and defense tasks, important and essential services.