Nghe An: 10/16 tax revenues reached and exceeded estimates

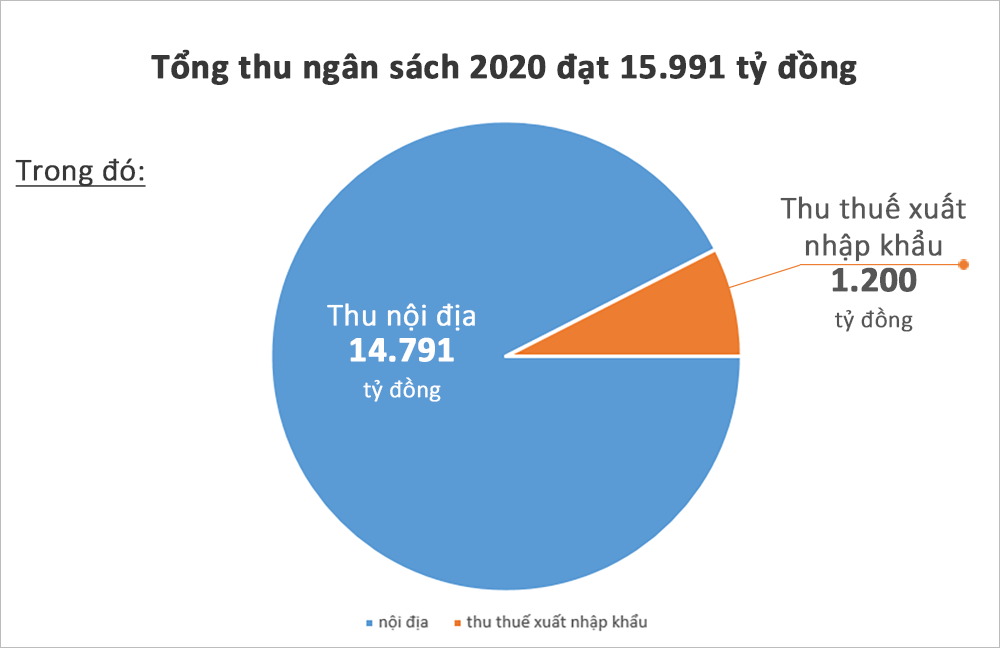

(Baonghean.vn) - A report from the Nghe An Tax Department shows that in 2020, the province's budget revenue is estimated at 15,991 billion VND, of which 10/16 domestic tax revenues reached and exceeded.

Accordingly, the structuredomestic revenuemainly, estimated to achieve 14,791 billion VND, reaching 107.5% of the adjusted estimate and equal to 99.2% compared to the same period in 2019; import-export tax revenue only reached 1,200 billion VND due to the strong impact of the Covid-19 epidemic.

In domestic revenue, if excluding land use fees and lottery revenue, the remaining revenue was 10,465 billion VND, reaching 94.9% of the adjusted estimate and equal to 98.7% compared to the same period in 2019.

|

| In 2020, the Covid-19 epidemic affected industrial production and service activities in Nghe An. Photo: Documentary. |

10/16 revenue items reached and exceeded the adjusted estimate of the Provincial People's Council, specifically: Revenue from foreign-invested enterprises was 250 billion VND, reaching 104.2% of the adjusted estimate, up 6.6% over the same period; Non-agricultural land use tax was 39 billion VND, reaching 102.6% of the adjusted estimate, equal to 93% over the same period; Personal income tax was 620 billion VND, reaching 100% of the adjusted estimate, up 7.6% over the same period; Environmental protection tax was 2,200 billion VND, reaching 105.9% of the adjusted estimate, up 12.5% over the same period;Land use fee collection4,300 billion VND, reaching 158.5% of the adjusted estimate and equal to 100.5% over the same period;

Other revenues also exceeded: Revenue from granting mineral exploitation rights was 215 billion VND, reaching 110.3% of the adjusted estimate and equal to 89.8% over the same period; Other budget revenues were 450 billion VND, reaching 160.7% of the adjusted estimate, up 22.9% over the same period; Commune budget revenues were 50 billion VND, reaching 125% of the adjusted estimate, equal to 81.1% over the same period; Dividend and profit revenues were 11 billion VND, reaching 556% of the adjusted estimate, up 385.8% over the same period; Lottery revenues were 25.2 billion VND, reaching 105% of the adjusted estimate, up 8.3% over the same period.

|

| Graphics: Lam Tung |

However, there are still 6 expected revenue items that do not meet the adjusted Provincial People's Council estimate:

That is: Revenue from centrally managed enterprises: 540 billion VND, reaching 72% of the adjusted estimate, equal to 74.8% over the same period; Revenue from locally managed enterprises: 110 billion VND, reaching 95.7% of the adjusted estimate, equal to 87.2% over the same period; Revenue from the non-state industrial, commercial and service sector: 4,566 billion VND, reaching 90.1% of the adjusted estimate; Registration fee: 830 billion VND, reaching 92.2% of the adjusted estimate; Fee collection: 255 billion VND, reaching 89.5% of the adjusted estimate, equal to 95.9% over the same period; Land and water surface rental collection: 329.7 billion VND, reaching 80.3% of the adjusted estimate and equal to 95.8% over the same period.