Nghe An: In 6 months, more than 43,000 poor households received policy loans

(Baonghean.vn) - In the first 6 months of the year, in Nghe An, policy credit capital has provided capital to 43,094 poor households, near-poor households and other policy beneficiaries to invest in production and business, serving the essential needs of life.

|

| On the afternoon of July 12, the Board of Directors of the Vietnam Bank for Social Policies held its 60th regular meeting to discuss the operational plan for the last months of the year. Comrade Le Hong Vinh - Member of the Provincial Party Committee, Vice Chairman of the Provincial People's Committee, Head of the Board of Directors of the Vietnam Bank for Social Policies chaired the meeting. Photo: Thu Huyen |

As of June 30, there were 19 policy credit programs being implemented in the province with a total capital of VND8,237 billion, a growth rate of 6.26% (0.54% higher than the same period last year).

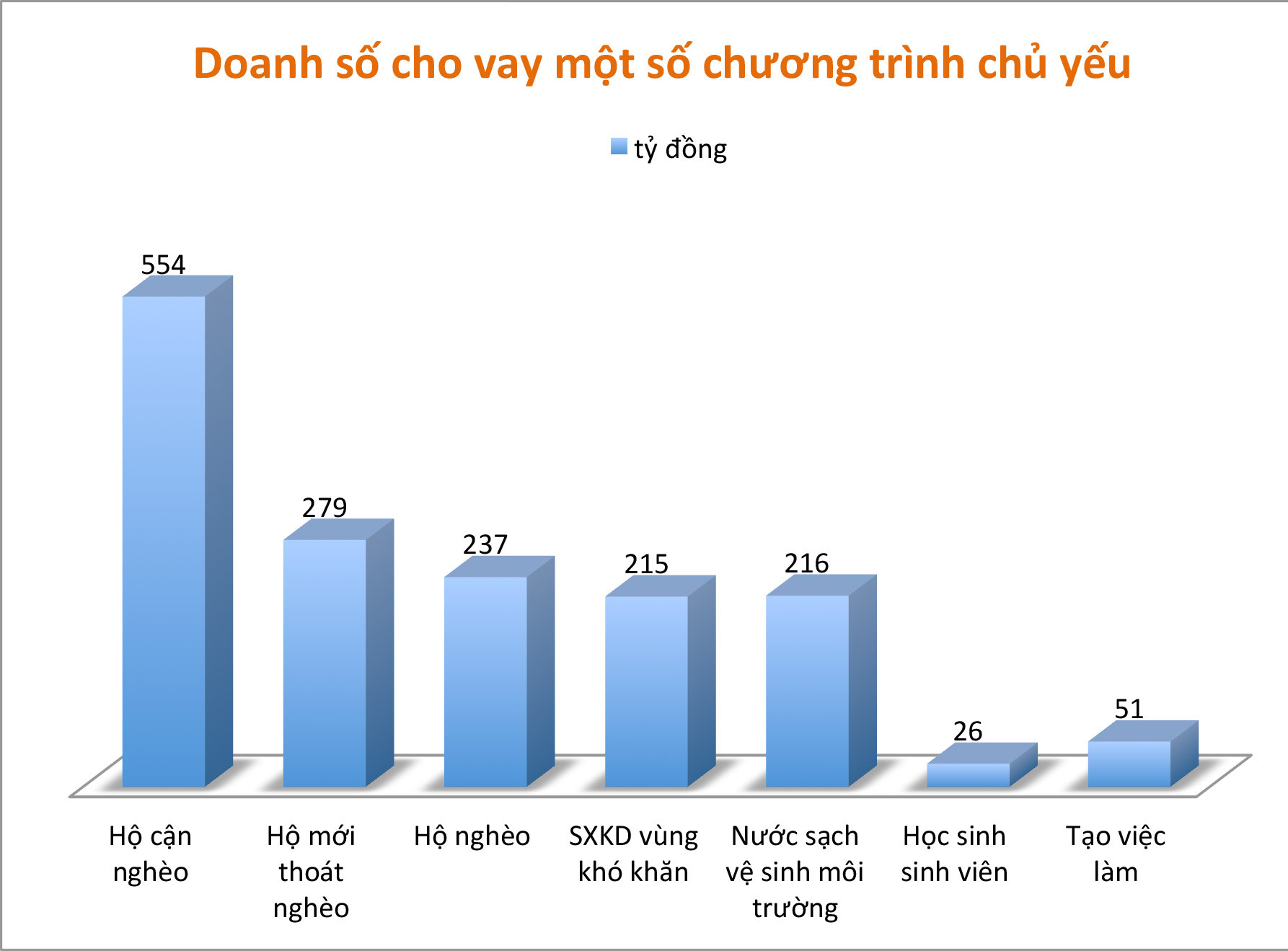

Loan turnover in the first 6 months of the year reached 1,657 billion VND, up 13% over the same period last year. Large loan turnover mainly focused on key programs for poor households, near-poor households, newly escaped poverty households, rural areas and disadvantaged areas. New credit programs were vigorously implemented to meet the needs of poor households and policy beneficiaries.

|

| Loan sales of some main programs in Nghe An in the first 6 months of 2019. Graphics: Thu Huyen |

Total outstanding loans reached VND8,222 billion, an increase of VND478 billion, a growth rate of 6.17%, and basic credit programs have basically completed the assigned plan by June 30.

Along with credit growth, the branch pays special attention to improving credit quality, and indicators reflecting credit quality are regularly paid attention to and closely monitored.

At the meeting, delegates also gave their opinions on rewarding organizations and individuals with outstanding achievements in implementing Directive 40-CT/TW and expected allocation of capital plan for the third phase of 2019.

|

| Vice Chairman of the Provincial People's Committee Le Hong Vinh spoke at the meeting. Photo: Thu Huyen |

Concluding the meeting, Vice Chairman of the Provincial People's Committee Le Hong Vinh acknowledged the achievements of the Social Policy Bank, Nghe An branch in the past time; at the same time, requested that in the coming time, the Board of Directors continue to effectively direct the implementation of the contents of Directive No. 29-CT/TU of the Provincial Party Committee and Plan No. 463/UBND-KH of the Provincial People's Committee. Pay attention to maximizing capital channels and actively mobilizing capital sources according to market interest rates, in order to complete the target of capital growth and outstanding debt in 2019 of over 7%.

|

| People in Dien Ngoc, Dien Chau borrow capital from NHCS to process seafood and develop household economy. Photo: Thu Huyen |

It is necessary to strengthen the direction of good disbursement of credit programs, especially new credit programs. Advise on timely adjustment of capital sources from student credit programs to other programs when this program is no longer needed. At the same time, seriously implement the quality of transaction work at the commune to ensure safety and convenience for the people.

The Vice Chairman of the Provincial People's Committee also requested members of the Board of Directors to strengthen internal inspection and control at units according to the set plan; review, analyze, evaluate and classify bad debts and overdue debts to have appropriate solutions for handling and management; closely monitor customer debts that are disbursed many times, avoid lending to change the nature of debt...