Nghe An: Directive 40 fuels policy credit activities

(Baonghean.vn) - The implementation of Directive No. 40-CT/TW of the Party Central Committee Secretariat on strengthening the Party's leadership over social policy credit has mobilized the participation of the entire political system.

Positive move

Yen Thanh district is considered one of the leading units with large policy credit scale in Nghe An. In recent times, the loan capital in Yen Thanh district has continuously grown, increasingly meeting the borrowing needs of the poor and other policy subjects in the area. The capital growth structure has shifted from central capital to local capital, especially since the issuance of Directive No. 40-CT/TW dated November 22, 2014.

|

| Leaders of Yen Thanh District Social Policy Bank inspect households borrowing capital to develop livestock farming. Photo: Thu Huyen |

Mr. Phan Huu Trang - Director of Yen Thanh District Social Policy Bank said: Implementing Directive No. 40 and the Prime Minister's conclusion on adding the Chairman of the Commune People's Committee to the Board of Directors' Representative Board has brought policy credit to a new level. Up to now, in addition to the central and provincial budgets, the district and commune budgets have entrusted loans through the Social Policy Bank to reach 3.7 billion VND, an increase of 630 million VND in 2022. The District People's Committee regularly pays attention to supporting the construction of facilities and working facilities; the District Social Policy Bank has a spacious headquarters on a land area of nearly 3,000 m2.2, with full and modern equipment and machinery, meeting the requirements for performing professional tasks in the area.

In Dien Chau district, up to now, the capital entrusted by the local budget is more than 11 billion VND, of which: Loan capital from the provincial budget entrusted through the Social Policy Bank is 6,378 billion VND. Capital from the district and commune budgets entrusted through the District Social Policy Bank is 4,640 billion VND.

|

| Trong Phuc Garment Company Ltd. in Dien Chau district borrowed capital from the Vietnam Bank for Social Policies to pay salaries to its workers. Photo: Thu Huyen |

Mr. Pham Xuan Sanh - Vice Chairman of the District People's Committee, Head of the Board of Directors of the Social Policy Bank of Dien Chau district said that the significant increase in district and commune budget capital entrusted through the Social Policy Bank has demonstrated the attention and drastic participation of local authorities in implementing social policy credit programs.

In particular, since Directive No. 40 was issued, the District People's Committee has balanced the budget and transferred nearly 4 billion VND, and the Commune and Town People's Committees have transferred 840 million VND to the District Social Policy Bank to supplement loan capital, meeting the needs of the poor and other policy beneficiaries in the area, contributing to the implementation of the district's annual goals of rapid and sustainable poverty reduction, job creation, new rural construction, and ensuring social security in the area.

Currently, many localities are interested in and well implementing Directive 40, Conclusion No. 06-KL/TW of the Central Party Secretariat such as Vinh city, Hoang Mai town, Dien Chau, Yen Thanh, Nghi Loc districts, etc. In particular, many mountainous districts, although still facing difficulties, are very interested in policy credit activities such as Quy Chau, Con Cuong, Tuong Duong, Ky Son, etc. With the active participation of the political system, policy credit capital has been invested in 100% of villages and hamlets in the province, creating conditions for the poor and policy beneficiaries who have needs and meet the conditions to access credit capital quickly, promptly and conveniently.

|

| With the capital from the Vietnam Bank for Social Policies, many families in the coastal area of Dien Chau have invested in clean and hygienic water projects. Photo: Thu Huyen |

According to the Provincial Social Policy Bank, it is estimated that by December 31, the total outstanding loan balance will reach VND 10,881 billion, an increase of VND 1,211 billion, a growth of 12.52%, completing 100% of the plan assigned by the Central Government and exceeding the plan target set by the branch at the beginning of the year by 4.52%, exceeding the growth target according to the Resolution of the Provincial Social Policy Bank Party Congress for the 2020-2025 term. Loan turnover in 2022 will reach VND 3,291 billion; debt collection turnover is estimated at VND 2,077 billion; total interest revenue is estimated at VND 820 billion, exceeding the construction plan target at the beginning of the year.

In 2022, policy credit capital will still mainly focus on a number of key programs serving the goals of poverty reduction, job creation and social security; policy credit programs according to Resolution No. 11 of the Government on lending to support economic recovery and development after the Covid-19 pandemic. Along with the growth of outstanding credit programs, the quality of policy credit is constantly improving, bad debt is strictly controlled and continues to decrease by VND 2.4 billion compared to 2021.

Increase capital to meet loan demand

In close adherence to the content of Directive No. 40-CT/TW and its implementing documents, local authorities at all levels, entrusted organizations and the Vietnam Bank for Social Policies have actively participated and closely coordinated in capital investment with activities supporting the transfer of science and technology. Thanks to that, many economic models have been implemented and brought about high economic efficiency, creating stable income for poor households and policy beneficiaries, attracting labor, contributing to the restructuring of agricultural production in the area. Thanks to preferential capital sources through social policy credit programs in recent years, thousands of poor and near-poor households have been able to escape poverty sustainably and become rich.

|

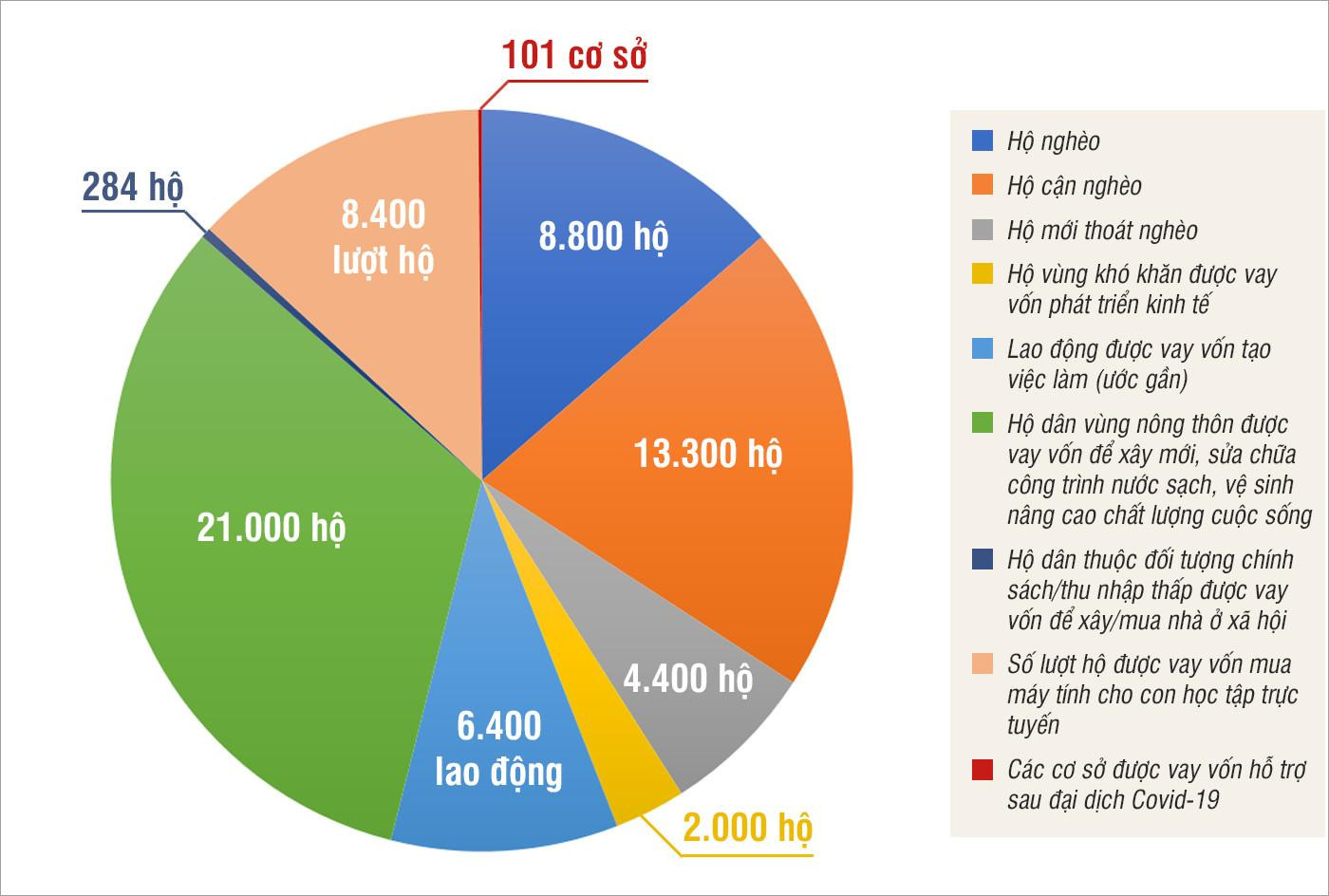

| In 2022, policy credit capital provided capital to 65,900 poor households and other policy beneficiaries to produce, do business, and improve their lives. Graphics: Huu Quan |

Mr. Nguyen Van Vinh - Deputy Director of the Provincial Social Policy Bank said: Implementing the policy of "diversifying resources to implement social policy credit", along with the capital of the Central Government; local authorities at all levels pay attention to arranging local budget capital to supplement the capital entrusted for lending; at the same time, directing the Social Policy Bank to focus on mobilizing idle capital from organizations, individuals, from savings of residents and from savings practice funds of poor households and policy beneficiaries through the network of Savings and Loan Groups, with the motto "The State and the people work together".

Up to now, the capital entrusted to the locality has reached 245.6 billion VND, accounting for 2.24%, an increase of 30 billion VND compared to the beginning of the year, completing 120% of the growth plan assigned by the Central Government in 2022; including: Provincial budget 175.9 billion VND; District budget 69.7 billion VND. Financial resources for investment in policy credit have been continuously increased, basically meeting the capital needs of poor households, near-poor households and other policy subjects in the area.

According to statistics, in 2022, 65,900 poor households and other policy beneficiaries were provided with capital for production, business, and improving their lives. 23,800 poor and near-poor households escaped poverty thanks to policy credit capital, contributing significantly to the successful implementation of the poverty reduction target.

|

| Con Cuong Social Policy Bank disburses in Thach Ngan commune. Photo: Thu Huyen |

However, although resources have been invested, they have not yet met the actual needs of policy beneficiaries, especially capital for lending to create jobs and maintain jobs, and change workers' careers... Every year, local budget capital has been supplemented by People's Committees at all levels to entrust the Vietnam Bank for Social Policies to lend to policy beneficiaries, but the proportion is still very low (2.24%) compared to the total capital (while the national average is over 8%), some localities have not paid due attention to allocating budget capital to entrust the Vietnam Bank for Social Policies to lend according to the content of Directive 40-CT/TW.

To continue to effectively implement Directive 40, it is necessary to have specific policies and solutions from the province to the grassroots level, creating maximum conditions for the activities of the Social Policy Bank in the area, in order to transfer preferential credit capital to the right beneficiaries. Continue to mobilize maximum resources to supplement policy credit capital associated with the transformation of production structure, economic development, education, vocational training, job creation, ensuring social security; organize technical training activities, training and technology transfer associated with borrowing activities, helping borrowers use capital effectively./.