Nghe An: More than 4,000 billion VND for students to borrow money for studying

(Baonghean) - After more than 10 years of implementing Decision 157/2007/QD-TTg on credit for students in difficult circumstances, Nghe An province has thousands of families receiving loans.

Program effectiveness

Nghe An is the province with the highest outstanding student loan debt in the country. With the spirit of "not letting any student with difficult circumstances drop out of school due to lack of money to pay tuition", the Social Policy Bank, Nghe An branch (SBP) is determined to overcome difficulties, bring capital to the people, and bring learning opportunities to tens of thousands of poor students. Thanks to access to preferential capital, the burden on thousands of poor families has been reduced.

|

| Dien Chau Social Policy Bank Transaction Office disburses program capital to customers. Photo: Thu Huyen |

Implementing Decision 157/2007/QD-TTg on credit for students in difficult circumstances, over the past 10 years, the Nghe An Branch of the Vietnam Bank for Social Policies has coordinated with entrusted socio-political organizations to effectively evaluate and approve loans for 244,668 students, achieving a turnover of 4,143 billion VND.

As of July 31, 2017, the total outstanding debt was VND 952,710 billion, with 35,774 students borrowing capital, completing 99.57% of the capital plan announced by the Central Government.

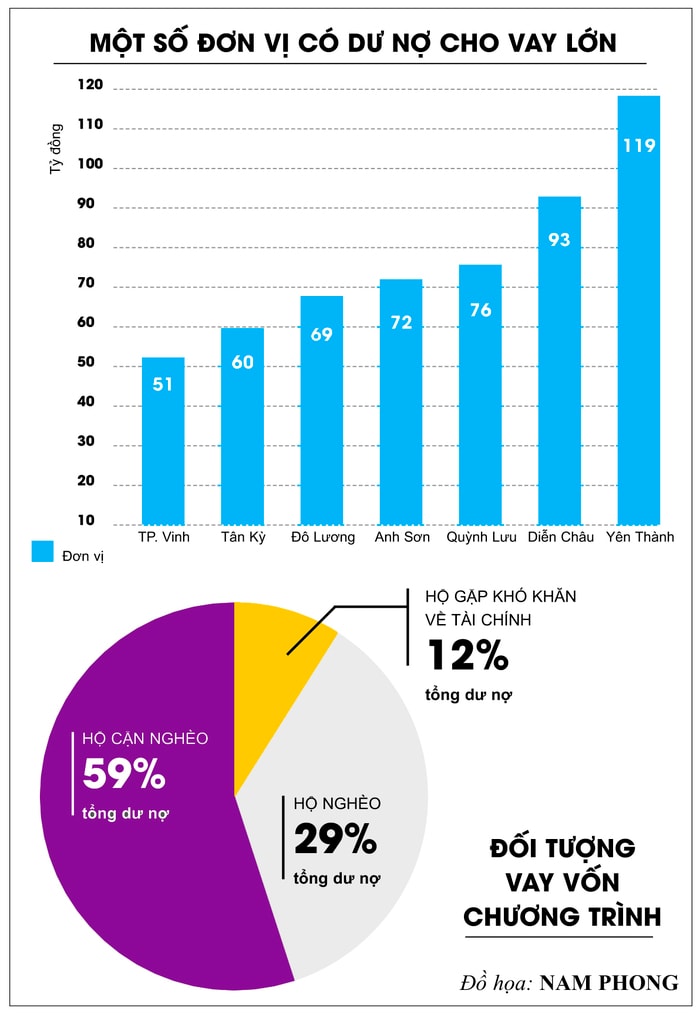

Some localities have large outstanding loans such as: Yen Thanh 119 billion VND, Dien Chau 93 billion VND, Quynh Luu 76 billion VND, Anh Son 72 billion VND, Do Luong 69 billion VND, Tan Ky 60 billion VND, Vinh City 51 billion VND...

The most beneficiaries of the program are near-poor households (families with an average income per capita of up to 150% of the average income per capita of poor households), VND 562 billion belonging to 22,178 households, accounting for 59% of the total outstanding debt and 58.9% of the total number of households borrowing capital. Next are poor households, accounting for 29% of the total outstanding debt and 27% of the total number of households borrowing capital; households facing financial difficulties account for 12% of the total outstanding debt and 14% of the total number of households borrowing capital; in addition, other beneficiaries such as: orphaned students, demobilized soldiers, rural workers learning a trade... also benefit from student credit capital.

|

| Information chart on units with large loan balances and program borrowers. |

From the capital source, there were 27,573 university students with outstanding debt of 663 billion VND, accounting for 69.5% of outstanding debt; there were 11,867 college students with outstanding debt of 246.6 billion VND, accounting for 25.9%; there were 2,645 secondary school students with outstanding debt of 43 billion VND, accounting for 4.5%. In addition, there were 13 short-term vocational students (less than 1 year) with outstanding debt of 169 million VND, accounting for 0.02%. Debt collection revenue up to July 2017 reached more than 250 billion VND. Units with good debt collection results include: Yen Thanh, Dien Chau, Quynh Luu, Thanh Chuong, Anh Son...

Mr. Tran Dai Nghia - Deputy Director of the Transaction Office of the Dien Chau Social Policy Bank said: Through 4 times of adjusting the loan level, from 800,000 VND/month/student in 2007 to 1,500,000 VND/month/student now, it has helped partly overcome difficulties and accompanied them in their studies. By lending through households, well-organized lending, debt collection, and interest collection at commune transaction points have helped households save costs and travel time, while being aware of saving from the family's total income to repay bank loans. Since the beginning of the year, the loan turnover from the program in the district has reached more than 3.3 billion VND; the total outstanding debt has reached nearly 97 billion VND with 3,839 customers with outstanding debt.

Strengthening inspection and supervision work

Inspecting and supervising the implementation of the credit program for students is not only the responsibility of the VBSP but also the responsibility of the government, relevant departments and branches from the central to local levels. In that process, the commune level plays an important role from the stage of reviewing, confirming, approving loan recipients, checking the use of loans to the stage of checking and urging compliance with timely debt repayment to the State. Therefore, the VBSP provincial branch actively advises the Provincial People's Committee, the Provincial Board of Directors to issue documents directing the inspection and supervision work; at the same time, coordinates with socio-political organizations receiving the trust, relevant departments and branches to organize inspections in various forms to limit negative impacts, ensure capital goes to the right recipients, for the right purposes, and recovers capital safely.

The provincial branch of the Social Policy Bank has also implemented many measures to strengthen and improve the quality of operations of savings and credit groups (S&Cs) of entrusted activities with socio-political organizations at all levels, mobile transaction groups and transaction points at communes. In particular, the branch has promptly and seriously implemented the Prime Minister's direction in Notice 231/TB-VPCP on organizing debt collection and monthly interest collection at transaction points for households with conditions and voluntarily repaying principal and interest before due date.

The unit has also implemented a policy of reducing interest by 50% for cases where customers repay their debts early. Up to now, the Nghe An branch of the People's Credit Fund has supported interest reduction for thousands of households who repay their debts early. After 10 years of implementation, the quality of the student credit program has been and is showing very good results. The debt recovery rate is over 90%, overdue debt accounts for a very small proportion of the total outstanding debt.

|

| Disbursement of student program capital at Hung Nguyen transaction office. Photo: Viet Phuong |

However, the determination of criteria for near-poor households to benefit from Decision 157 among commune-level localities is not consistent; some places are too strict, while others are loose; some localities and commune-level People's Committees have not conducted timely surveys and investigations of poor and near-poor households every year, affecting the disbursement of the program.

Mr. Tran Khac Hung - Director of the provincial branch of the Social Policy Bank said: The Credit Program for Students demonstrates profound social significance, affirming the preferential policies of the Party and the Government, and has created high consensus in the social community. This is also a highly socialized policy credit program, involving many levels, many sectors, many organizations and individuals from the central to local levels in mobilizing capital to organizing loans, debt collection and settlement.

The director of the provincial branch of the Social Policy Bank suggested: "In order for the program to continue to be highly effective, we hope that authorities at all levels will regularly review and promptly supplement the poor and near-poor households, thereby having a basis for seriously implementing the confirmation of families eligible for student credit loans, promoting the positive values of the program...".

Thu Huyen

| RELATED NEWS |

|---|