Nghe An: Affirming the effectiveness of policy credit

(Baonghean) - In 2019, Nghe An Bank for Social Policies (CSXH) achieved many successes, from capital mobilization, loan growth to improving the quality of the network of savings and loan groups (TK&VV)... Regarding this field, Nghe An Newspaper reporters talked with Mr. Tran Khac Hung - Director of the Provincial CSXH Bank.

Mr. Tran Khac Hung:In 2019, thanks to timely and correct guidance, the VBSP branch continued to receive important attention and support from local Party committees and authorities at all levels, thereby successfully completing the plans and tasks set out; successfully organizing the conference to review 5 years of implementing Directive 40; exceeding the assigned capital target. By December 31, 2019, the capital received from the trust reached 156.4 billion VND, a number of transaction offices completed the plan at a high level such as: Nam Dan, Anh Son, Dien Chau, Con Cuong, Que Phong, Quy Chau, Quy Hop, Tuong Duong... In which, the 2 units Nam Dan and Anh Son made great efforts, creating a breakthrough in the results of capital mobilization from enterprises inside and outside the province.

|

| Mr. Tran Khac Hung - Director of the Bank for Social Policies, Nghe An branch. Photo: Thu Huyen |

In 2019, the Central Committee focused on directing the implementation of many important contents of the industry. In order to promptly implement assigned tasks, the branch proactively advised the Representative Board to direct the fields of operation. In general, the quality of the branch's advice continued to improve, contributing to directing the branch to perform well its professional tasks, completing and exceeding the assigned goals in 2019.

PV:Credit activities are considered one of the core tasks of the unit. In your opinion, what are the highlights of this field in 2019?

Mr. Tran Khac Hung:Thanks to actively making the most of central and local capital resources, and focusing on capital mobilization solutions in the area, the capital growth rate has been stable, increasing by 8.04% compared to the previous year, with total capital reaching VND 8,375 billion. Capital mobilized from organizations and individuals in the area reached VND 1,392 billion, an increase of VND 200 billion compared to the beginning of the year. In general, the Branch's capital has well met the actual needs of policy beneficiaries in the area.

|

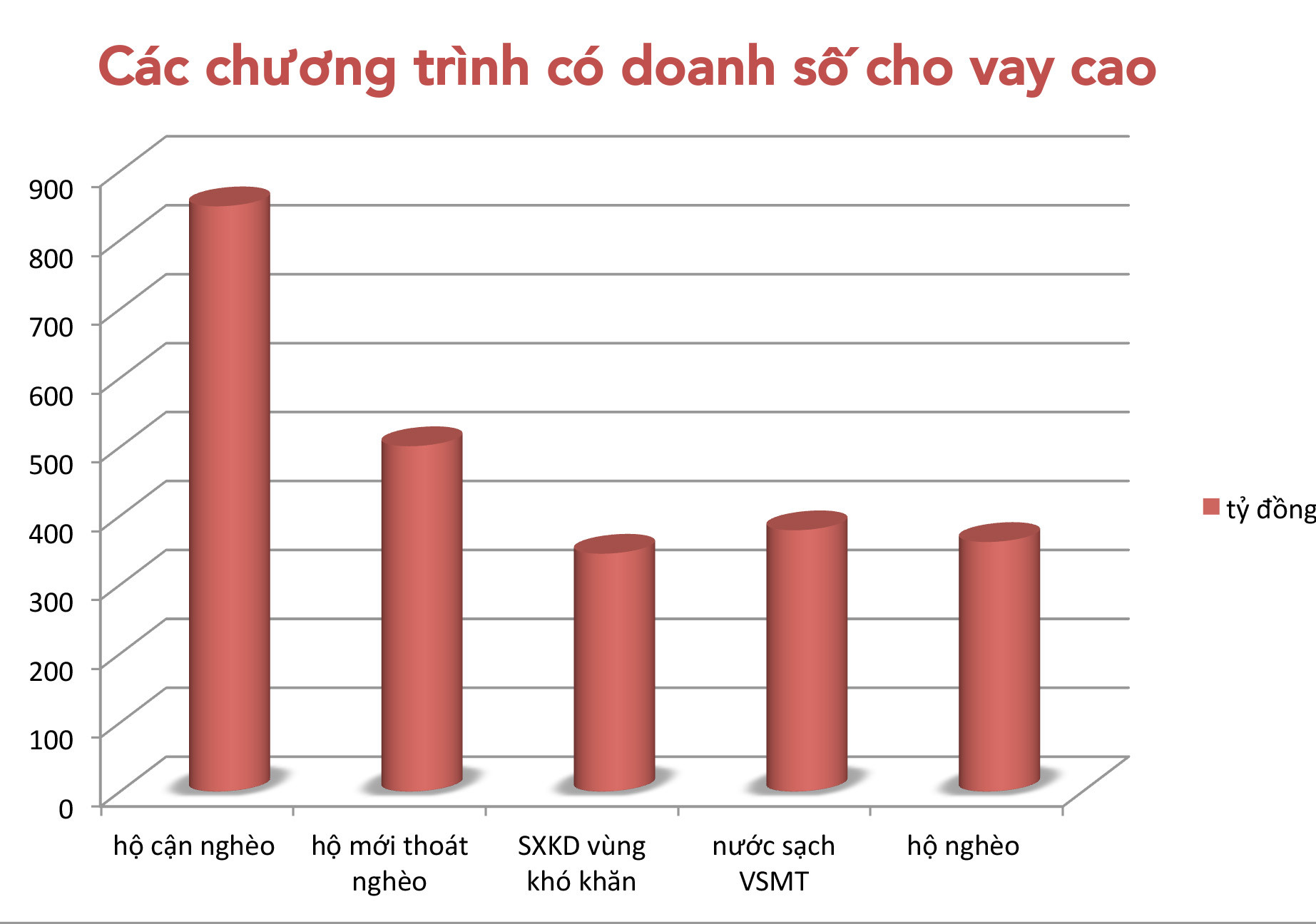

| Graphics: Thu Huyen |

Total outstanding loans reached VND8,364 billion, up 8.01% over the previous year. The loan structure changed in a suitable direction, key programs maintained a stable growth rate, playing an important role in loan growth, 4 programs including: newly escaped poor households, near-poor households, clean water and VKK production and business increased by VND801 billion.

Loan turnover reached 2,800 billion VND, an increase of 184 billion VND compared to the same period in 2018. Programs with high loan turnover: loans to near-poor households 849 billion VND, newly escaped poverty households 501 billion VND; VKK production and business 345 billion VND, NSVSMT 379 billion VND, loans to poor households 362 billion VND. Debt collection turnover reached 2,254 billion VND, of which 6 programs had large outstanding debt including loans to poor households, near-poor households, newly escaped poverty households, clean water and environmental sanitation, students and disadvantaged areas, accounting for 95% of total debt collection.

|

| Leaders of the Vietnam Bank for Social Policies visit and present gifts to policy beneficiaries in Ta Ca (Ky Son). Photo: Thu Huyen |

Implementing new credit programs with good results, lending for social housing, lending for ethnic minorities in accordance with Decision No. 2085/QD-TTg and lending according to Decree 75/2015/ND-CP completed 100% of the planned targets.

The branch continues to direct transaction offices to focus on improving loan quality, controlling well right from the stage of evaluating subjects to ensure the goals: lending to the right beneficiaries, borrowers using capital for the right committed purposes and fulfilling obligations well. Controlling and implementing debt settlement well, minimizing limitations in business operations while improving and enhancing credit quality assessment indicators compared to 2018.

|

| Officials of the Social Policy Bank of Quy Hop district inspected the loan model for farm economic development of Mr. Chu Quoc Tru's family in My Dinh hamlet, Chau Dinh commune (Quy Hop). Photo: TH |

PV:One of the important areas in the operation of the policy bank is the trust activities and the network of savings and credit groups. Could you please tell us how the operation of this network has been in the past year?

Mr. Tran Khac Hung:The tasks set for 2019 are relatively heavy, on the one hand, we must complete the target of increasing outstanding debt by 7-8% compared to 2018 under the condition of recovering and rotating over 1,500 billion VND of due debt, on the other hand, we must continue to coordinate to comprehensively improve all aspects of entrusted activities of associations at all levels to the network of savings and credit groups according to the set goals, focusing on the following tasks: improving the quality of loan assessment of savings and credit groups, the quality of capital use inspection of commune-level associations, and improving the quality of management of records kept at commune-level associations and savings and credit groups.

Debt collection turnover through entrustment reached 2,217 billion VND, up 7.8% compared to 2018, loan turnover reached 2,780 billion VND, up 6.5%; entrusted outstanding debt reached 8,340 billion VND, up 8.05%. Savings mobilization through the group increased by 90 billion VND, the balance reached 446 billion VND, completing 128.5% of the plan.

Currently, the Branch is continuing to vigorously implement solutions to improve the network's operational volume in order to create further breakthroughs in the quality of credit operations of the entire branch in the coming years.

|

| Mr. Nguyen Van Hoa in hamlet 11, Duc Son commune (Anh Son) develops livestock farming from policy capital for poor households. Photo: TH |

PV:With the encouraging results in 2019, how will the unit develop? Can you tell us some basic goals for 2020?

Mr. Tran Khac Hung:Continue to advise on the effective implementation of Directive No. 29-CT/TU of the Provincial Party Committee, exceeding the growth target of capital sources entrusted from the local budget assigned by the Central Government. Capital growth and outstanding debt are at least 7% compared to 2019 (about over 600 billion VND), outstanding debt by the end of 2020 is estimated at about 9,000 billion VND. Exceeding the capital mobilization target assigned by superiors.

Actively and closely coordinate with entrusted organizations to drastically implement solutions to improve the efficiency and quality of entrusted activities at all levels, constantly strengthen the network of savings and credit organizations to contribute to effectively implementing credit programs in the area, improve credit quality, and continue to develop branches in a stable and sustainable direction.

PV:Thank you!