Nghe An: Many strong solutions to fight and prevent 'black credit' activities

(Baonghean.vn) - Implementing Directive No. 12 of the Prime Minister on strengthening the prevention and fight against crimes and law violations related to "black credit" activities, the government and functional forces in Nghe An have deployed many strong solutions to prevent, stop and handle.

Strongly handle groups and subjects

In 2023, the authorities in Nghe An have implemented many drastic solutions, destroying, arresting, and handling many lines, groups, and subjects operating "black credit". Many cases of "Lending at high interest rates in civil transactions" have been prosecuted, investigated, prosecuted, and strictly handled.

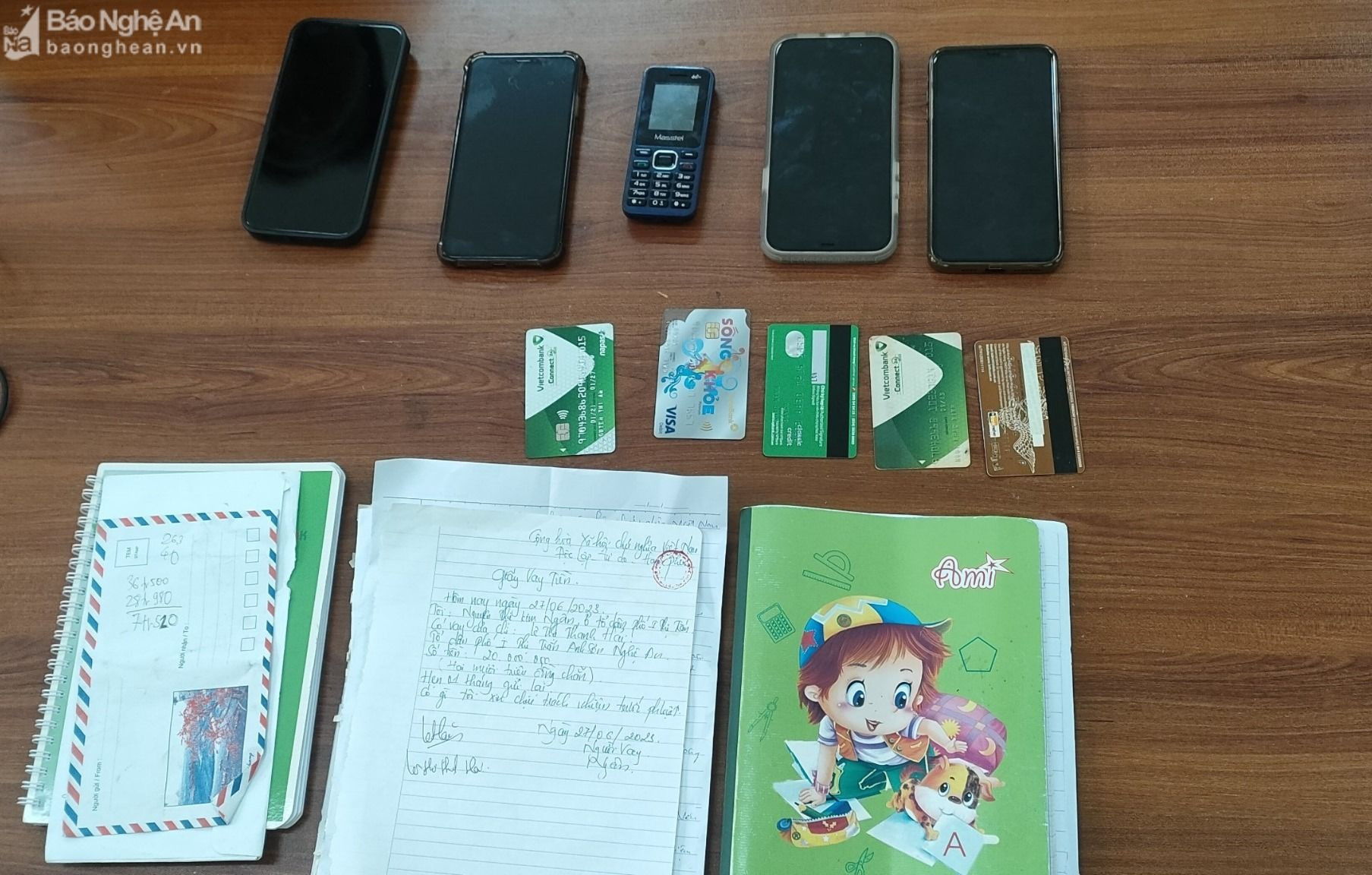

Typically, at the end of December 2023, the Criminal Police Department of the Provincial Police presided over and coordinated with relevant units to eradicate a loan sharking ring in civil transactions with a total amount of nearly 20 billion VND. The ringleader of the ring was Le Thi Thanh Hai (residing in Anh Son town, Anh Son district).

Hai has two previous convictions for gambling. In addition to Hai, the police also arrested three other suspects in the ring, including Nguyen Thi An, residing in Vinh Tan Ward, Nguy Khac Manh, residing in Ben Thuy Ward (Vinh City), and Nguyen Van Khuong, residing in Dien Xuan Commune (Dien Chau).

This ring conducts usury in civil transactions by the form of “drawing alms”. To borrow money from the above group, borrowers must leave personal documents such as: Citizen ID, driver’s license... When borrowers are slow to pay their debts, Hai and the other members of the ring insult and threaten borrowers, even sending people to follow them to put pressure when borrowers go to see a doctor.

Many people have lost their fortunes when falling into the "black credit" trap set by the above group of subjects. With interest rates ranging from 108%/year to over 2,400%/year when lending money to victims, the police initially determined that from May 2023 until their arrest, the above 4 subjects had lent many people in Nghe An province a total of nearly 20 billion VND. The total amount of money the subjects illegally profited was more than 2 billion VND.

Previously, on December 15, 2023, Vinh City Police successfully broke up a case and arrested Nguyen Ngoc Anh, residing in Block 1, Cua Nam Ward, for lending at high interest rates in civil transactions.

With simple loan procedures and no need to mortgage assets, many people who need to borrow money have come to Nguyen Ngoc Anh to borrow at high interest rates. If the borrower does not pay the interest on time, Anh will add the interest to the principal to continue calculating interest, or threaten the borrower to pay both the principal and interest immediately.

In particular, to run the loan sharking business, Nguyen Ngoc Anh went online to buy and install an application (app) to manage the lending.

From 2021 to present, this subject often lends money to people who need quick loans, need money urgently... with interest rates from 3,000 to 5,000 VND/1 million VND/day. According to the initial investigation, Nguyen Ngoc Anh lent 2 people 70 million VND, illegally profiting more than 83 million VND.

According to the authorities, the current method of operation of "black credit" criminals has been combined with technology, transforming into the form of pawn shops and financial consulting services with business registration. Accordingly, in addition to using traditional forms such as: Disguising lending by using property lease contracts; paying interest through paying rent, cutting interest in advance, not recording interest in the contract... "black credit" criminals also use social networks, websites, pawn shop management applications or lending applications to advertise and approach borrowers.

Notably, the authorities have also discovered the tricks of the subjects establishing businesses including financial companies, enterprises, law firms, then buying bad debts, bad debts, then calling, texting threateningly to extort property; creating fake apps, imitating banks, financial companies to lure, invite to borrow money, asking customers to provide personal information then texting, threatening, and collecting debt. The subjects even asked the borrowers to deposit money and then appropriated it.

Criminals also use many sophisticated and cunning methods and tricks to cope with and avoid investigation and handling by the authorities. Meanwhile, victims involved in "black credit" cases are often threatened, fearful, and unwilling to report crimes.

In many cases, when the investigation agency discovers that organizations and individuals have signs of committing crimes related to "black credit", the borrowers do not cooperate, avoid reporting, and do not provide related documents and evidence, making it difficult for the investigation and handling.

Strengthen prevention and control

To strengthen the fight against crimes and law violations related to "black credit"; at the same time, strictly implement Official Dispatch No. 766/CD-TTg dated August 24, 2023 of the Prime Minister, Nghe An Provincial People's Committee issued Document No. 8505/UBND-NC dated October 9, 2023 on strengthening solutions to prevent, stop and handle "black credit" activities.

In Document No. 8505/UBND-NC, the People's Committee of Nghe An province requested provincial departments, branches, and sectors, People's Committees of districts, cities, and towns: Strengthen propaganda and dissemination of legal regulations on methods, tricks, and harms of "black credit" to raise awareness of people, organizations, and businesses. Strengthen state management, coordinate inspection, and handle violations of business establishments showing signs of "black credit" activities.

Proactively detect, exchange, and coordinate with functional forces to arrest, detain, and strictly handle crimes of loan sharking, fraud, and property appropriation... People's Committees of districts, cities, and towns, based on the local situation, establish periodic and ad hoc interdisciplinary teams to inspect pawnshops and financial service establishments that show signs of being involved in "black credit" activities to detect and handle crimes and violations of the law.

Regarding Nghe An Police, the Provincial People's Committee requested to implement measures to improve the effectiveness of State management of industries and businesses with conditions on security and order, and business establishments with signs and conditions for "black credit" activities. Timely detect, combat, and handle violations of financial service businesses, credit, online lending, loans via phone applications, forms of "ho, hui, bieu, phuong", financial investment, virtual currency, high-interest capital mobilization activities with signs of usury, fraud and appropriation of property... Strictly manage mobile criminals, subjects with criminal records, drug addicts, juvenile law violators... to limit these subjects from participating in or assisting in "black credit" activities.

The Provincial People's Committee also requested the Provincial People's Procuracy and the Provincial People's Court to closely coordinate with the investigation agencies, unify the handling of "black credit" cases, resolutely apply preventive measures and temporary detention for subjects who meet the conditions prescribed by law. Speed up the investigation, prosecution, trial and strict handling of cases related to "black credit" activities, serving the general education and prevention work.

Regarding the State Bank of Nghe An Province Branch, the Provincial People's Committee requests that it proactively research, recommend, and propose to the State Bank to perfect the banking credit mechanism and policy, develop the credit system, diversify loan types, and banking products and services to meet the legitimate and legal borrowing needs to serve the people's consumption life.

Strengthen inspection, examination, supervision and management of the activities of credit institutions, payment intermediaries and e-wallets to prevent subjects from colluding in "black credit" activities and promptly handle violations according to regulations. Strengthen management, supervision and handling of bank accounts with suspicious transactions, virtual accounts, and suspected "black credit" activities.

From the drastic direction of the Provincial People's Committee and the synchronous participation of the entire political system, in 2023, the functional forces in Nghe An province discovered and arrested 40 cases and 52 criminals operating related to "black credit".

It is forecasted that in the coming time, the economic, labor and employment situation will still face many difficulties, along with the increasing financial needs near the Lunar New Year, the crime situation and law violations related to "black credit" will still be potentially complicated.

Nghe An Provincial People's Committee has issued Official Dispatch 36/CD-UBND on strengthening security and order before, during and after the Lunar New Year 2024. It requires the Provincial Police to focus on fighting and suppressing all types of crimes, especially dangerous criminal crimes, organized activities, "black credit", "protection, debt collection, debt collection"...

However, in addition to the involvement of the authorities, people also need to raise awareness and vigilance, not participate in activities related to "black credit"; actively denounce crimes and violations related to "black credit" so that the authorities can promptly prevent and handle them.