Nghe An: Continue to increase resources for policy credit

(Baonghean.vn) - In 2022, policy credit will continue to make important contributions to the socio-economic development achievements of Nghe An province, helping 23,800 poor and near-poor households escape poverty.

On the afternoon of January 5, the Board of Directors of the Vietnam Bank for Social Policies held the 74th regular meeting to evaluate the performance results in 2022 and deploy tasks in 2023. Comrade Bui Thanh An - Member of the Provincial Party Standing Committee, Vice Chairman of the Provincial People's Committee, Head of the Board of Directors of the Vietnam Bank for Social Policies (VBSP) chaired the meeting.

|

Delegates attending the meeting. Photo: Thu Huyen |

78,688 poor households and policy beneficiaries are provided with preferential credit capital.

In 2022, policy credit activities will continue to receive attention from the Party, State, Government and local authorities at all levels, allocating resources to effectively implement the goal of poverty reduction, ensuring social security and economic recovery and development after the Covid-19 pandemic. Following the direction of superiors, the Board of Directors has led and directed the Nghe An Provincial Bank for Social Policies to successfully complete the goals and tasks set out in 2022.

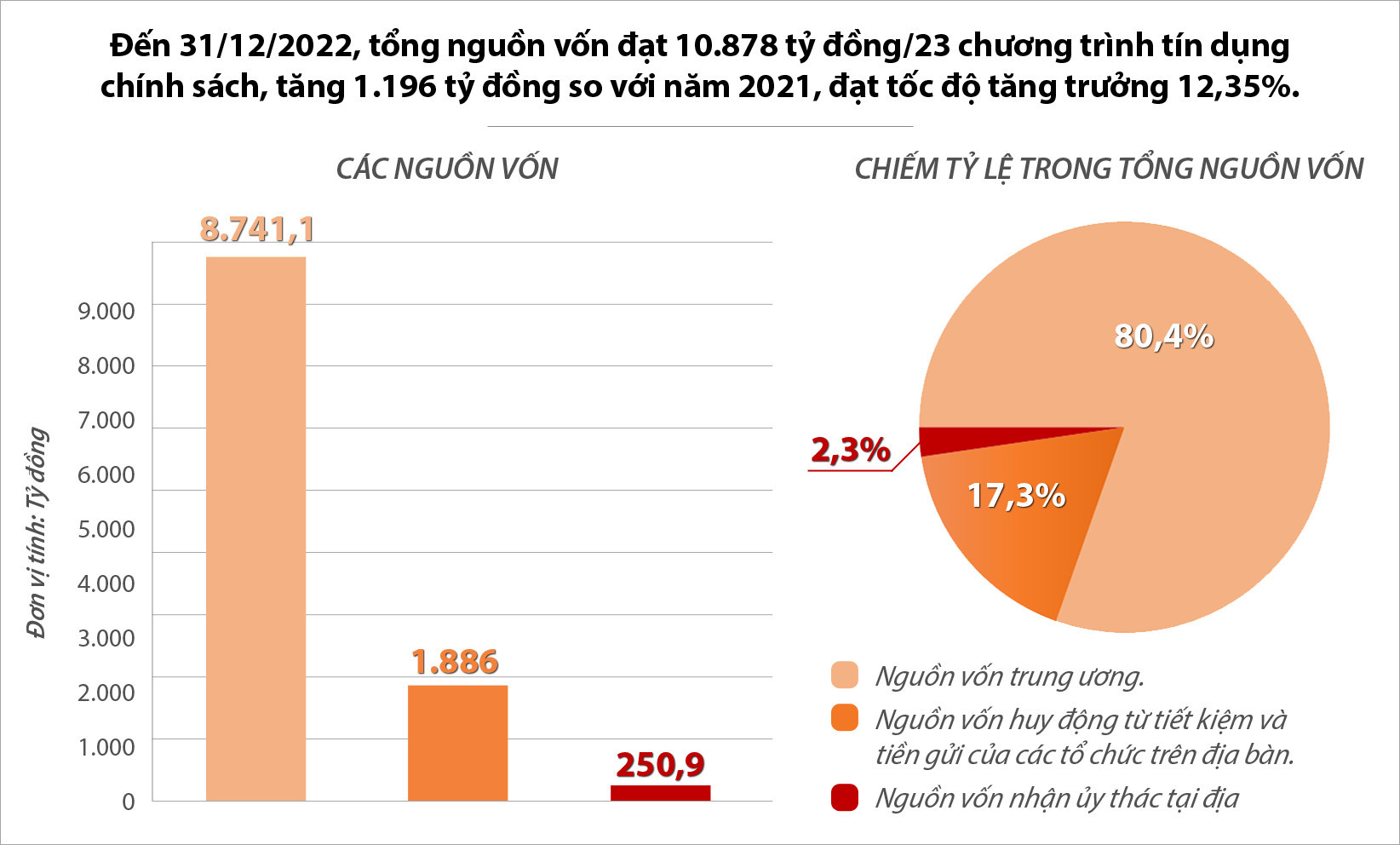

By December 31, 2022, total capital reached VND 10,878 billion/23 policy credit programs, achieving a growth rate of 12.35%.

|

Graphics: Huu Quan |

Loan turnover in 2022 reached VND 3,323 billion, an increase of 12.7% compared to 2021. Programs with high disbursement turnover continue to focus on programs with large targets and needs such as: Loans for near-poor households reached VND 977 billion, loans for poor households reached VND 575 billion, loans for clean water and rural environmental sanitation VND 502 billion, loans for job creation and employment support VND 439 billion, loans for social housing VND 134.6 billion.

|

Comrade Nguyen Van Vinh - Deputy Director of the Provincial Social Policy Bank reported on activities in 2022 and deployed tasks for 2023. Photo: Thu Huyen |

Total outstanding debt reached 10,865.8 billion VND, achieving a growth rate of 12.36%, exceeding the growth target set by the Board of Representatives (target: 7%-8%).

Based on local capital needs, the Vietnam Bank for Social Policies has provided preferential credit capital to branches implementing programs under Resolution No. 11 in 2022, amounting to VND 548.4 billion/05 programs.

In 2022, Nghe An Bank for Social Policies provided preferential credit to 78,688 poor households and other policy beneficiaries. Policy credit continues to make important contributions to the province's socio-economic development achievements in 2022, helping 23,800 poor and near-poor households escape poverty. With the achievements, the Emulation and Commendation Council of the Bank for Social Policies has recognized and highly appreciated the results of Nghe An Branch and has considered rewarding the most outstanding unit nationwide in 2022.

|

Director of the State Bank of Vietnam, Nghe An branch, Nguyen Thi Thu Thu, speaks at the meeting. Photo: Thu Huyen |

Attention to capital sources for policy credit

2023 target: Capital and outstanding debt growth reaches 7%-8% (expected to increase by about 760 billion VND - 870 billion VND). Receive entrusted capital from local budget sources reaching 35 billion VND, completing 100% of the plan for capital growth mobilized from the market according to the Central target. Interest rate reaches at least 95%.

|

Comrade Bui Thanh An - Vice Chairman of the Provincial People's Committee delivered a concluding speech at the conference. Photo: Thu Huyen |

Speaking at the conference, Vice Chairman of the Provincial People's Committee Bui Thanh An acknowledged and highly appreciated the achievements of the Social Policy Bank.

In 2023, to achieve the set goals, it is recommended that the Board of Directors at the provincial and district levels advise and direct the implementation of the Development Strategy of the Bank for Social Policies to 2030; direct the implementation of the credit plan for assigned growth programs from the beginning of the year; continue to promptly implement the preferential policy credit package in the 2022-2023 Socio-Economic Recovery and Development Program; implement the policy credit program for ethnic minority and mountainous areas for the period 2021-2030 according to Decree No. 28 of the Government. Continue to direct the effective implementation of Directive No. 40-CT/TW to increase resources and mobilize the entire political system to actively participate in policy credit activities.

For the provincial and district-level Social Policy Bank, it is necessary to perform well the responsibility of advising the Provincial Board of Directors to perform tasks according to the Regulations on implementing living regimes, managing capital allocation, directing and supervising policy credit activities. Promote capital mobilization to meet the loan needs of poor households, near-poor households and other policy beneficiaries in 2023, strive to basically complete the target of increasing outstanding loans of policy credit programs before September 30, 2023...

Every year, the Representative Board and the Policy Bank need to report on their performance to the local Standing Committee. Strengthen coordination between departments, branches and sectors with entrusted organizations and the Social Policy Bank in supporting and improving the efficiency of loan use by policy beneficiaries. Link policy credit activities with national target programs being implemented in the area. Continue to review the tasks of the Provincial Party Congress Resolution for the 2020-2025 term to implement policy-related indicators.

On this occasion, the conference also gave opinions and approved a proposal to reward collectives and individuals with achievements contributing to social policy credit activities in the whole province in 2022.