Nghe An: Policy credit grows safely and effectively

(Baonghean.vn) - Recently, the branch's operations have encountered many difficulties due to the impact of the Covid-19 epidemic. However, the entire branch of the Vietnam Bank for Social Policies (VBSP) in the province has focused on overcoming difficulties and made efforts to successfully complete the target of outstanding loan growth.

Good growth in outstanding loans

According to the reportPeople's Credit FundAs of March 31, 2021, the total capital reached VND 9,169 billion, an increase of VND 143 billion compared to 2020, achieving a growth rate of 1.58%. Debt collection turnover reached VND 563 billion, accounting for 80.3% of loan turnover, contributing significantly to creating a stable and proactive revolving loan source in the locality, meeting the borrowing needs of poor households and policy beneficiaries. Total outstanding debt reached VND 9,143.6 billion/20 policy credit programs, an increase of VND 135.2 billion compared to the beginning of the year, achieving a growth rate of 1.5%.

|

| The broiler chicken farming model of Mr. Le Van The's family in Hamlet 4, Dien Trung Commune (Dien Chau) was effectively invested from a loan of 100 million VND from the Bank for Social Policies. Photo: Thu Huyen |

Of the 20 programs under management, 9/20 have increased outstanding loans compared to the beginning of the year, some programs have increased significantly such as: Loans for near-poor households (increased by 102 billion VND); Clean water and rural environmental sanitation (increased by 42.6 billion VND); Loans for production and business households in difficult areas (increased by 32 billion VND); Loans for job creation (increased by 25 billion VND).

|

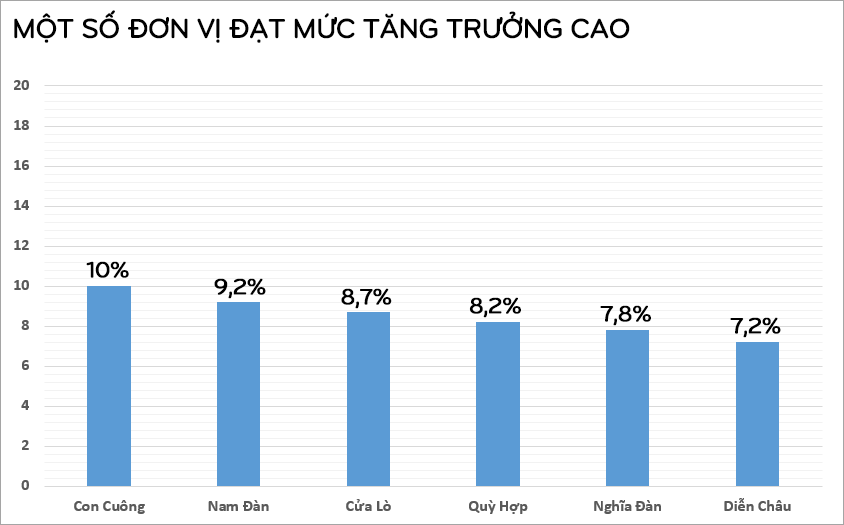

| Graphics: Lam Tung |

Loan turnover in March - April 2021 reached 83.1 billion VND; Accumulated from the beginning of the year reached 103 billion VND. Some programs with large loan turnover such as: Loans for production and business households (SXKD) in difficult areas 35.5 billion VND, loans for near-poor households 34 billion VND, poor households 17.4 billion VND... Total outstanding debt as of April 30, 2021 reached 584.3 billion VND, an increase of 44 billion VND compared to the beginning of the year, growth rate reached 8.2%, completing 100% of the assigned plan. We are currently implementing 16 policy credit programs with 12,515 customers with outstanding debt.

In Thanh Chuong district, the Transaction Office has actively taken advantage of capital from superiors and promotedlocal fundraising; has basically met the needs of production and business development and served part of the essential needs of poor households and other policy beneficiaries. As of March 31, 2021, the total capital under management reached nearly VND 680 billion; loan turnover in the quarter reached VND 46,603 billion for 1,053 borrowers.

Total outstanding loans reached 669 billion VND, a growth rate of 2.2%. Some of the growth programs include loans for production and business households in difficult areas of 13,198 billion VND, clean water and rural sanitation of 2,689 billion VND, job creation of 1,390 billion VND, social housing loans of 827 million VND, and the program for newly escaped poverty households that was allowed to continue lending from March 30, 2020 has not yet disbursed any loans. The district has 22 communes with outstanding loans increasing compared to the beginning of the year (communes with outstanding loans decreasing mainly due to few subjects eligible for loans).

|

| Tea garden of Ms. Pham Thi Xuan's family in Da Bia hamlet, Thanh Mai commune (Thanh Chuong). Photo: Thu Huyen |

Mr. Nguyen Huu Hien - Vice Chairman of the District People's Committee, Head of the Representative Board of the Bank for Social Policies of Thanh Chuong District said: The loan has helped poor households and other policy beneficiaries build and repair 496 clean water and environmental sanitation works, helped 32 workers have jobs and maintain jobs, 6 low-income households build houses from social housing capital, 738 poor, near-poor households, and production and business households in difficult areas have capital to invest in production, livestock and business to develop the economy...

The Board of Representatives has directed the Social Policy Bank to coordinate well with local authorities and entrusted units to pay attention to improving credit quality, strictly controlling bad debts, and resolutely directing the collection of due and overdue debts.

Improve credit quality

In recent times, the branch has made good use of capital from the Central Government, actively advised on capital sources entrusted from local budgets and organizations at all levels, promoted the mobilization of capital with interest rate subsidies, met the demand for loan capital, and completed the set goals.

Some units have introduced new ways of approaching customers appropriately and effectively: Combining sustainable group building with community activities to mobilize capital contributions from group members and their relatives in Tuong Duong; combining training to propagate and dialogue with the commune-level association team and the group management board about the deposit products of the Vietnam Bank for Social Policies in Cua Lo town; closely coordinating with the Finance Department and the District-level Site Clearance Board to mobilize capital in Hoang Mai, Dien Chau, and Quynh Luu towns...

The entire branch actively reviewed and coordinated the implementation of lending to employers to pay for the suspension of work for employees affected by the Covid-19 pandemic under the direction of the General Director. Increased lending, support for borrowers of production and livestock after the pandemic, implemented solutions to extend, postpone debt, and provide additional loans to those facing difficulties due to the impact of the pandemic. Continued to implement lending - debt management for 20 previously implemented credit programs with good results.

|

| With loans from the Social Policy Bank, many families have boldly built many highly effective economic models. Photo: Thu Huyen |

In the coming time, Nghe An Social Policy Bank will continue to focus on comprehensively improving credit quality, closely following the contents of Directive No. 40 of the Secretariat, Directive No. 29 of the Provincial Party Committee and the plan of the Provincial People's Committee to actively advise Party committees, authorities, and Board of Directors at all levels to maximize their roles and responsibilities in leading and directing policy credit; pay attention to allocating sufficient local resources and non-budgetary capital entrusted through the Social Policy Bank in the direction of linking with local socio-economic development projects.

Directing the rapid disbursement of capital for programs, meeting the needs of production and social security loans for poor households and policy beneficiaries. At the same time, guiding borrowers to use capital effectively, integrating with project programs, doing a good job of consulting, guiding the construction and replication of typical production and business models, helping each other to escape poverty sustainably.