Besides the cost of buying a car, what other costs are needed to get the car 'on the road'?

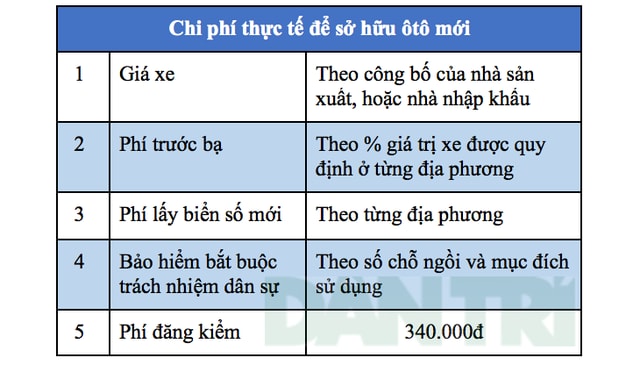

In addition to the cost of buying a car, consumers will have other expenses, such as registration fees, insurance fees, new license plate fees...

In addition to the moneyWhen buying a car, consumers also have to prepare a large amount of money for various fees, so that the car can legally roll (sometimes it needs up to several hundred million dong); and that is also part of the reason why used cars, even though they have the same price as new cars, still have customers...

|

According to current regulations of Vietnamese law, in addition to the amount of money used to buy a car, there will be many factors that go along with the cost for you to own a car.

1. Car price

The price used as the basis for calculating registration fees is the announced price (listed price) of domestic manufacturing and assembly facilities and automobile import businesses.

However, the fact that car prices at dealers have changed continuously in recent times also affects the registration fee, because according to the regulations of Circular 304/2016/TT-BTC, if the car price increases/decreases by no more than 20%, the initial announced car price will still be used to calculate the registration fee.

|

| Ford is reducing the price of the EcoSport model by 25 to 35 million VND depending on the version, but the registration fee remains unchanged. |

2. Car registration fee

According to Decree 140/2016/ND-CP, the fee for first-time car registration is 10% of the car's value. And depending on the locality, the People's Council of the province/city directly under the central government can adjust this fee up, but not more than 50% of the general regulation (10% of the car's value). Currently, Hanoi has a registration fee of 12% for first-time car registration, Ho Chi Minh City is 10%, Hai Phong and Da Nang are 12%, Can Tho is 10%.

|

For example, a Mazda3 2.0L automatic priced at 750 million VND will have to pay a registration fee of 90 million VND in Hanoi and 75 million VND in Ho Chi Minh City.

3. Fee for new license plate

According to the collection rate table in Circular 212/2010/TT-BTC, the two cities with separate collection rates are Hanoi at 20 million VND and Ho Chi Minh City at 11 million VND, the centrally-run cities and provincial cities, and towns have a collection rate of 1 million VND. Other areas have a collection rate of 200,000 VND.

Civil liability insurance fee: According to Circular No. 22/2016/TT-BTC, for passenger cars with less than 6 seats that are not used for transportation business, the compulsory civil liability insurance fee of the motor vehicle owner is 480,700 VND (including VAT), and for cars with 6 - 11 seats it is 873,400 VND. However, depending on the insurance company, there will be different fees, but all are lower than this prescribed level due to business and management factors.

For example, a 2.8L diesel Fortuner that Toyota announced the selling price for this coming August is 1.354 billion VND. After buying the car, if you are in Hanoi, you will have to pay a registration fee of 162.48 million VND (12%), then 20 million VND for vehicle registration to get a new license plate.

When you have the vehicle registration, you also have to go through the vehicle inspection procedure with a fee of 340,000 VND (unified nationwide) and buy compulsory civil liability insurance of 873,400 VND (according to general regulations).

Thus, the total amount of money you have to spend to legally roll a Toyota Fortuner 2.8L on the road will be about 1.538 billion VND, an additional 184 million VND compared to the price of the car; that does not include the costs of beautifying, caring for the car, or service fees to speed up the procedure. In case Toyota reduces the selling price of this car model without exceeding 20% (about 307 million VND), you will still have to pay the registration fee according to the level previously announced by the manufacturer (12% of the selling price of 1.354 billion VND).