People need to buy compulsory motorbike insurance today

(Baonghean.vn) - Although it is a mandatory product, most of the current motorbike owners when participating in traffic have not equipped themselves with compulsory civil liability motorbike insurance. So why do we have to participate in this type of insurance? If not, what will be the penalty? These are common questions of motorbike owners.

Representatives of the Motor Vehicle Insurance Fund (Vietnam Insurance Association) have given very detailed answers to the most common questions of readers.

Question: In my university class, some of my friends bought compulsory civil liability insurance for motorbike owners, some of them didn't. Should I buy it and where can I buy it?

Answer: Compulsory civil liability insurance of motor vehicle owners is a type of insurance that all individuals and organizations that own motor vehicles in Vietnam must participate in according to State regulations to ensure the rights of third parties in case the vehicle owner or driver unfortunately causes damage to them. Accordingly, the Certificate of Compulsory Civil Liability Insurance of Motor Vehicle Owners is one of the types of documents that car and motorbike drivers must carry with them when participating in traffic.

Decree 100/2019/ND-CP also stipulates that if the vehicle owner does not carry the Certificate or the certificate is no longer valid, he will be fined from 100,000 VND to 200,000 VND for motorbikes, and from 400,000 VND to 600,000 VND for cars.

|

| People are increasingly interested in compulsory motorbike insurance because of the practical benefits this product brings. |

The product can be easily purchased at insurance companies, online or at insurance agents, so if you do not have one, car owners need to join today to always be assured of being protected against unforeseen risks that may occur. The current insurance premium is only 60,000 VND/year for motorbikes and from 437,000 VND/year or more for cars depending on the purpose of using the vehicle.

If I buy compulsory motorbike insurance for 60,000 VND/year, how can I be compensated?

Traffic accidents are always a constant worry for every family. According to published information, in just 7 days of Lunar New Year holiday, there were 198 accidents nationwide, killing 133 people and injuring 174 others.

|

| The explosion of motorbikes and low traffic awareness are the reasons why the number of traffic accidents is constantly increasing. |

In reality, in many accidents, the person causing the accident runs away or does not have enough money to compensate the victim's family, causing them to suffer the pain of losing a loved one and to be even more miserable due to losing the family's breadwinner. Meanwhile, if the car owner participates in insurance, in case of an accident, the insurance companies will use the insurance money collected from the majority to compensate the few people who are in the accident.

That helps some people who, for some reason, cause an accident to protect themselves from financial risks, be responsible for the accident that occurred according to the level of liability of the insurance they participated in, ensure the obligation to remedy the consequences and not be prosecuted for losing the ability to compensate other subjects. Accidents within the scope of insurance, the insurance company will compensate the vehicle owner for this civil liability at a level of up to 100 million VND/person/incident.

I have a relative who died in a traffic accident during Tet. The person who caused the accident ran away so we don’t know who they are to claim compensation. What should we do now?

You can contact the Motor Vehicle Insurance Fund for humanitarian financial support. The Motor Vehicle Insurance Fund is annually contributed by non-life insurance companies that provide compulsory civil liability insurance for motor vehicle owners, and has been managed by the Ministry of Finance and the Vietnam Insurance Association since 2009.

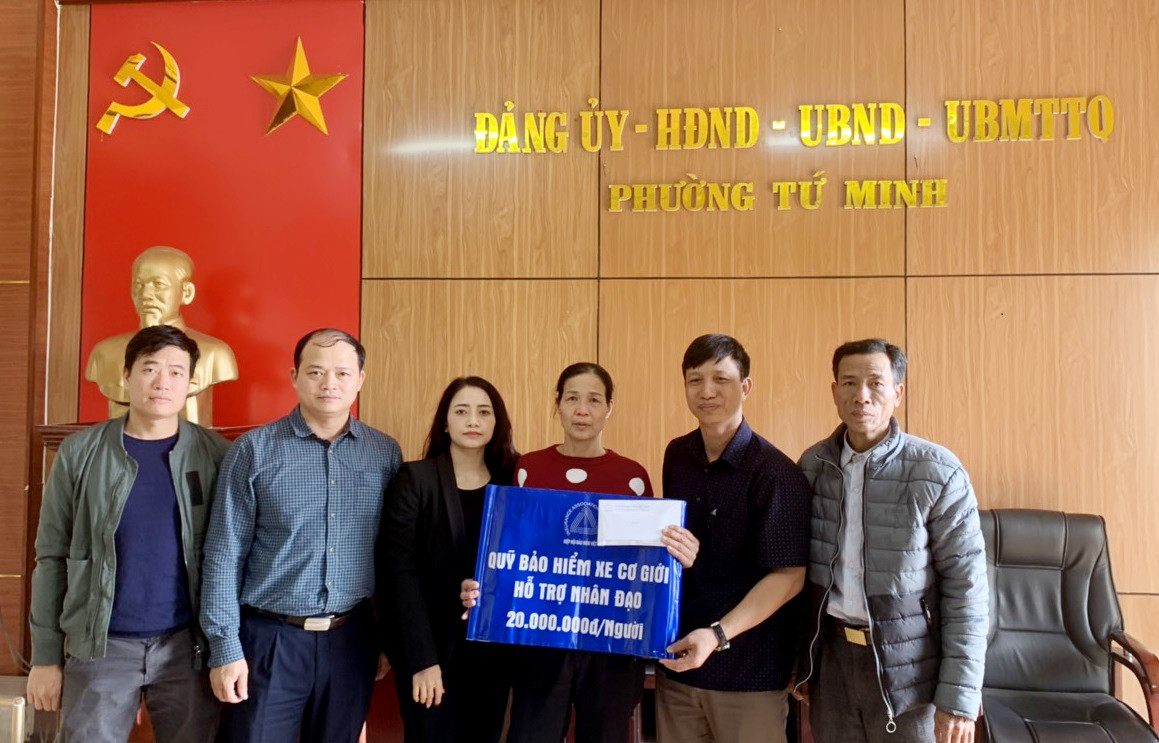

|

| The Motor Vehicle Insurance Fund gives humanitarian support to relatives of a victim who died in a traffic accident in Hai Duong province. |

In case the vehicle causing the accident cannot be identified or the accident is not covered by insurance, the Fund will support humanitarian compensation for the victim up to 20 million VND/person. This regulation has partly supported the financial difficulties of the vehicle owner as well as the victim's family, proving the superiority of the policy in recent times.

The following cases will receive humanitarian assistance:

- Police could not identify the motor vehicle that caused the accident.

- The vehicle causing the accident is not covered by compulsory civil liability insurance for motor vehicle owners.

- The vehicle causing the accident is covered by compulsory civil liability insurance for motor vehicle owners but is not compensated by the insurance company because it is excluded from insurance according to the law, such as the driver causing the accident intentionally fleeing, driving without a driver's license or the driver's license is not suitable for the type of motor vehicle that requires a driver's license...

How can I contact the Motor Vehicle Insurance Fund?

When a victim dies in a traffic accident and falls into the above-mentioned supported cases and has a conclusion from the police handling the accident, the victim's relatives can call the Motor Vehicle Insurance Fund hotline at 024 3941 2063 or 0967235155 or the website: www.iav.vn (Motor Vehicle Insurance Fund section) for support.

.jpg)