Vietnamese are borrowing to spend beyond their means.

Dragon Viet Securities Company (VDSC) commented that Vietnamese people are too optimistic about future income, so they are willing to trade off and borrow more for current expenses.

VDSC’s analysis report provides statistics on consumer credit growth in Vietnam. According to this report, the increase was nearly 60% in 2017 and the forecast for the next 3 years is that the average loan growth rate of the consumer sector will reach 29-30%/year.

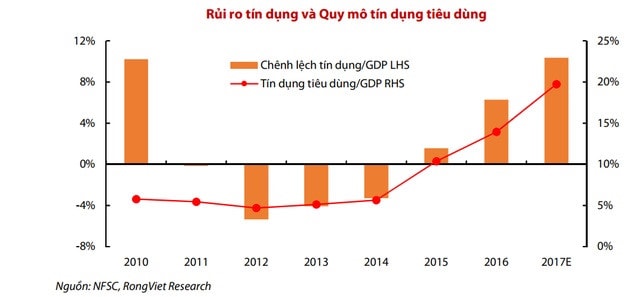

People borrow moreVDSC assesses that in the short term, the growth potential of this sector is still very open when the scale of consumer credit is only about 19% of GDP in 2017. This capital flow will create momentum for the economy's total demand and positively impact GDP growth in the coming years, supporting the recovery of the Vietnamese real estate and stock markets.

However, financial risks are also growing as the household sector's spending and borrowing mentality becomes more open in the context of a savings rate that is quite low compared to other countries in the region.

|

By 2016, Vietnam's savings rate was only 29% of GDP, quite low compared to other countries in the region. With consumer behavior trends, VDSC found that people are overly optimistic about their future income potential and are willing to trade off and borrow more for current spending.

According to VDSC, this raises concerns about people’s ability to repay debts. Moreover, if increased consumer spending is not linked to economic growth, the health of the economy will weaken in the long term.

Lessons from around the worldVDSC also believes that household debt growth and asset price movements have a two-way interaction through historical lessons from countries around the world.

Since the 2008 financial crisis, home prices in Canada and the United States have diverged significantly. While the U.S. home price index has fallen nearly 25% since its mid-2008 peak, Canadian home prices have generally maintained a long-term upward trend.

One of the important reasons is the difference between the credit flow to the household sector. On the contrary, when real estate assets increase in value and are used as collateral, it will improve the credit picture of households. Therefore, households tend to actively use personal financial leverage.

VDSC also noted lessons from China when most experts were concerned about the property bubble in this country. The close positive correlation between the rate of house price increase in major cities and the rate of increase in household debt in China.

|

| Illustration photo |

Story in Vietnam

With the developments in the Vietnamese market, housing and office prices have clearly recovered over the past 5 years.

As of the second quarter of 2017, the housing price index in Ho Chi Minh City reached 93 points, up 5.1% compared to the bottom of 2014. Meanwhile, the office price index was recorded at 89 points, up 23.1% compared to the beginning of 2013.

There are many reasons to explain the above recovery, but VDSC believes that credit capital flow is one of the highlights.

Thus, the room for consumer credit growth is still wide open and will have a positive impact on the economy in the medium term.

However, the potential risks cannot be ignored when more than 50% of consumer credit flows into real estate, which is a huge driving force supporting the market recovery. This contributes to creating errors in the calculation and published data on real estate credit flows.

According to VDSC's assessment, the above developments also pose risks when the above assets are mortgaged and banks overestimate the creditworthiness of borrowers.