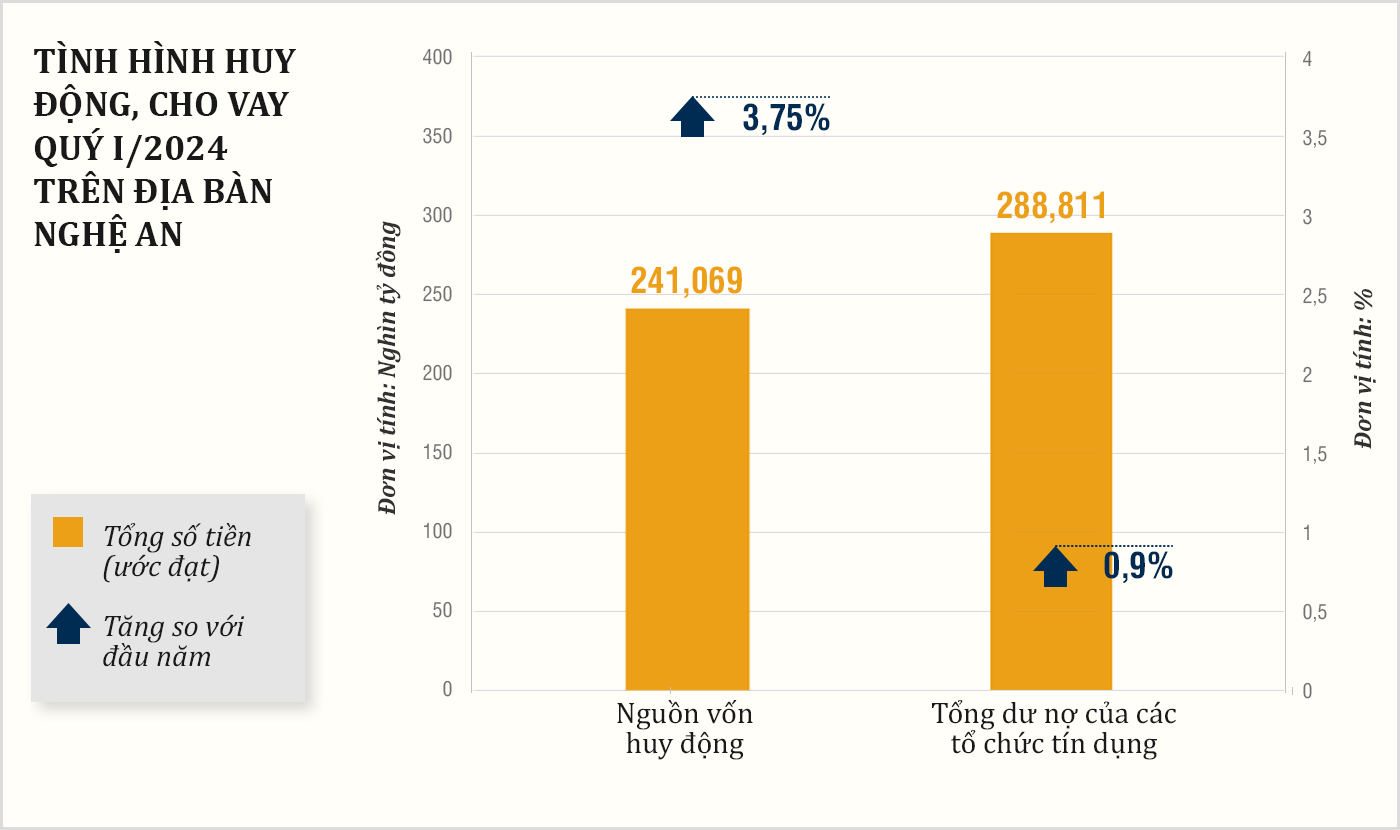

Capital mobilized in the first quarter of 2024 in Nghe An increased by 3.75%

(Baonghean.vn) - In the context of the first quarter of 2024, nationwide, both mobilization and outstanding loans decreased, Nghe An's banking industry still maintained good growth in mobilized capital and outstanding loans.

In the first quarter of 2024, the banking industry's mobilization and lending situation faced many difficulties, with both mobilization and outstanding loans decreasing nationwide. By February 20, 2024, nationwide mobilization decreased by 1.83%; nationwide credit decreased by 1.09%.

In that context, Nghe An Banking industry still maintains a good growth rate of mobilized capital and outstanding debt.

It is estimated that by March 31, 2024, the mobilized capital in the province will reach VND 241,069 billion, an increase of 3.75% compared to the beginning of the year. The total outstanding debt of credit institutions in the area is estimated at VND 288,811 billion, an increase of 0.9% compared to the beginning of the year.

Some priority areas for lending support include: loans for rural agricultural development, loans to encourage the development of high-tech agriculture, clean agriculture and credit programs under the direction of the Government and the Prime Minister; loans for major projects of the province; support debt collection for loans for aquaculture development. Implement the directives for some important sectors and fields of the economy such as real estate, petroleum, key traffic projects.

The bad debt ratio of Nghe An banking sector has always been maintained at a low level (below 2%) compared to the general level of the whole country. It is estimated that by March 31, 2024, the total bad debt of banks in the area will account for 1.96% of total outstanding debt.

The leader of the State Bank of Nghe An branch said: The banking sector continues to direct credit institutions in the area to reduce costs to reduce the lending interest rate level, promptly support people and businesses. Monitor the implementation of the announcement of average lending interest rates, the difference between average deposit and lending interest rates, lending interest rates for credit programs, credit packages and other types of lending interest rates.

The banking sector continues to implement Directive 01/CT-NHNN in 2024 to balance capital sources to meet credit capital needs for the economy, ensure liquidity for the banking system, thereby contributing to removing difficulties and promoting the real estate market to develop safely, healthily and sustainably.

Credit management meets capital needs for production and business in a timely manner, and promotes the bank-business connection program.