Chinese Yuan plunges, will Vietnam's trade balance be severely affected?

When the Chinese Yuan depreciated sharply, Vietnam's trade balance was severely affected due to cheap Chinese goods flowing into the domestic market.

Assessing the impact of the US-China trade war on Vietnam's trade, the Vietnam Institute for Economic and Policy Research (VEPR) said that currently, the VND is still pegged to the USD. When the CNY depreciates sharply, Vietnam's trade balance will be severely affected due to the massive influx of cheap Chinese goods into the domestic market.

The yuan has depreciated sharply.

|

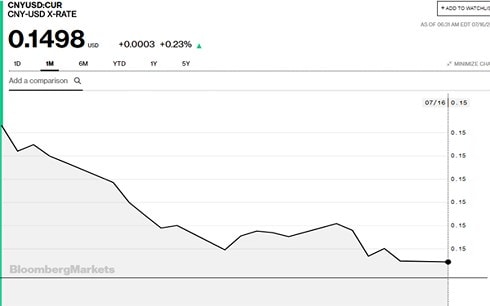

| Chart of exchange rate movements between USD and CNY in the past month (according to Bloomberg) |

According to Bloomberg, over the past month, the exchange rate between the Chinese Yuan and the USD has been continuously decreasing. At 5:00 p.m. on July 16, 1 CNY was only worth 0.1498 USD (or 1 USD was worth 6.675 CNY). The CNY is at a record low against the USD. The current sharp decline in the CNY is raising concerns that China may be ready to devalue its currency as a weapon in the erupting Sino-US trade war.

The Chinese yuan exchange rate fell 0.73% last week compared to the previous week's closing price and was the lowest level since January 2016. Over the past month, the yuan has fallen more than 4%, and since April, the yuan has lost 5.4%. Many forecasts also suggest that the yuan will be adjusted to decrease even more deeply in the coming time.

Analyzing the impact of the above moves, VEPR experts said: The US and China are two particularly important trade partners for Vietnam. While the US is Vietnam's largest export market with about 1/5 of total export turnover, Vietnam imports the most from China with about 1/4 of total import turnover.

The US-China trade war and the recent devaluation of the CNY have had a major impact on the world economy, including Vietnam. By the end of the second quarter of 2018, China's foreign exchange reserves had decreased by about 30 billion USD compared to the first quarter. This may reflect the passive position of the People's Bank of China (PBoC) in the event of the CNY's sharp devaluation against the USD. It is highly likely that foreign investors have begun to withdraw capital from China, forcing the PBoC to reduce foreign exchange reserves to maintain the value of the CNY.

In the context of the US-China trade war, the Fed's monetary tightening and the devaluation of the CNY, VEPR suggests a policy of devaluing the VND against the USD at a moderate level and lower than the devaluation of the CNY against the USD. With the characteristics of a country that imports a lot of raw materials from China for processing and export, such an exchange rate adjustment makes raw material importers benefit from the Chinese market, while importers benefit from exporting to the US. Taking advantage of these two large markets can help Vietnam improve its production situation and trade balance.

Vietnamese businesses need to focus more on the domestic market.

Looking back at the import-export results in the first half of this year, VEPR assessed that the trade surplus was the fourth consecutive quarter. Specifically, exports and imports increased by 10.20% and 6.03% (yoy), respectively. The trade surplus in the second quarter reached approximately 1.4 billion USD, marking the fourth consecutive quarter of surplus. In the first 6 months of the year, the trade balance had a surplus of 2.7 billion USD.

The FDI sector continues to be the trade locomotive of the Vietnamese economy with a trade surplus of 8.06 billion USD, up 34.0% over the same period last year. Meanwhile, the domestic sector still suffered a deficit of 6.66 billion USD, equivalent to last year's deficit.

According to partners, after the second quarter, the US surpassed the EU to become Vietnam's largest export market with a turnover of 21.5 billion USD after the first 6 months of the year, up 9.2% over the same period. Followed by the EU and China, reaching 20.5 and 16.6 billion USD respectively.

Regarding imports, China continued to be the largest import market, reaching 31.1 billion USD (up 15.6%) with key items being fabrics, phones and components. The large import turnover helped China replace South Korea to become Vietnam's largest trade deficit market in the first half of 2018.

In the context of the trade war between the US and major trading partners, VEPR believes that open and small economies like Vietnam will receive both opportunities and risks.

According to VEPR analysis, Vietnam’s trade is still on a positive growth path in a relatively favorable context of global trade. However, the current openness of the economy at over 190% also puts Vietnam under many risks and challenges if the global economy enters a period of recession due to trade wars. The 2008 global financial crisis is still a vivid lesson for Vietnam.

A possible solution proposed by VEPR is that businesses need to focus more on the domestic market with increasing purchasing power. If they ignore the potential domestic market, the possibility of losing right at home is very high when there are currently many foreign businesses looking for business opportunities in Vietnam. Of course, the world market is still the biggest opportunity for Vietnamese products to develop in the long term thanks to the advantage of scale./.