Multiplying the effectiveness of policy capital

(Baonghean.vn) - In 2021, the policy credit capital of the Vietnam Bank for Social Policies helped many households escape poverty; some remote villages and communes reached the new rural finish line, and people's lives improved a lot.

GIVE FISHING ROD THAN GIVE FISH

Visiting the chicken and duck farm of Mr. Nguyen Van Hung in Nam Giang commune, Nam Dan district, few people would think that his family used to be very poor. Understanding how important policy capital is for people in difficult circumstances; it is the key to opening the door to the future for poor households, near-poor households, businesses in difficult areas..., 3 years ago, Mr. Hung borrowed 50 million VND from the poor household program to invest in a livestock farm.

After that, the livestock farming developed, he escaped poverty and continued to borrow 100 million VND fromnew poverty alleviation programManaged by the Farmers' Association, to expand investment in barns and breeding animals.

|

| Nguyen Van Hung's chicken and duck farm in Nam Giang commune, Nam Dan district. Photo: Thu Huyen |

Also in Nam Giang commune, Nam Dan district, the family of Mrs. Tran Thi Trung (67 years old) in hamlet 5 borrowed 100 million VND to escape poverty and invest in a 4-hectare farm. The fruit garden includes pink grapefruit, lychee, longan, papaya... which produces sweet fruit all year round.

Along with raising chickens and pigs, digging ponds to raise fish, the VAC-model farm of Mrs. Trung and her husband provides clean, safe food to serveEcotourism in Eo Gio area.

|

| The family of Mrs. Tran Thi Trung (67 years old) borrowed 100 million VND to escape poverty and invest in a 4-hectare farm in hamlet 5, Nam Giang commune, Nam Dan. Photo: Thu Huyen |

In the mountainous district of Quy Hop, in 2015, Ms. Nguyen Thi Thanh in Tho Son hamlet, Tho Hop commune started a model of breeding cows, using capital from the Social Policy Bank to develop the economy. Although she is a poor household in Tho Hop commune, with her hard-working and studious nature, when the commune opened training classes on basic knowledge of production and breeding, Ms. Thanh registered to participate to learn. Thanks to that, after only 5 years, Ms. Thanh's family's herd of cows has continuously grown; with the profit from raising cows, she continued to raise pigs, chickens and invested in raising goats. Currently, Ms. Thanh's family has paid off all debts, escaped poverty, and become a well-off household in the village.

It is difficult to list all the effective business models fromloan source from the Social Policy Bankhas been sowing sweet fruits in all localities. It is worth mentioning that, from the perspective of innovation to increase sustainability, currently, lending policies are being designed in the direction of conditional support rather than giving them away. With the policy perspective of "giving fishing rods rather than giving fish strings", the Nghe An branch of the Vietnam Bank for Social Policies has seriously and promptly implemented the disbursement of capital.

|

| Policy Bank staff guide people through loan procedures. |

However, according to Mr. Nguyen Van Vinh - Deputy Director of the Provincial Social Policy Bank, capital is only a partial support for the poor and policy households in escaping poverty. The effectiveness of capital depends largely on the guidance of functional sectors such as agriculture, forestry, industry and trade... to help people grasp and apply science and technology in livestock production, economic business and product consumption in the fastest way. People themselves must have the consciousness to rise up; change the way of thinking, the way of doing, know how to calculate in spending, know how to use capital in the most effective way...

More than 66.2 thousand policy beneficiaries have received funding

In 2021, the Covid-19 pandemic caused countless difficulties for the economy and people's lives, putting pressure on the Vietnam Bank for Social Policies. However, many solutions were proposed and with the spirit of dedication and effort, putting oneself in the highest working mode, many indicators of the Vietnam Bank for Social Policies of Nghe An province achieved a good growth rate, capital resources were maximized effectively.

Up to now, the Nghe An Provincial Branch of the Vietnam Bank for Social Policies is managing 21 policy credit programs, with a total outstanding loan balance of VND 9,646 billion, a growth rate of 7.08%, completing 100% of the plan assigned by the superiors. In 2021, the main policy credit capital source will still focus on poor areas and the subjects of poor, near-poor, and newly escaped poverty households to successfully implement the poverty reduction target for the period 2021-2025 andnew rural construction.

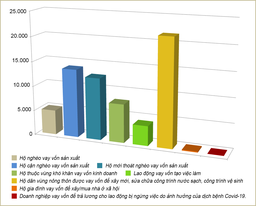

|

| Policy subjects receiving capital from the Nghe An Social Policy Bank in 2021. Graphics: Huu Quan |

Particularly, the loan turnover for 3 subjects (poor, near-poor and newly escaped poverty households) reached 1,692 billion VND, accounting for 60.27% of total turnover; loans for clean water and rural environmental sanitation programs contributing to the construction of new rural areas reached 429 billion VND; social housing loans for low-income people/policy subjects were 59.4 billion VND. In particular, the unit disbursed loans to support businesses to pay salaries for workers who were suspended due to the impact of the Covid-19 epidemic, which was 8,144 million VND/32 businesses/1,496 paid workers.

Policy credit capital has promptly provided capital to 66,200 poor households and other policy beneficiaries with capital for production, business, and improving their lives. Policy credit capital has really brought efficiency to poor households and policy beneficiaries. According to statistics in 2021, 31,700 poor and near-poor households escaped poverty thanks to policy credit support, contributing significantly to the successful implementation of the poverty reduction target.

|

| Con Cuong District Social Policy Bank staff inspect raw material areas to support local businesses affected by the Covid-19 pandemic. Photo: Thu Huyen |

The quality of policy credit has been continuously improved, bad debt has been strictly controlled and continues to decrease. The branch management board regularly follows the base to direct the review, assessment and classification of debt to have appropriate solutions; on the one hand, strengthening solutions to recover debt, on the other hand, doing a good job of handling risky debts due to objective reasons (natural disasters, epidemics, death, missing). Bad debt currently accounts for only 0.22% of total outstanding debt, down 0.05% compared to the end of 2020.

Over the years, the credit policy implemented by the Vietnam Bank for Social Policies has proven to be an important tool in poverty reduction for the Government and localities. The value of the capital source does not stop at supporting and motivating poor, near-poor households and policy families to escape poverty; ensuring social security but is also multiplied many times by those who have benefited and used the capital effectively.

|

| In the face of the complicated developments of the Covid-19 epidemic, the transaction activities of the Vietnam Bank for Social Policies, Nghe An branch, have always strengthened the implementation of the dual goal of both effectively preventing the epidemic and promoting the disbursement of capital for socio-economic development. Photo: Thu Huyen |

Promoting those results, in 2022, the Branch will focus on directing the implementation of the dual goal of both preventing the Covid-19 epidemic and accelerating the completion of the plan targets. The focus is on advising local Party committees and authorities at all levels to continue to implement well and effectively.Directive No. 40-CT/TW dated November 22, 2014 and Conclusion No. 06-KL/TW dated June 10, 2021 of the Central Party Secretariat on strengthening the Party's leadership over social policy credit. Maximize capital sources to meet the loan needs of poor households and other policy beneficiaries.

At the same time, closely follow the capital needs of credit programs to maximize the central capital source; actively mobilize capital from provincial, district, commune budgets and other organizations; continue to mobilize deposits from residents, effectively implement the method of receiving deposits from poor households and policy beneficiaries at transaction points and through the Savings and Credit Group to promptly meet the capital needs of poor households and policy beneficiaries with resources to invest in economic development and improve essential needs. Thereby, gradually stabilize life and strive to become rich legitimately./.