How is Japan trying to regain its position as a technology leader?

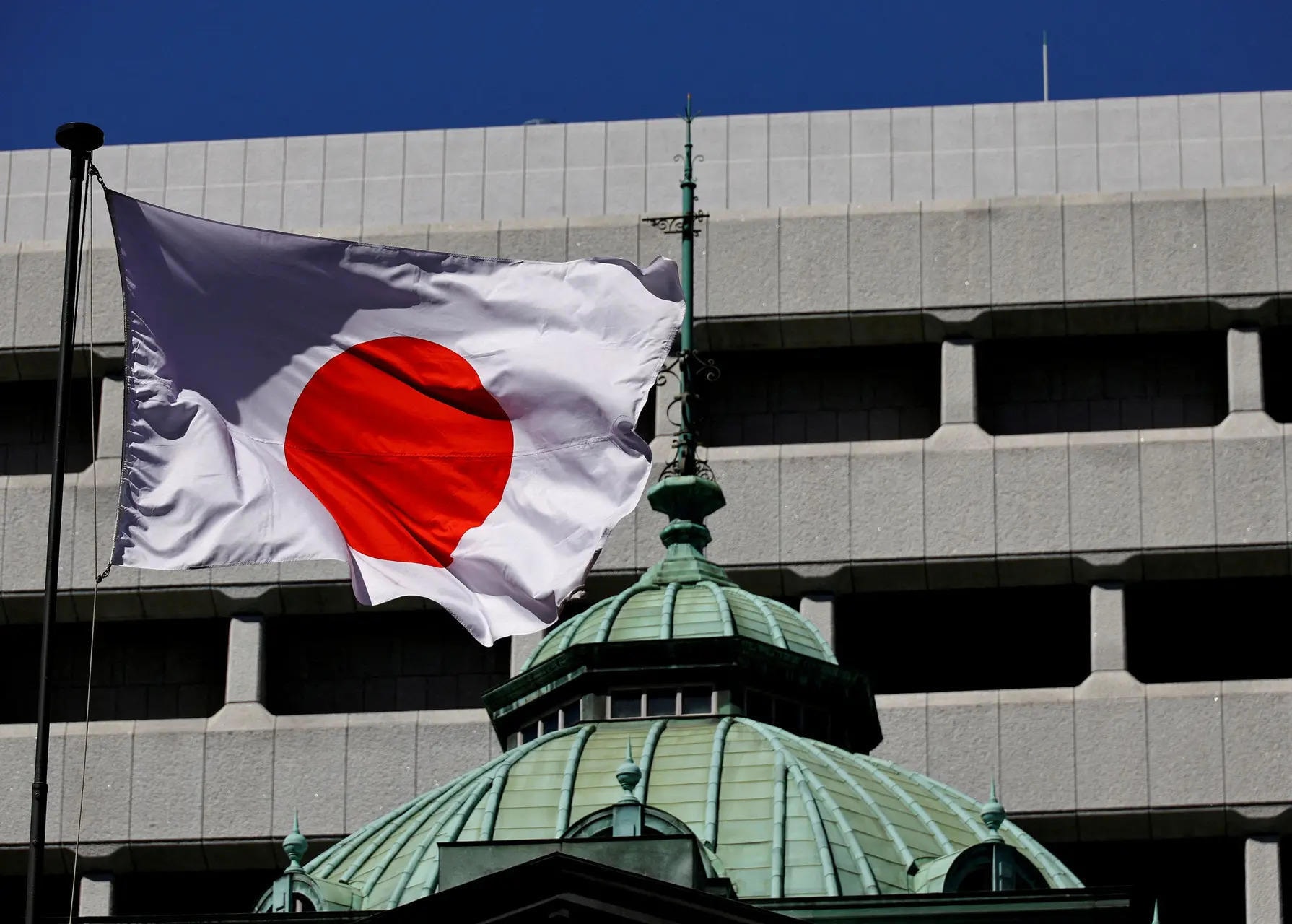

Japan, once a high-tech powerhouse with groundbreaking inventions such as robots, cars and consumer electronics, is making relentless efforts to regain its technological leadership on the international stage.

China's remarkable success in using industrial policy to expand its economy and finance green manufacturing has contributed to fierce competition among countries to develop and protect domestic firms.

It has been 40 years since concerns about the potential for a rising Asian power first began to prompt government intervention in the West’s largest free-market economies. But back then, the source of the anxiety was Japan, not China, as it is today.

A 1990 survey found that nearly two-thirds of Americans said Japanese investment in the United States posed a threat to their economic independence. Concerns about Japanese companies peaked just as signs of a recession emerged following the collapse of Japan's real estate and stock market bubble in 1991.

Now, after a period of stagnation that the Japanese Ministry of Economy calls "three lost decades", the Tokyo government is trying to revive by investing billions of dollars in modern industries to return the country to its former strong growth and technological leadership.

Efforts to promote cooperation with countries around the world in the field of technology

Japan has rarely collaborated with foreign technology companies in the past. But this time, Japan is collaborating with leading technology companies in the US and other countries – a collaborative approach that would have been unthinkable decades ago.

Despite Japan's efforts to open up more, its controversial acquisition of US Steel, the largest steel producer in the United States, has become the focus of a trade protectionist war. This shows that even if Japan intends to cooperate more, the United States still puts its national interests first and is willing to protect its core industries.

Japan is currently focusing on investing heavily in advanced technologies such as batteries, solar energy and especially the semiconductor industry. The Japanese government has poured more than 27 billion USD into the semiconductor industry in the past three years, with the aim of regaining its leading position in the global market.

According to Akira Amari, former Japanese Minister of Economy, Trade and Industry, the future will see a clear division between countries. On one side are countries that are capable of producing chips themselves, and on the other side are countries that are completely dependent on chip supplies from abroad. Mr. Amari asserted that this is the division between winners and losers.

"We realize that, to succeed in the chip field, international cooperation is extremely important. Therefore, Japan is actively cooperating with international partners right from the early stages of projects, based on lessons learned," said Mr. Akira Amari.

While other countries are pouring hundreds of billions of dollars into the technology race, Japan stands out with a different approach. They rely on their successful experience in using industrial policy to restore the economy after World War II.

"Japan doesn't need to start from scratch like other countries, because it already has its own foundations," said Alessio Terzi, an economist at the European Commission.

Japan's Semiconductor Industry 'Revival' Project: From a Phone Call to a Giant Construction Site in Hokkaido

Amidst the blooming flower fields and snow-capped mountains of Hokkaido, Japan’s northernmost island, a bustling construction site is taking shape. This is no ordinary site, but the site of Japan’s most advanced semiconductor chip factory, part of an effort to revive the industry that once made the country famous.

The idea for the factory began with a phone call in the summer of 2020. John E. Kelly III, a veteran IBM executive, contacted Tetsuro Higashi, president of Rapidus, a Japanese chip startup. Kelly told Higashi about a new, cutting-edge 2-nanometer chip technology that IBM had developed at its Albany, New York, lab. He proposed a collaboration between the two companies to produce the chips in Japan.

For Higashi, this was an opportunity not to be missed. He realized that Japan, once a chip manufacturing powerhouse, was gradually losing its position. Failure to seize this opportunity could cause Japan to fall behind its competitors in the technology race. After careful discussion, Higashi decided to cooperate with IBM and proceed with the construction of a chip manufacturing plant in Hokkaido.

To make this project a reality, Higashi contacted Akira Amari, a senior Japanese government official in charge of industrial policy. With the government's support, the project was quickly implemented. The new factory, funded with billions of dollars, will use IBM's advanced 2-nanometer chip technology, promising to revolutionize Japan's semiconductor industry.

The image of a modern factory gradually taking shape on the land of Hokkaido, famous for its natural beauty, is a clear demonstration of Japan's determination to restore its position in the high-tech field.

New policies aim to restore Japan's position as a global technology leader

The COVID-19 pandemic has exposed serious flaws in global supply chains, causing shortages of a wide range of goods, from high-tech components like computer chips to familiar consumer products like sriracha hot sauce.

In addition, the conflict in Ukraine has exacerbated the situation, pushing up energy prices and causing other uncertainties. In this context, the Japanese government and other governments around the world have clearly recognized the urgent importance of building a safe, stable and sustainable supply chain.

In 2020, Japan introduced a series of policies to encourage domestic companies to produce essential products such as semiconductors, wind turbines, and medical supplies. The goal of this policy is to reduce dependence on foreign supplies, especially from China, while increasing self-sufficiency in production.

Faced with growing challenges in the global economy, Japan made a major shift in its industrial policy in 2021. The Ministry of Trade announced a series of proactive interventions to promote the development of key industries.

According to the assessment of the new policy planning committee, the main cause of Japan's economic stagnation over the past many years is the excessive application of the principle of government non-intervention in the economy. This change shows that Japan has clearly recognized the importance of the state's proactive role in shaping the country's economic future.

The Ministry of Commerce has conducted an extensive study of the industrial policies of major competitors such as the United States, the European Union and China. In addition to comparing current policies, the Ministry has also conducted a thorough analysis of the industrial and economic policies that Japan has adopted in the past, from which valuable lessons can be drawn to build a new development strategy.

The commission asserts that this 'new direction' will mark a radical departure from previous industrial policies, which have focused on protecting and promoting specific industries. Instead, the government will use the entire policy toolkit to pursue broader goals, such as promoting green technology and energy conservation. These projects are expected to be large-scale, long-term and rigorously planned.

The ideas presented in this report reflect a significant shift in economic thinking, particularly influenced by prominent economists such as Mariana Mazzucato (Italy) and Dani Rodrik (Harvard University, USA). These economists have been actively advocating for a proactive role for governments in guiding economic development, especially in areas such as green transition and digitalization. Their ideas have contributed significantly to shaping this new industrial policy.

Twenty-five years ago, in the face of the decline of the chip industry, Japan decided to carry out a major restructuring. They merged several leading chip manufacturing companies into a single corporation, Elpida Memory, in the hope of creating a "giant" that could compete in the international market. The Japanese government poured a large amount of investment capital and preferential loans into Elpida. However, these efforts did not bring the expected results. In 2012, Elpida had to declare bankruptcy, becoming one of the largest bankruptcies in Japanese economic history since World War II.

Today, semiconductor chips are not simply the product of one country. Taiwanese companies, for example, can manufacture chips based on designs from American engineers, using highly sophisticated manufacturing equipment from the Netherlands and Japan. This shows that the production of a chip is the result of complex collaboration between many countries, each playing an important role in the global supply chain.

Semiconductor startup Rapidus, heavily backed by the Japanese government, is undertaking an ambitious project to develop advanced semiconductor manufacturing technology. The company will transfer technology from IBM, one of the giants in the chip industry, to produce high-performance chips.

To ensure the project’s success, hundreds of Japanese engineers were sent to IBM’s research facilities in Albany, USA, to learn and work directly with leading experts. The Japanese government not only invested in large projects like Rapidus, but also supported smaller projects, aiming to build a strong and comprehensive chip manufacturing ecosystem in the country.

Japan has succeeded in luring Taiwan's world-leading chipmaker TSMC to invest in building a manufacturing plant in the town of Kikuyo. The project marks a major step forward in Japan's efforts to revive the semiconductor industry.

With the participation of domestic enterprises such as Sony and financial support from the government, the factory officially went into operation in February. The cooperation between the parties has created a strong industrial alliance, contributing to bringing Japan back to the leading position in the field of semiconductor chip production.

A conference held this spring at the Brookings Institution's Asia Policy Research Center noted that "without government intervention, many projects currently underway in Japan may not come to fruition."

But there are still skeptics in Japan. The Rapidus plant has been criticized for its ambitious timeline and failure to attract much private sector investment. Still, Mr. Amari says there is no alternative: “If you don’t get into the semiconductor industry now, you’re going to be in the losing camp from the start. Japan will never choose that.”