Japan surpasses China to become America's largest creditor

(Baonghean) - Japan surpassed China to become the country holding the largest amount of US Treasury bonds last June, amid the tense US-China trade war.

|

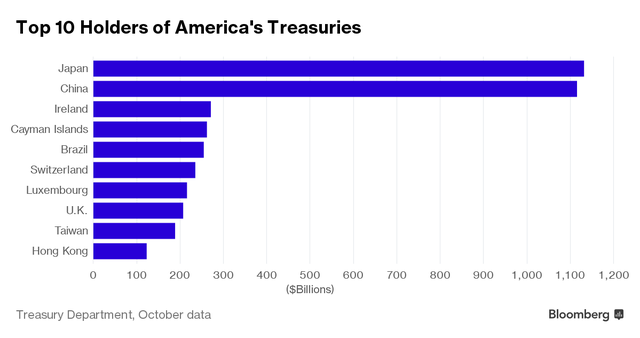

| List of the 10 largest "creditors" of the US, according to data from the US Treasury Department. Photo: Bloomberg |

International media reported that Japan surpassed China to become the largest creditor of the United States in June, with its holdings at the highest level in nearly three years, the US Treasury Department said on August 15.

Specifically, the amount of US public debt held by Japan increased by 21.9 billion USD in June to 1.1229 trillion USD, according to data from the ministry. Japan has surpassed China to become the largest owner of US public debt in the past 2 years.

Meanwhile, China held $1.1125 trillion of U.S. debt in June, up slightly by $2.3 billion from the previous month after three straight months of declines. So far, China appears to have been less active in buying U.S. debt.

Amid the trade war between the two countries, analysts have speculated about the possibility of Beijing dumping US debt in retaliation against Washington. However, there is currently no sign that China will use this "weapon".

It is known that the last time Japan held the position of the largest creditor of the US was in May 2017. Since October 2018, Japan has continuously bought net US Treasury bonds, with a total net purchase volume of more than 100 billion USD.

U.S. Treasury yields have been falling recently, but remain positive. Meanwhile, the amount of negative-yielding government bonds globally is growing rapidly. For example, Japanese government bond yields are currently at minus 0.23%.

Therefore, the appeal of US Treasury bonds is very large, especially when investors are worried about fluctuations in the financial market, trade wars, and the risk of a global economic recession. Besides gold, US Treasury bonds are always considered a safe, traditional method.

"The buying of US Treasuries by Japanese investors is a clear reflection of the current global low and negative yield environment," said strategist Ben Jeffery of BMO Capital Markets.

The yield on the 30-year US Treasury bond fell below 2%, a historic low, on Thursday, while the yield on the 10-year US Treasury bond fell below 1.5%, a three-year low.