Many business owners have their departure from the country suspended due to tax debts.

From April 9 to 16, 2025, the Tax Department of Region X issued a notice of temporary suspension of exit for a number of individuals who are legal representatives of enterprises that are being forced to execute administrative decisions on tax management, due to not having fulfilled their tax payment obligations.

According to the Tax Authority, the temporary exit suspension measure is applied to ensure that related businesses and individuals fully perform their financial obligations to the State. Some individuals subject to this measure include:

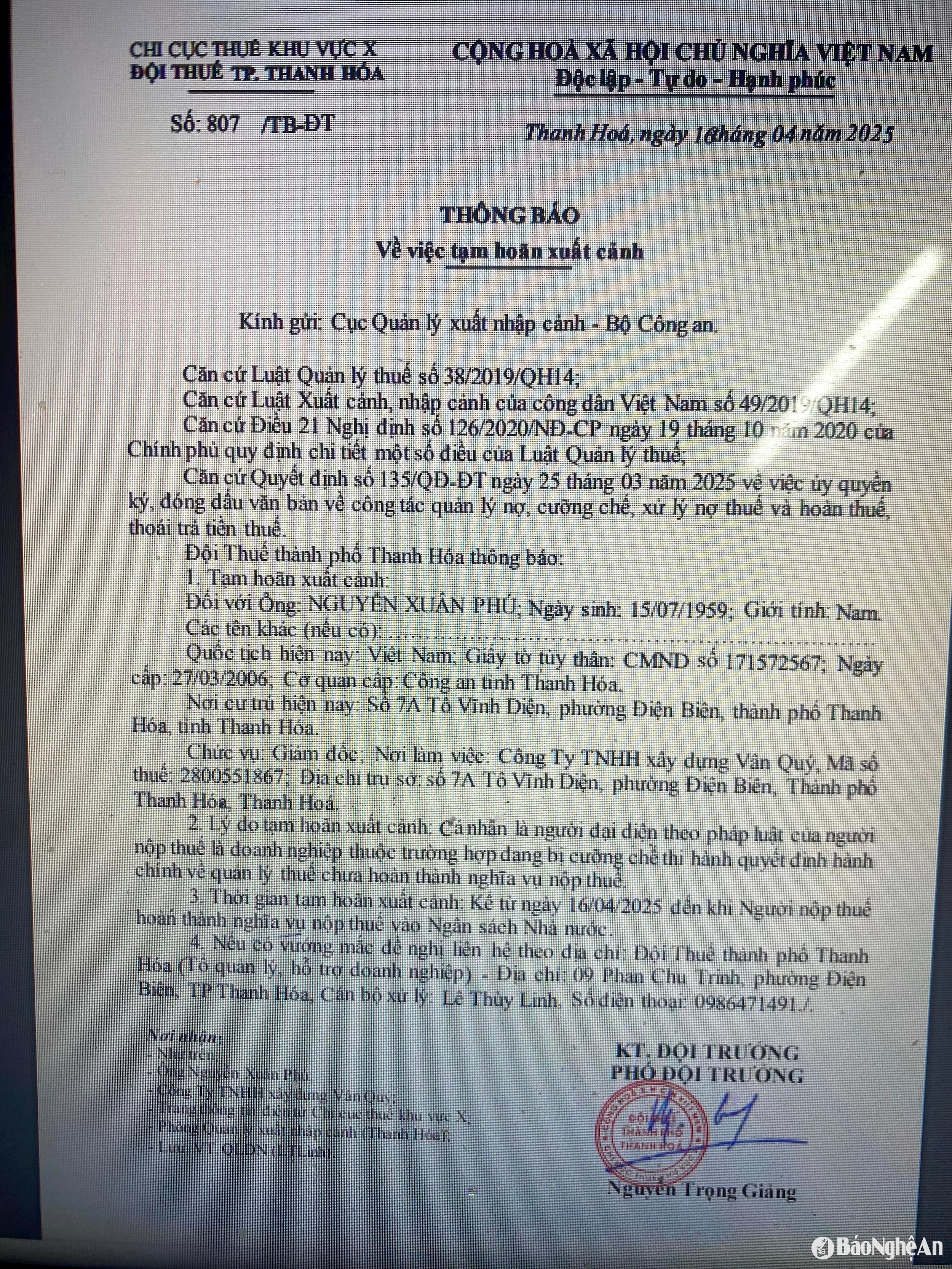

- Mr. Nguyen Xuan Ph., born on July 15, 1959, address at No. 7A To Vinh Dien, Dien Bien Ward, Thanh Hoa City, Thanh Hoa Province. Mr. Ph. is the legal representative of Van Q. Construction Company Limited with headquarters at the same address.

- Mr. Le Tan C., address at 61 Ly Thuong Kiet Street, Vinh City, Nghe An Province. He is the legal representative of DONAMART Supermarket Joint Stock Company.

- Mr. Dang Cong V., address at Tay Ho 1 block, Quang Tien ward, Thai Hoa town, Nghe An province, is the legal representative of Cua Lo Real Estate Joint Stock Company.

- Mr. Hoang Van D., residing in Hamlet 1, Xuan Son Commune, Do Luong District, Nghe An Province. Mr. D. is the legal representative of Thien Nhan Real Estate Joint Stock Company.

The temporary suspension of exit is carried out according to the procedures of the Tax Department. After reviewing and verifying the tax obligations of individuals, the tax authority will make a list and send a request to the immigration authority. At the same time, a notice will also be sent to taxpayers so that they are aware and can promptly complete their financial obligations.

Immediately after receiving the document from the Tax authority, the immigration authority will proceed to suspend exit according to regulations and publicize the information on its electronic information portal.

In case the taxpayer has fulfilled his/her financial obligations, within 24 working hours, the Tax authority shall be responsible for issuing a document canceling the temporary suspension of exit and sending it to the immigration authority for updating, ensuring the legitimate rights of citizens.