Many Vietnamese customers bargain when buying cars.

Unprecedented price reductions in 2017 have led to a higher rate of Vietnamese customers bargaining before deciding to buy a car.

JD Power has just released its 2017 Vietnam Auto Sales Satisfaction Index study. Factors that Vietnamese customers carefully consider include brand, model, dealer and promotion. They bargain more at authorized dealers before deciding to buy a car.

Nearly two-thirds (65%) of new car buyers said they looked more closely at models and visited more dealerships than in 2016.

|

| Vietnamese customer satisfaction index decreased in 2017. |

On average, each customer researches 7 different sources of information to gain initial knowledge and opinions about the vehicle they are looking at. The internet is the most used information channel, at 99%.

Search rates on car websites and social media increased significantly over last year, while manufacturer and dealer websites received less attention.

"The race in the Vietnamese auto market is getting fiercer than before, when the policy of reducing import tax within ASEAN took effect from 2018. Genuine dealers are trying to attract customers and boost sales with big discount and promotion programs," said Loic Pean - Senior Manager of JD Power.

"But the price reduction has had the opposite effect. Consumers are waiting for car prices to hit rock bottom, while many sales staff are trying to find ways to quickly sell old cars to make way for new ones. This has negatively affected the satisfaction level of Vietnamese customers," he added.

JD Power's research also shows that the sales service experience standards of new car buyers have decreased significantly, to only 19.6 points, which means lower than the 20.6 points of 2016. This score is based on a scale of 22 important standards given for evaluation.

Customer interactions were found to be less attentive than last year. Many customers complained that sales staff were not focused on them (down 13%), they were not given a detailed introduction to the car’s features and benefits (down 10%), and they were not kept informed during the delivery process (down 8%).

Additionally, only 77% of customers say that salespeople use a showroom vehicle to demonstrate actual features, up from 90% in 2016.

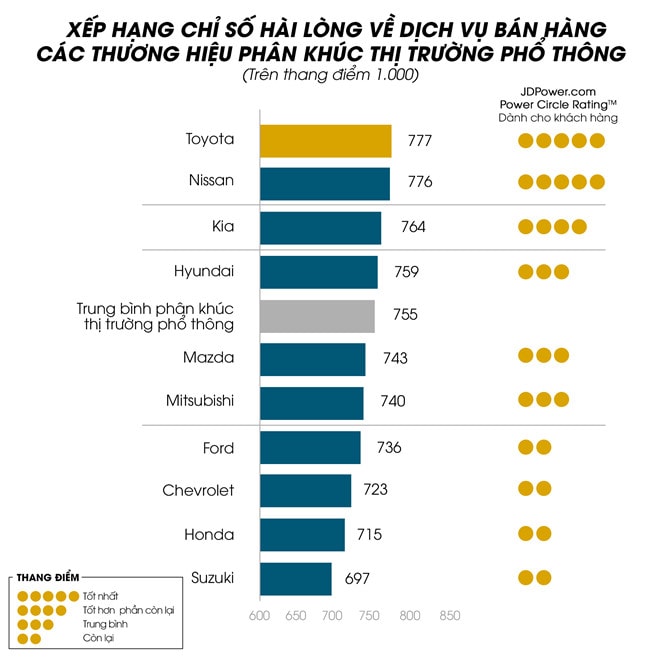

Average satisfaction with sales and delivery service fell to 755 (on a 1,000-point scale) in 2017, down from 793 in 2016.

New car buyers are bargaining more, with 60% saying they negotiated the price before making a purchase, up 25% from 2016. As a result, 66% of customers received discounts and 98% received promotional gifts from dealers. However, 27% of new car buyers said they paid more for their car than they originally planned, a sharp increase from 12% in 2016.

|

| Toyota leads the 2017 satisfaction index. According to JD Power. |

Among new car owners, 42% said they would “definitely” recommend the dealership they purchased their car from to a friend, and 22% said they would “definitely” return to the same dealership to buy a car. Those figures were 39% and 14%, respectively, in 2016. However, only 51% said they would use the same dealership for after-sales service over multiple years.

In terms of brand satisfaction, Toyota continues to lead this year, with a score of 777. The Japanese automaker performed well in sales service, dealer facilities, and delivery. Nissan ranked second (776 points), followed by Kia (764 points).

JD Power’s study looked at the mass-market car segment, based on six factors that contribute to customer satisfaction throughout the car-buying process. The list, ranked by importance, is first: delivery time (21%), dealership facilities (17%), deals (17%), delivery process (16%), sales service (16%), and sales staff (13%).

2017 is the ninth year JD Power has conducted the Automotive Sales Satisfaction Index study. This year’s study was based on responses from 1,734 new vehicle owners who purchased their vehicle between January and October 2017.

According to Zing

| RELATED NEWS |

|---|