Many violations at the Farmers Support Fund of Quynh Tan Commune

(Baonghean) - Many members have received loans from the Fund Management Board many times in excess of the regulations, including many loans that were established falsely.

According to people's feedback, recently, at the Farmers Support Fund (HTND) of Quynh Tan commune, many violations have occurred in lending activities. Many people are upset and have sent petitions to the authorities.

For example, during the period from 2008 to 2010, when Mr. Ho Minh Mau (currently Chairman of the People's Committee of Quynh Tan Commune) was Chairman of the Farmers' Association of Quynh Tan Commune and Head of the Farmers' Fund Management Board, he ignored regulations and abused his authority in lending capital.

Accordingly, in just 2 years (2008 - 2009), Mr. Ho Minh Mau approved loans for Mr. Ho Ba Uyen 35 times with the amount of 816,086,000 VND, of which 05 vouchers did not have the signature of the recipient, 01 voucher did not have the signature of the person making the voucher, 31 vouchers did not have the signature of the accountant, 4 vouchers did not have the signature of the head of the department and 7 people had fake names.

Along with that, Mr. Ho Minh Mau also abused his power, mobilized capital against regulations by borrowing 71 taels of gold, causing a loss of 108 million VND to the association's fund, and automatically withdrew 18 million VND from the loss-compensation risk fund...

|

| Headquarters of the People's Committee of Quynh Tan Commune (Quynh Luu). Photo: Thao Nguyen |

In 2010, Mr. Ho Minh Mau became Chairman of the People's Committee of Quynh Tan commune. The successor of the position of Chairman of the Farmers' Association of Quynh Tan commune, concurrently Head of the People's Credit Fund Management Board, Ms. Nguyen Thi Ha, continued to commit violations.

Specifically, instead of reporting the violations of her predecessor to the Commune Party Committee to find a solution, Ms. Ha kept everything a secret, continuing the mistake and causing many other serious violations.

Accordingly, Ms. Ha "quietly" paid off the gold loan contract left by Mr. Mau, because when borrowing, the converted gold price was 156,910,000 VND, now she has to pay the current price of 265,540,000 VND, causing a loss of 108,630,000 VND to the Association Fund.

In addition, Ms. Ha continued Mr. Ho Minh Mau's previous "project", lending Mr. Ho Ba Uyen more capital, increasing his debt to VND 2,092,935,000, which is difficult to repay.

In particular, on September 30, 2017, Ms. Ha approved loans for 24 households (of which Ms. Ha borrowed 145,000,000 VND) with a total amount of up to 1,198,897,000 VND while other households came to withdraw money but did not have it.

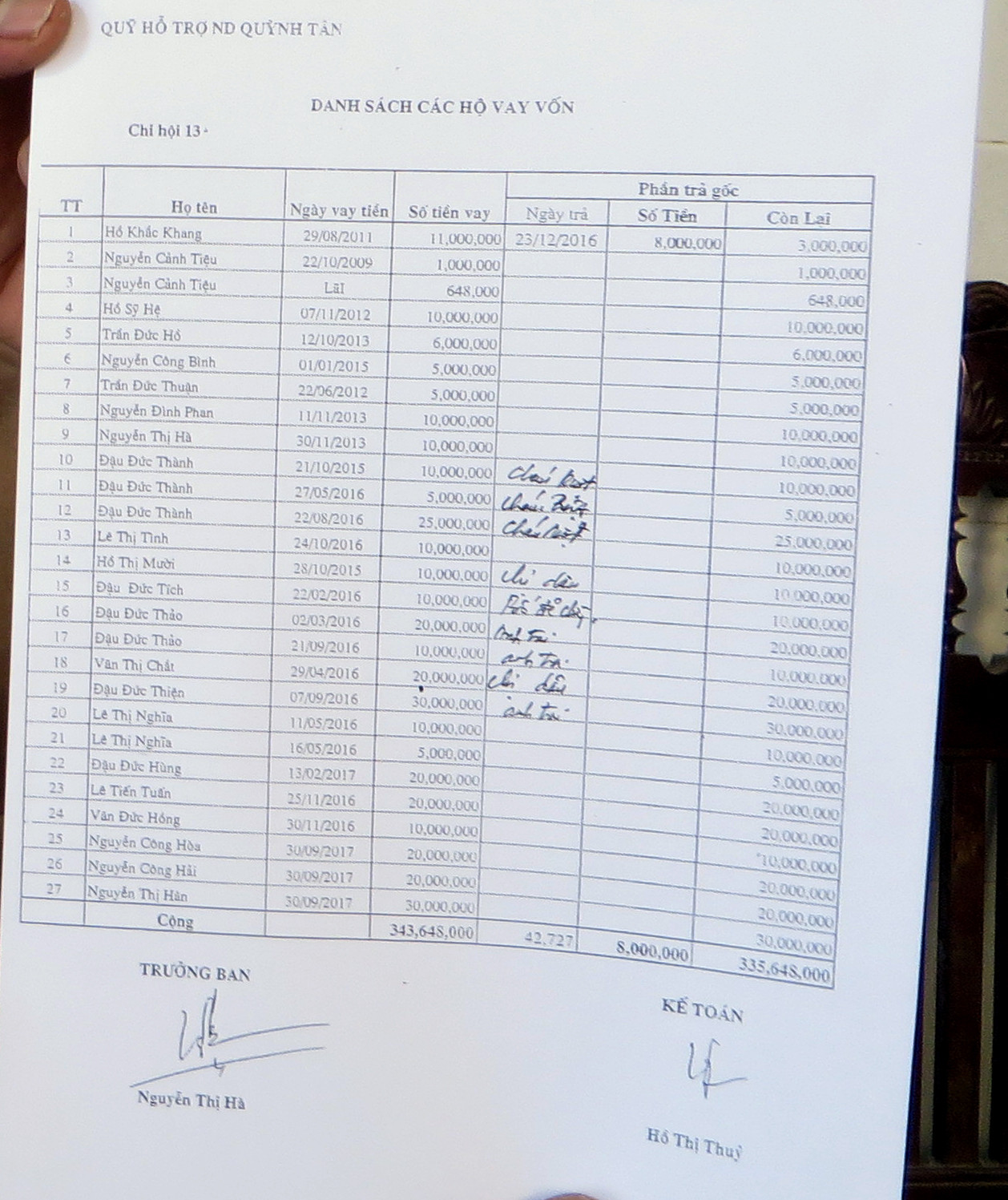

Of these 24 households, 16 are relatives of members of the People's Credit Fund Management Board. 7 households, including relatives of Mrs. Nguyen Thi Ha - President of the Farmers' Association and Head of the People's Credit Fund Management Board, received loans, including: Mr. Dau Duc Tich (Mrs. Ha's father-in-law) borrowed 10 million VND; Mr. Dau Duc Thien (brother-in-law) 30 million VND; Mr. Dau Duc Thao (brother-in-law) 30 million VND; Mr. Dau Duc Thanh (brother-in-law's son) 45 million VND; Mrs. Van Thi Chat (sister-in-law) 20 million VND; Mrs. Ho Thi Muoi (sister-in-law) 10 million VND and Mr. Dau Duc Dong (Mrs. Ha's husband) 30 million VND.

However, it is worth mentioning that among the borrowers, Ms. Ha's mother, two brothers, husband, father-in-law and two brothers-in-law do not have loan applications.

According to the monitoring minutes of the activities of the People's Council Monitoring Team of Quynh Tan Commune, the total amount of money deposited by farmers into the Farmers' Association Fund as of September 30, 2017 was 4,994,209,000 VND/198 households. Total loan amount was 4,899,037,000 VND/256 households. The remaining balance in the Fund was 95,172,000 VND; the remaining balance in the risk, reward, and purchase funds was 197,762,000 VND, the total remaining balance in the Fund was only 292,934,500 VND.

|

| In the list of borrowers, many households do not have any records. Photo: Thao Nguyen |

Faced with the above violations of the People's Credit Fund of Quynh Tan commune, on February 22, 2018, the Farmers' Association of Quynh Luu district issued Notice No. 02 "Conclusion of the Standing Committee of the District Farmers' Association", in which it affirmed: "The People's Credit Fund of Quynh Tan commune does not operate in accordance with Circular 36 of the Ministry of Finance, Decision 851 and Instruction 459 of the Central Committee of the Vietnam Farmers' Association".

Previously, the monitoring board of the People's Credit Fund of the People's Council of Quynh Tan commune also had a record of conclusion: "The annual management board did not report or publicize the list of overdue and difficult-to-collect borrowers. Many loan vouchers did not ensure procedures, did not follow financial principles, one person was allowed to borrow many contracts, borrowed twice a day with a large amount of money, leading to not being able to recover capital and fees but there were no timely remedial measures, did not comply with regulations and circulars, instructions, and legal regulations, leading to serious violations and errors".