The biggest price 'bubbles' in history

Because of greed or trends, many businesses and speculators suffered heavy losses due to the tulip mania, South Sea bubble, and Dotcom.

Could Bitcoin be one of the biggest bubbles in history? The virtual currency has risen more than 1,400% this year. According to people like Warren Buffett, Bitcoin has all the hallmarks of a giant speculative bubble. And if it bursts, the results could be devastating.

|

| Bitcoin price is called "bubble of bubbles". |

“The history of bubbles suggests that Bitcoin will end in a burst. I can’t think of any other outcome,” said Sharon Zoller, an economist at ANZ. Four famous financial bubbles in history will help us better understand what might happen to Bitcoin in the future.

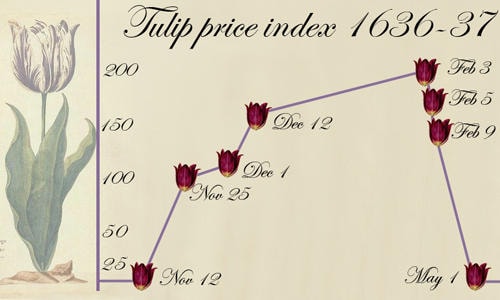

Tulip mania

In the early 17th century, speculators drove the price of tulip bulbs in Holland to unprecedented highs. At the time, newly imported tulips from Türkiye were a novelty in Holland.

Data from those days is scarce, so it’s hard to know exactly how high prices were driven. However, according to the Rijksmuseum in Amsterdam, people mortgaged their homes to buy tulip bulbs.

|

| The 17th century tulip bubble in the Netherlands. |

Like many bubbles, tulip bulb prices were driven by greed and fear of missing out. Speculators bought bulbs in the hope of selling them at a higher price.

However, this phenomenon did not last long. The sudden increase in sales caused a domino effect and the price of tulip bulbs plummeted.

Stephen Innes, head of brokerage Oanda in Asia, believes Bitcoin will have a similar outcome. “The price will be so far out of reach that demand will disappear,” he said.

South Sea Bubble

In the 18th century, shares in the South Sea, a British trading company, soared on the expectation that the company would soon reap huge profits from trading in South Africa. However, these profits never materialized.

South America was controlled by Spain, which was at war with Britain at the time, making a British company's trade monopoly in the region impossible, according to Encylopedia Britannica.

|

| The Great Wall Street Crash of 1929. |

However, individual investors in the UK inflated the price of South Sea shares, causing them to rise 900% in a year. Soon after, the stock began to plummet as speculators sold off. Eventually, the South Sea bubble burst, leading to a series of bankruptcies.

Five years before the crash of 1929, the Dow Jones Industrial Average (DJI) stocks on the New York Stock Exchange rose 500%. Investors were so optimistic about the “Roaring Twenties” US economy that they paid higher prices for stocks.

Eventually, the economic collapse began. But it wasn't just a one-day crash. According to the Federal Reserve, it caused the Dow Jones Industrial Average to plummet for multiple days in a row.

This was made worse by the fact that many investors entered the market with previously borrowed money. Wall Street could not find a bottom for two years until the Dow Jones Industrial Average fell 90% from its 1929 peak.

Dotcom Bubble

Investors were swept up in the internet frenzy of the late 1990s. In just over a year, they poured money into web-focused companies, pushing the Nasdaq up about 200%.

The surge was fueled by a string of billion-dollar bubble stocks of unprofitable internet and software companies.

The fun didn't last long, however. The bubble burst in early 2000, in part because of rising interest rates. The Nasdaq fell about 80% over the next few years.

However, Shane Oliver, an economist at AMP Capital, said that Bitcoin's rapid rise is unlike any bubble he has seen before. "Bitcoin will leave them for dead," he asserted.

According to VNE

| RELATED NEWS |

|---|