Pay non-agricultural land use tax to the authorized collection account of the commune or ward.

Nghe An Provincial Tax Department has just researched and supplemented the collection method for this tax through implementing the payment of non-agricultural land use tax.

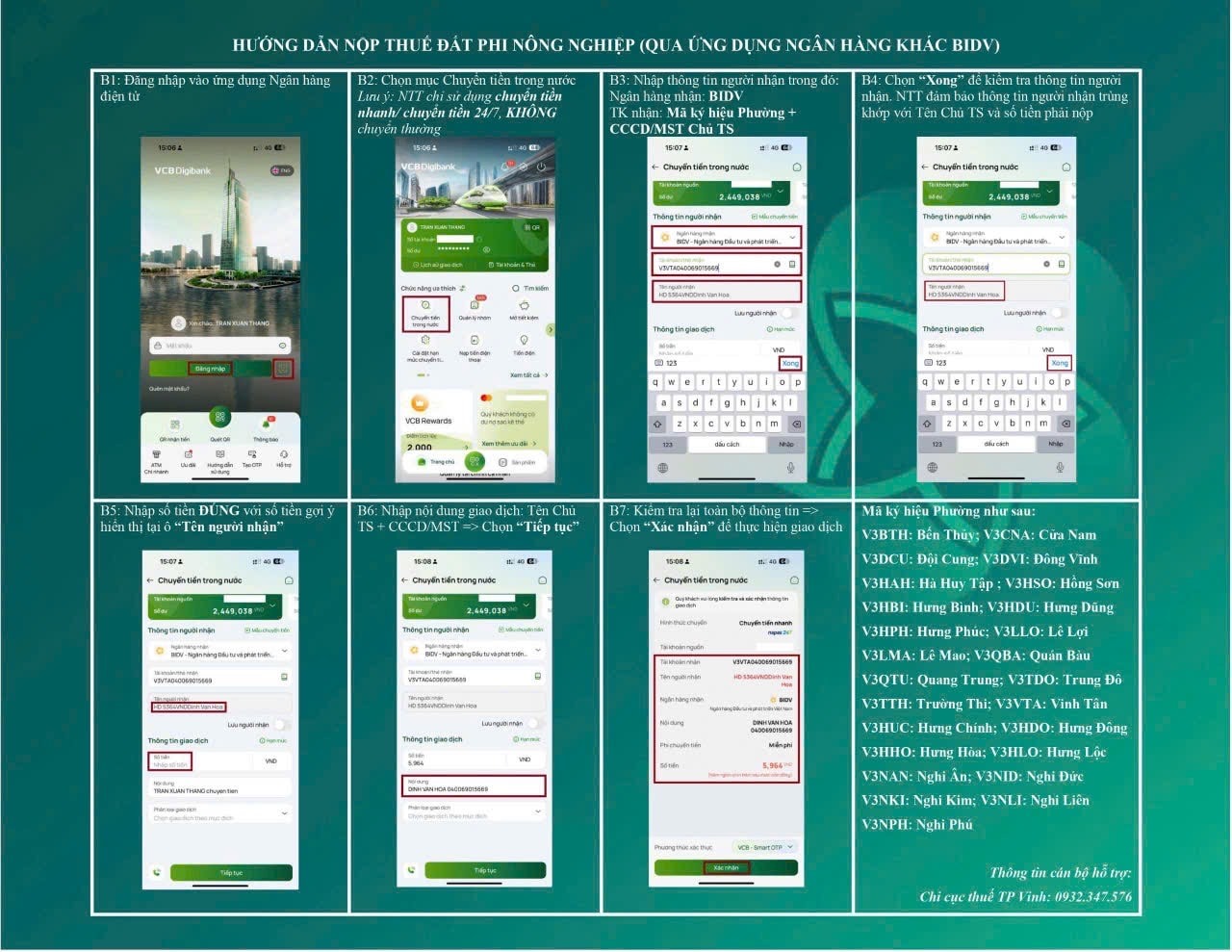

With this form, taxpayers use mobile phones, log in to the Mobile Banking application of all banks, enter the commune or town code and the taxpayer's identification number, which is the tax code or citizen identification number, into the beneficiary account section, the system will display the taxpayer's name and the tax amount payable.

After selecting confirm payment, you have completed your non-agricultural tax obligations with the tax authorities.

Paying non-agricultural land use tax in this form is a new solution, creating convenience for taxpayers when they can use any bank account to pay tax by transfer, can pay on behalf of other taxpayers. Taxpayers only need to have information about tax code or citizen identification, quickly pay the correct amount of tax incurred during the period without having to pay fees at all banks. Thereby minimizing administrative procedures, limiting errors, saving travel time and costs, especially taxpayer information is safe and secure.

Nghe An Tax Department encourages all individuals and taxpayer households to use the above method of paying non-agricultural land use tax to fulfill their tax obligations. Implementation time is from August 2024.

*Specific steps:

-Customer logs into account, BIDV smartBanking

-Select the money transfer item.

-Select internal money transfer.

- Enter account number in the format: Code is citizen identification number or tax code.

- Select check, the system displays the taxpayer's name and the amount to be paid.

- Select check.

- Select continue steps like transfer.

Customers need to contact:

-02383.969.697 (Propaganda Department for Support of Foreign Workers).

http://nghean.dgt.gov.vn.

Pursuant to Article 2 of the Law on Non-Agricultural Land Use Tax 2010, the types of land subject to non-agricultural land use tax include: Rural residential land, urban residential land; non-agricultural production and business land including: land for industrial park construction; land for construction of production and business facilities; land for mineral exploitation and processing; land for production of construction materials and pottery. Non-agricultural land specified in Article 3 of the Law on Non-Agricultural Land Use Tax 2010 is used for business purposes.