Nurturing the dream of going to school from policy credit

(Baonghean) - From the student credit program, over the past 11 years, Nghe An province has had thousands of households borrow capital to send their children to study at universities, colleges and vocational high schools. Preparing to enter the new school year, Nghe An Social Policy Bank continues to be ready to serve new students with difficult circumstances to pursue their studies.

|

| Disbursement of student program capital at Hung Nguyen transaction office. Photo: Tung Chi |

Following students to school

Visiting village 1, Tuong Son commune, Anh Son district, Le Thi Oanh's family, who is near-poor. Thanks to a loan from the Bank for Social Policies with a total amount of 103.6 million VND, all 3 children have graduated and have stable jobs. The two sisters Ngo Thi Xoan - Ngo Van Lam - both graduated from Thai Binh Medical University and are currently working at Nghe An Oncology Hospital. The youngest son, Ngo Van Phi, is currently working locally.

Ms. Oanh shared: “My family is a farmer, if there was no student loan program of the Bank for Social Policies, my family would not have enough money to send my children to university. With the loan support, my family has money to pay tuition and other expenses for my children to study. Currently, all 3 children have stable jobs and my family always fully fulfills its debt repayment obligations to the State.”

In Tuong Son commune, there is also the family of Mr. Ho Huu Minh in village 10 - a typical Catholic household of studiousness. Currently, the eldest daughter of the family, Ho Thi Quyen, has graduated from the Faculty of Medicine, Van Hien University, and has found a job after graduation. The second daughter, Ho Thi Xuyet, is studying at Hanoi University of Industry, and the son, Ho Huu Hiep, is studying at Hanoi University of Science and Technology and continues to borrow capital from the Social Policy Bank to cover tuition fees. Mr. Ho Huu Minh said that although his family is an agricultural producer, although they are actively working, it is still very difficult to raise 3 children to study at universities in the city. Fortunately, thanks to student credit, our family is able to send our children to school.

Anh Son district currently has 1,698 households borrowing, 1,924 students borrowing capital under the credit program for students with outstanding debt of more than 52 billion VND. Director of the district's Social Policy Bank, Mr. Tran Khac Thi said: In 11 years of implementing the program, many households have received loans to support their children's education at secondary schools, colleges and universities. Thanks to the student loan program, many cases with difficult circumstances have realized their dreams and ambitions, many students after graduation have had stable jobs and paid off their debts ahead of schedule.

|

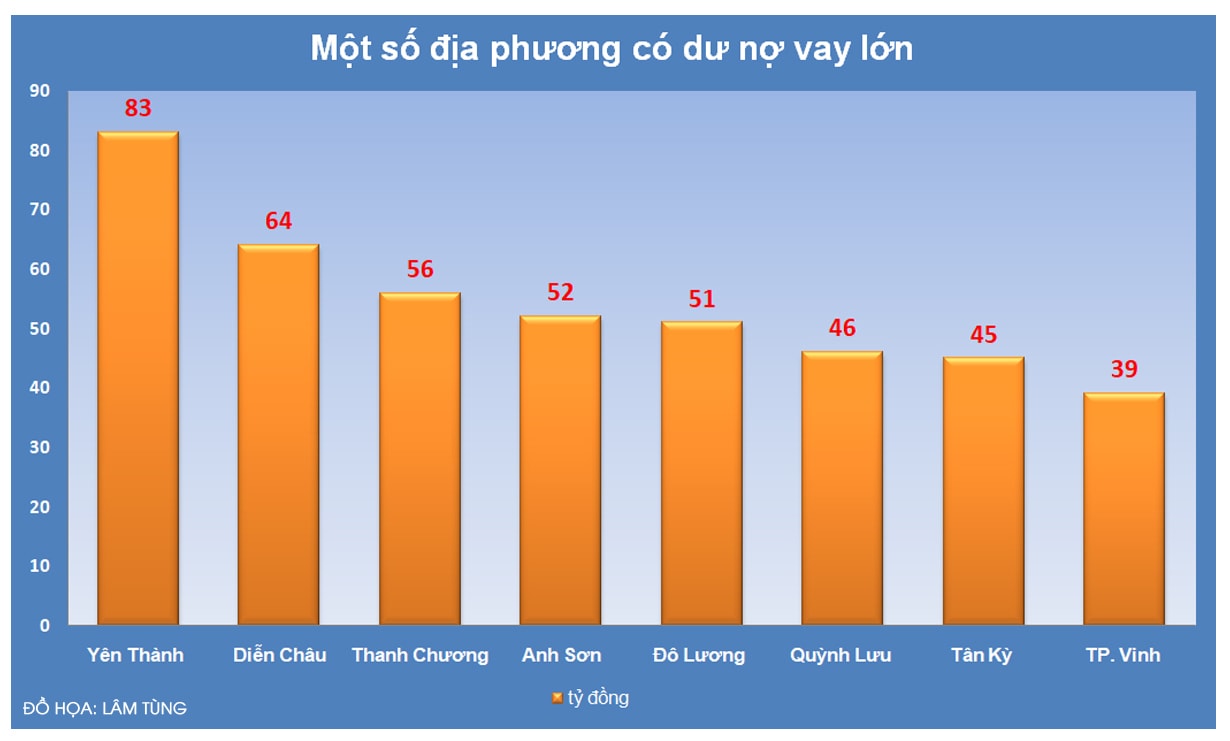

| Graphics: Lam Tung |

Student loan is a program with profound humanitarian significance, demonstrating the State's special concern for the cause of "growing people". Nghe An is a land of learning, and is also the province with the highest outstanding student loan program in the country. With the spirit of "not letting any student with difficult circumstances drop out of school due to lack of money to pay tuition", Nghe An Provincial Social Policy Bank is determined to overcome difficulties, bring capital to the people, and bring learning opportunities to tens of thousands of poor students.

Implementing Decision 157/2007/QD-TTg on credit for students in difficult circumstances, over the past 11 years, Nghe An Provincial Bank for Social Policies has closely coordinated with entrusted socio-political organizations to effectively evaluate and approve loans for 545,898 students, achieving a turnover of 4,256 billion VND. As of July 31, 2018, the total outstanding loan balance of the program reached 676 billion VND, with 27,639 students borrowing loans. Some localities with large outstanding loans include Yen Thanh district with 83 billion VND; Dien Chau with 64 billion VND; Thanh Chuong with 56 billion VND; Anh Son with 52 billion VND; Do Luong with 51 billion VND; Quynh Luu with 46 billion VND; Tan Ky with 45 billion VND; Vinh City with 39 billion VND...

Continue to expand the program's effectivenessAccording to the synthesis from the Nghe An Provincial Social Policy Bank, currently, the subjects borrowing the most from the program are households with a maximum per capita income equal to 150% of the per capita income of poor households with 398 billion VND/14,337 households, accounting for 59% of the total outstanding debt and 58.9% of the total number of households borrowing capital. Next are poor households, accounting for 29% of the total outstanding debt and 27% of the total number of households borrowing capital; the subjects are households facing financial difficulties, accounting for 12% of the total outstanding debt and 14% of the total number of households borrowing capital.

In addition, other subjects such as: orphaned students, demobilized soldiers, rural workers learning a trade, loans for medical students after graduation according to Decision No. 09/2016/QD-TTg dated March 2, 2016 of the Prime Minister... also benefit from the capital source of the student credit program.

|

| Graphics: Lam Tung |

From the loan capital, there were 27,573 university students with outstanding debt of 663 billion VND, accounting for 69.5% of outstanding debt; there were 11,867 college students with outstanding debt of 246.6 billion VND, accounting for 25.9%; there were 2,645 secondary school students with outstanding debt of 43 billion VND, accounting for 4.5%... Debt collection turnover up to July 2017 reached more than 250 billion VND. In parallel with lending activities, the inspection and supervision of the implementation of the credit program for students has always been focused on by the Bank for Social Policies. In particular, the unit has promptly and seriously implemented the direction of the Prime Minister in Notice 231/TB-VPCP on organizing debt collection and monthly interest collection at transaction points for households with conditions and voluntarily paying off principal and interest early.

Mr. Tran Khac Hung - Director of Nghe An Provincial Social Policy Bank said: After more than 11 years of implementation, the quality of the student credit program has been and is being very effective. The debt recovery rate is always high, overdue debt accounts for a relatively low proportion compared to the outstanding debt of the program. We hope to continue to receive the attention of authorities at all levels, sectors and organizations in directing the review, supplement and confirmation of timely and accurate subjects for banks to base on for lending, especially the close coordination from the entrusted organizations in propagating and widely disseminating the student credit policy to the people to maximize the effectiveness of the program in the coming time.