'Made in Vietnam' cars are losing ground

The Ministry of Finance does not agree to give additional incentives to domestically produced cars because it is concerned that it will violate international commitments. Meanwhile, the Ministry of Industry and Trade and domestic car manufacturing and assembly enterprises warn that without these additional incentives, the Vietnamese auto industry will have difficulty competing with imported cars.

Worried about "made in Vietnam" cars losing ground

Previously, the Ministry of Industry and Trade proposed changing the price for calculating special consumption tax on domestically produced vehicles in the direction of not calculating special consumption tax on the value added part created domestically (components and spare parts).

This helps reduce the price of “made in Vietnam” cars, encouraging car manufacturers to increase the value-added content produced domestically.

However, recently, the Ministry of Finance disagreed because this plan was not consistent with the National Treatment (NT) Rules stated in Article III of the General Agreement on Tariffs and Trade - GATT.

|

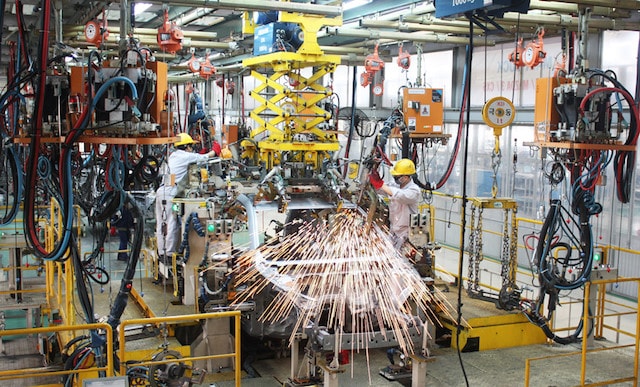

| Domestic auto production faces pressure from imported cars. |

Mr. Le Ngoc Duc, General Director of Hyundai Thanh Cong Automobile Company, said: "This is not good news. Thanh Cong Group, Truong Hai,... are having many strategies for domestic automobile production, calling on automobile corporations to transfer technology, grant copyrights to produce components in Vietnam, thereby creating an automobile industry, realizing the dream of exporting Vietnamese automobiles to ASEAN. At Thanh Cong, we have also planned a strategy for that, aiming to increase the localization rate to at least 40% by 2019 for export."

Talking about the worst that could happen, Mr. Duc said: "We have plans to invest in the production of components with high value content, such as the plan to invest in a car body stamping factory, or to produce some details in the engine gearbox. The investment cost for these components is very large. If we are not allowed to deduct the special consumption tax for domestically produced components, we will have to review the investment, and can only invest in the production of low-value parts and small investments. Thus, it is difficult to realize the localization rate."

In a document sent to the Ministry of Finance on January 12, the Ministry of Industry and Trade continued to request the Ministry of Finance to study and supplement the content of special consumption tax on cars with 9 seats or less as previously proposed by the Ministry. That is, the price for calculating special consumption tax on domestically produced cars with 9 seats or less is deducted from the price of domestically produced components and spare parts.

Mr. Le Ngoc Duc said: This is a policy applied by many countries such as Malaysia, Indonesia, Thailand, India. Without that policy, domestic component production cannot compete with components from major manufacturers in the world; it is not possible to connect domestic component manufacturers with automobile assembly manufacturers. Because many times, components purchased from abroad are cheaper due to large-scale production.

“There are concerns about violating WTO commitments, but our policy does not step on the commitments but rather approaches those red lines. The countries I just mentioned are all WTO members, they have cleverly applied them and we need to refer to them. The proposal of the Ministry of Industry and Trade can be issued with a roadmap of 3-5 years, so that car manufacturers have conditions to develop,” Mr. Le Ngoc Duc shared.

Many places are concerned about violating commitments.

In fact, during the process of collecting opinions on this matter, many dissenting opinions were sent to the Ministry of Finance. Even the Vietnam Automobile Manufacturers Association (VAMA) - where most of the "foreign" automobile companies are located - did not agree.

The Vietnam Automobile Manufacturers Association (VAMA) is concerned that this policy will create an uneven playing field for automakers in general and does not comply with Vietnam's commitments to the WTO.

|

| Vietnamese people still crave the dream of cheap cars. |

The Ministry of Planning and Investment acknowledges that determining the tax price as above will encourage assembly production, increasing the localization rate of domestic automobiles. However, the Ministry suggests that the above regulation should be studied to avoid violating the WTO non-discrimination principle and the trade agreements that Vietnam has signed, especially the effective agreements related to the automobile sector.

Bac Ninh Provincial People's Committee also proposed to keep the current regulations, the amendment is unreasonable.

“Deducting the value of domestically produced components and spare parts will create a risk of lack of transparency, making it easy for people to take advantage of imported components but label them as domestically produced for profit (this has happened before),” the People's Committee of Bac Ninh province is concerned.

Meanwhile, the People's Committee of Hai Phong City commented: Reducing special consumption tax to encourage an increase in the localization rate for the production of cars with 9 seats or less is appropriate. However, this is an item subject to a very high special consumption tax, so reducing tax based on the criterion of "minus the value of domestically produced components and spare parts" needs to be carefully considered.

“Currently, how much is the value of domestically produced components and spare parts for businesses? Is there a possibility of increasing the value of domestically produced components and spare parts when applying the special consumption tax reduction policy? Will the special consumption tax amount be reduced when applying the new policy? From there, there will be a specific conclusion about the benefits of applying the new policy on special consumption tax for the domestic automobile manufacturing industry,” Hai Phong City People's Committee suggested.