Trump makes a decision that is unfavorable to Elon Musk

The policy of supporting up to $7,500 in tax credits when Americans buy electric cars will end on September 30, according to a new law passed by the US Congress.

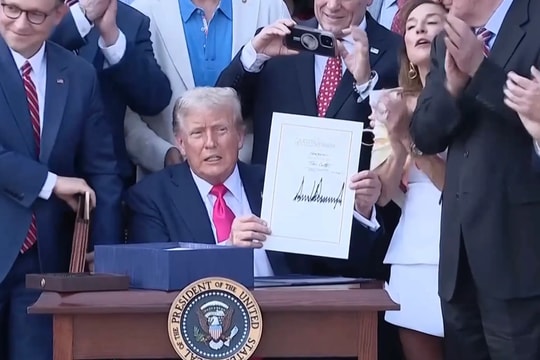

The US Congress has officially passed the Public Spending and Tax Cuts Act (OBBBA), dubbed the 'big and beautiful bill' proposed by President Donald Trump.

One of the most controversial parts of the bill is the complete end to electric vehicle incentives from the time of former President Joe Biden, creating major changes in the US auto industry.

Under current policy, consumers who switch to electric vehicles can enjoy tax credits of up to $7,500 for new vehicles and $4,000 for used vehicles, which has been one of the main drivers of American consumers switching from gasoline to electric vehicles in recent years.

The $7,500 electric vehicle tax credit has a long history dating back to 2008. The program was originally designed to be capped at 200,000 vehicles per manufacturer, to encourage automakers to invest in electric vehicle technology without creating too much of a budget burden.

However, under the newly approved regulations, this electric vehicle incentive program will officially expire on September 30. The $4,000 credit for used electric vehicles, a policy that has contributed significantly to promoting green car sales in recent years, will also be completely eliminated.

Earlier, the Republican-controlled US House of Representatives also passed a controversial proposal to impose an annual fee of $250 on electric vehicle owners to offset the cost of maintaining transportation infrastructure. The reason given is that electric vehicles do not use gasoline and therefore do not contribute to the gasoline tax used for road maintenance.

However, the fee was removed in the final version of the law passed by Congress, possibly due to pressure from advocacy groups and concerns about the backlash from electric vehicle voters.

Impact on the electric vehicle industry

The cancellation of the incentive is expected to have a profound impact on the entire electric vehicle supply chain in the US. Electric vehicle manufacturers such as Tesla, GM, Ford and many others may have to adjust their business strategies and prices to remain competitive.

At the same time, suppliers of batteries, components and EV charging services are also likely to be negatively affected by the decline in market demand, which could slow the development of nationwide EV charging infrastructure.

The Coalition for Electrification, an electric vehicle advocacy group, expressed deep concern about the repeal of the incentive, saying the Trump administration’s move would severely weaken the competitiveness of the US EV industry, especially as China’s dominance in the global electric vehicle market continues to grow.

As electric vehicles take up a larger share of the global auto market, the future of transportation is clearly electrified. The bill would mean the United States cedes leadership to China, the group warned in a public statement.

A Harvard University study published in March made a worrying prediction about the impact of repealing this policy. According to the study, if the electric vehicle tax credit were removed, electric vehicle penetration in the US could fall by 6% by 2030.

However, the move also has financial benefits for the federal government, saving about $169 billion over the next 10 years.

The end of the electric vehicle tax credit in less than three months could lead to an interesting phenomenon in the market, according to Dan Levy, automotive analyst at Barclays. He predicts a wave of early buying by consumers looking to take advantage of the tax policy before it expires.

The loosening of both the stick and the carrot will slow the transition to electric vehicles in the US, Mr. Levy said. After a surge in purchases, the market could see a significant decline in sales in the coming period.

Benefits for gasoline vehicle manufacturers

In addition to eliminating electric vehicle incentives, the new law also significantly benefits traditional automakers by eliminating penalties for companies that fail to meet fuel economy standards under the Corporate Average Fuel Economy (CAFE) regulations.

This change would make it easier for manufacturers to produce more gasoline-powered cars without worrying about penalties.

Over the years, many major automakers have paid large fines for failing to meet fuel economy standards. Last year, Chrysler’s parent company, Stellantis, paid a $190.7 million fine for failing to meet standards in 2019-2020.

Stellantis Group was also fined nearly $400 million in the 2016-2019 period for similar reasons. General Motors (GM) was also not exempt from fines, having to pay $128.2 million in fines for the years 2016-2017 for failing to meet prescribed fuel economy standards.

The abolition of these penalties is seen as a huge boon to the traditional auto industry, allowing them to focus on producing more profitable vehicles without having to worry about fuel consumption constraints.