What do I need to prepare to get motorcycle insurance?

To get motorbike insurance, people need to prepare the necessary documents and papers.

Within one year from the date of the accident, except in cases of objective and force majeure causes, the person eligible for motorbike insurance must prepare the following documents:

Identity documents

Including documents related to the vehicle and driver: Notarized copy or copy certified by the insurance company after comparing with the original.

Vehicle registration certificate (or a certified copy of the vehicle registration certificate with the original receipt from the credit institution that is still valid, in lieu of the original vehicle registration certificate during the period the credit institution holds the original vehicle registration certificate) or vehicle ownership transfer documents and vehicle origin documents (in case there is no vehicle registration certificate).

Driver's license, ID card or passport or other identification documents of the driver.

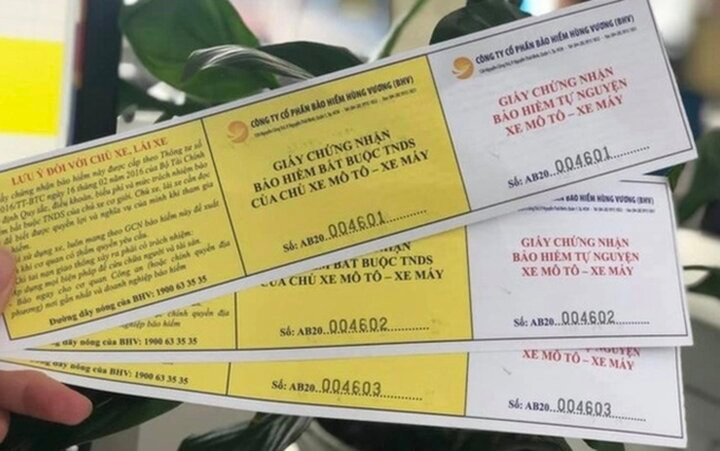

Certificate of compulsory insurance.

Documents proving damage

Documents proving damage to health and life: Copy of medical facilities or copy certified by the insurance company after comparison with the original.

Certificate of injury.

Medical records.

Extract of death certificate or death notice or confirmation document from the police or forensic examination results in case of death of the victim in a vehicle or death due to an accident.

Documents proving damage to property

Including valid invoices and documents on repair and replacement of damaged property caused by traffic accidents (in case the insurance company carries out repairs and damages, the insurance company is responsible for collecting these documents).

Documents, invoices, and vouchers related to expenses incurred by the motor vehicle owner to minimize losses or to comply with the instructions of the insurance company.

Other documents in the valid file will be collected by the insurance company.

Procedure for motorcycle insurance compensation

Step 1: Notify the insurance company about the accident

- Time: 5 days from the date of accident (except in case of force majeure).

- Form: In writing or electronically.

Step 2: Cooperate with insurance companies to assess losses

The appraisal results must be made in writing and signed by the relevant parties.

Step 3: Receive insurance compensation advance (applicable to cases of damage to health and life)

The advance payment period is within 3 working days from the date the insurance company receives notification of the accident.

In case the accident is determined to be within the scope of compensation for damages:

In case of death: 70% of the prescribed insurance compensation/person/case

For cases of body part injury that require emergency treatment: 50% of the prescribed insurance compensation/person/case

In case the accident is not determined to be within the scope of compensation for damages:

In case of death: 30% of the prescribed insurance liability level

For cases of body part damage requiring emergency treatment: 10% of the prescribed insurance liability level/person/case

Step 4: Submit insurance claim application

The time limit for claiming compensation is 1 year from the date of the accident, except in cases of objective and force majeure causes.

Step 5: Receive insurance compensation

The compensation payment period is 15 days from the date of receipt of complete and valid insurance claim documents (in case of verification of documents, it shall not exceed 30 days).

If refusing to pay compensation, the insurance company must notify in writing the reasons for refusing to pay compensation within 30 days from the date of receiving complete and valid documents.