The National Assembly allows the use of increased revenue and budget savings to build inter-level boarding schools at the border.

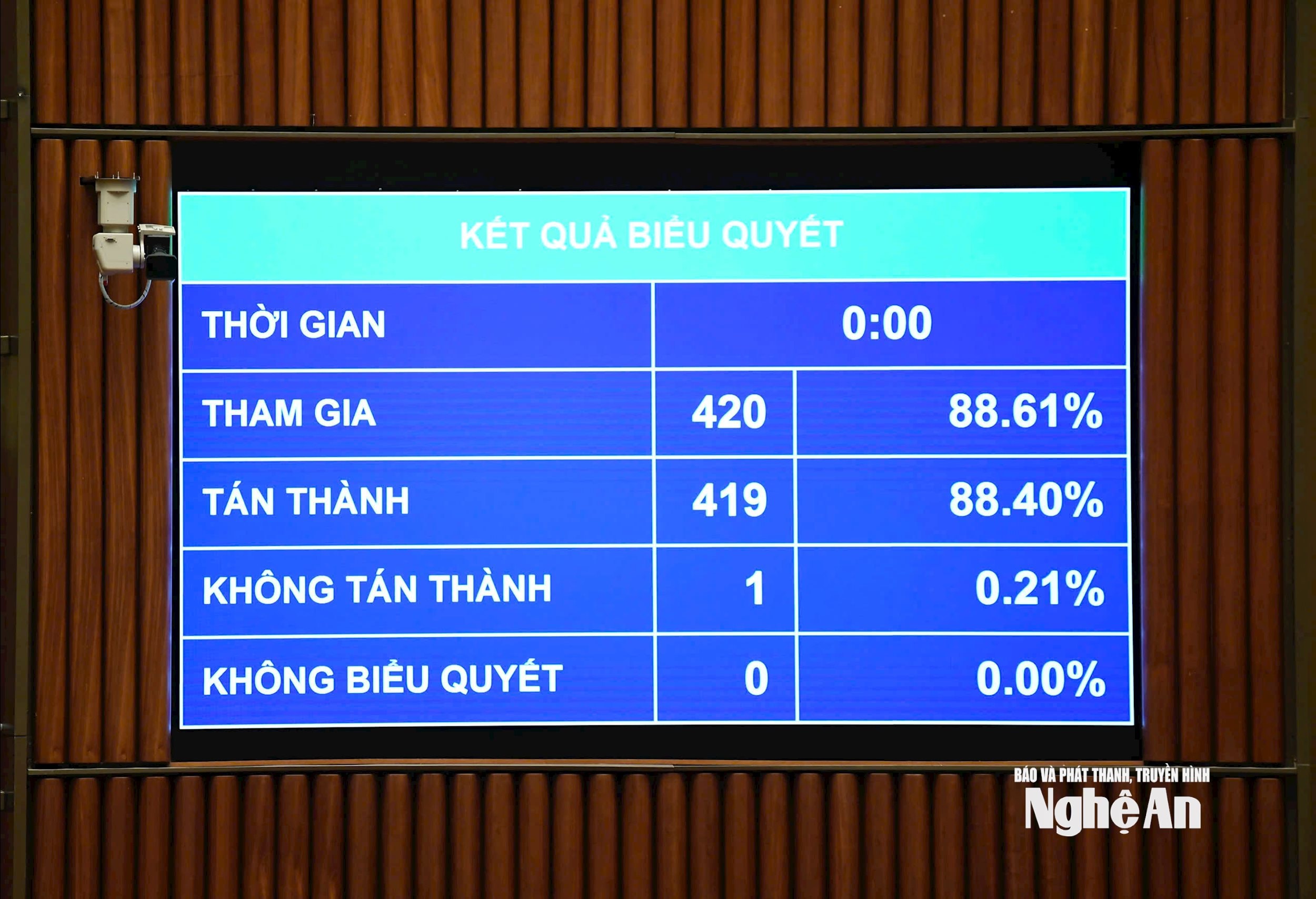

On the afternoon of November 13, the 10th Session of the 15th National Assembly voted to pass the Resolution on the State budget estimate for 2026, with 419/420 National Assembly deputies present in favor, reaching a rate of 99.76%.

According to the Resolution, the state budget revenue is 2,529,467 billion VND; of which the central budget revenue is 1,225,356 billion VND, and the local budget revenue is 1,304,111 billion VND.

Notably, the National Assembly allowed the use of 23,839 billion VND of the local budget's salary reform fund until the end of 2025, with the remaining balance transferred to the local budget for 2026, to implement the basic salary of 2.34 million VND/month.

Total state budget expenditure is 3,159,106 billion VND; of which central budget expenditure is 1,809,056 billion VND; local budget expenditure is 1,350,050 billion VND, excluding expenditure from targeted supplementary sources, balanced supplementary sources, and supplementary sources to ensure basic salary of 2.34 million VND/month.

The State budget deficit level set by the National Assembly is 4.2% of GDP, equivalent to 605,800 billion VND; of which the central budget deficit is 4% of GDP, and the local budget deficit is 0.2% of GDP.

A highlight of the Resolution is that the National Assembly allows the use of regular spending savings in 2025 to build primary and secondary boarding schools in land border communes to develop education in border areas.

Specifically, this source of savings includes: 10% of regular expenditures from the State budget assigned in early 2025, increased compared to the estimate assigned in early 2024; saving an additional 10% of regular expenditures from the State budget in the last 7 months of 2025. The National Assembly assigned the Prime Minister to allocate this capital source when the allocation conditions are met according to the provisions of law.

The National Assembly also allowed the transfer of the 2024 central budget revenue increase and the 2025 state budget regular expenditure savings to build primary and secondary boarding schools in land border communes that have not been fully used in 2025 to 2026 for continued implementation.

Regarding wage and social security policies, the National Assembly requested ministries, central and local agencies to continue implementing solutions to create sources for wage policy reform according to regulations.

In 2026, some revenues will be excluded when calculating the increase in local budget revenue compared to the estimate to ensure sources for salary reform, including: One-time land rent collected for investment in advance for compensation, support and resettlement; revenue from handling public assets at agencies, organizations and units decided by competent authorities to be used for investment expenditure according to regulations; revenue from protection and development of rice-growing land; fees and charges for visiting relic sites and world heritage sites; fees for using infrastructure works, service works and public utilities in border gate areas; environmental protection fees for wastewater; revenue from public land fund, revenue from profits and public assets at communes and revenue from renting and selling State-owned houses.

The Resolution also expands the scope of using the Central budget's salary reform accumulation fund to adjust pensions, social insurance benefits, monthly allowances, preferential allowances for meritorious people and streamline the payroll.

Local budget salary reform resources are also allowed to be used for social security policies issued by the Central Government and to implement staff streamlining.

The National Assembly assigned the Government to review the budget for savings in regular operating support expenses (salary and operating expenses as prescribed by law) due to streamlining the payroll and reorganizing the apparatus to implement the 2-level local government model; allowing localities to use this savings to supplement the local budget's salary reform resources.

From 2026, the Government is assigned to proactively use accumulated resources for salary reform to ensure the implementation of salary, allowance and income regimes according to regulations.