In the first quarter, nearly 20,000 subjects in Nghe An received policy loans.

(Baonghean.vn) - In the first quarter, policy credit capital provided capital to 19,512 poor households, near-poor households and other policy beneficiaries in Nghe An to invest in production and business, serving essential needs of life.

On the morning of May 14, the Board of Directors of the Social Policy Bank, Nghe An branch, held a regular meeting to evaluate the first quarter's operations and deploy tasks for the second quarter of 2019. Comrade Le Hong Vinh - Member of the Provincial Party Committee, Vice Chairman of the Provincial People's Committee, Head of the Board of Directors of the Provincial Policy Bank chaired the meeting.

|

| Vice Chairman of the Provincial People's Committee Le Hong Vinh spoke at the meeting. Photo: Viet Phuong |

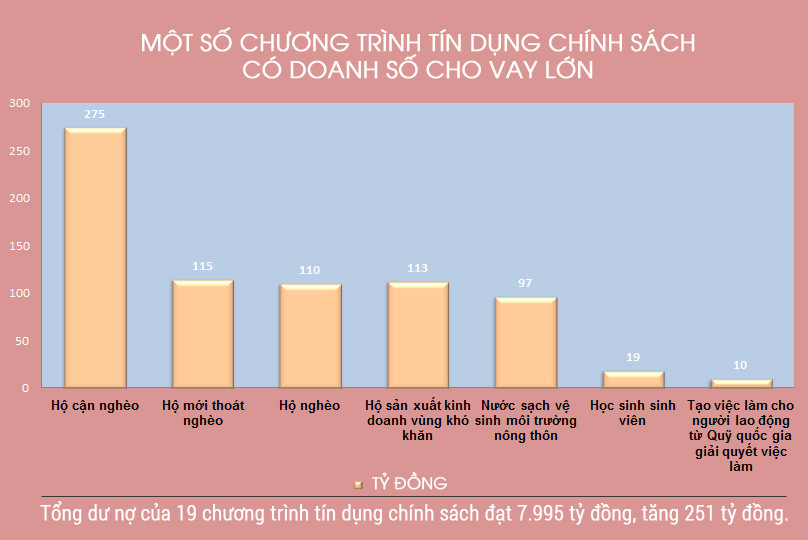

Outstanding debt of 19 policy credit programs reaches nearly 8,000 billion VND

In the first quarter of 2019, policy credit continued to have many positive changes. Local Party committees and authorities at all levels, district-level Board of Directors, and entrusted socio-political organizations have enhanced their roles and responsibilities to lead, direct, inspect, and supervise policy credit activities in the area; credit programs are implemented promptly as soon as capital is available, and disbursement is strictly implemented from the loan evaluation stage to ensure transparency and correct targets.

The results of receiving entrusted capital from local budgets at all levels and from other organizations and individuals to lend to poor households and other policy beneficiaries in accordance with the spirit of the Directives have achieved quite good results. In the first quarter, it increased by nearly 19.8 billion VND, reaching 65.9% of the plan assigned by the Central Government.

|

| Director of the Provincial Social Policy Bank Tran Khac Hung reports on the performance of the first 3 months of 2019. Photo: Viet Phuong |

Total capital managed as of March 31, 2019 reached VND 8,011 billion, an increase of VND 259 billion compared to 2018; Completed loan disbursement for the growth target of outstanding debt assigned by the Central Government before March 31, bringing the first quarter loan turnover to nearly VND 758 billion.

|

| Graphics: Lam Tung |

Some credit programs with large loan turnover are: Loans for near-poor households 275 billion VND, newly escaped poverty households 115 billion VND, poor households nearly 110 billion VND, production and business households in difficult areas 113 billion VND, clean water and environmental sanitation in rural areas 97 billion VND, student credit loans 19 billion VND, loans to create jobs for workers from the National Employment Fund nearly 10 billion VND,... The total outstanding debt of 19 policy credit programs reached 7,995 billion VND, an increase of 251 billion VND, completing the assigned plan.

At the meeting, the opinions of the members of the Board of Directors also analyzed and clarified the results achieved as well as some limitations. Implementing the assignment of budget allocation targets for entrusted lending through the VBSP system in 2019, 19 district-level People's Committees have made transfers and directed commune-level People's Committees to make transfers. However, up to now, Hung Nguyen district and Cua Lo town have not had a plan to transfer the budget in 2019 (in 2017 and 2018, Hung Nguyen district People's Committee did not make transfers).

|

| The Vietnam Bank for Social Policies inspects the production loan model in Ky Son. Photo: Viet Phuong |

The implementation of lending capital to ethnic minority households to plant production forests according to Decree 75 of the Government has not been implemented yet because the Provincial People's Committee does not have counterpart capital and most of the households that are eligible for loans have a need to borrow but have not been granted a Certificate of Forest Land Use Rights.

In addition, the current demand for loans for social housing programs under Decree No. 100-ND/CP of the Government is very large, but the capital currently provided by the central government is too little compared to the demand (in 2018, the Central Government announced 10 billion VND and in 2019, it was 20 billion VND).

Some delegates also said that overdue debts still arise, and there are cases where people have the conditions to pay their debts but deliberately delay, causing difficulties in debt collection.

Strictly handle subjects who misuse capital, borrow money, and embezzle.

After listening to the opinions of the delegates, concluding the meeting, Vice Chairman of the Provincial People's Committee Le Hong Vinh highly appreciated the achieved results, policy credit continued to make important contributions to help poor households and policy subjects develop the economy, improve their lives, contribute to the implementation of the poverty reduction target, build new rural areas and stabilize security and politics in the locality.

|

| Presenting flowers to Vice Chairman of the Provincial People's Committee Le Hong Vinh - new Head of the Board of Directors of the Provincial Policy Bank. Photo: Viet Phuong |

To perform well the second quarter tasks,The Vice Chairman of the Provincial People's Committee proposedExecutive Board of the Social Policy Bank branchIt is necessary to pay attention to maximizing capital channels from the Central to local levels, continue to submit to the Central Government additional capital sources for loans for programs that have completed the plan targets in the first quarter, focus on receiving capital sources from local budgets and actively mobilize capital sources according to market interest rates to complete the plan targets.

The Head of the Board of Directors also assigned the Department of Agriculture and Rural Development to proactively advise the Provincial People's Committee and the Ministry of Agriculture and Rural Development to remove difficulties and obstacles in disbursing loans for production forest planting according to Decree 75/CP, in order to create conditions for beneficiaries of the program to access preferential capital sources; Assign entrusted organizations to urge debt collection, interest collection and timely debt settlement; direct the effective implementation of the mobilization of savings deposits through savings and loan groups and savings deposits at commune transaction points. Focus on directing the collection and settlement of due debts; advise the Party Committee and authorities on more drastic measures to deal with cases where they have the conditions to repay debts but deliberately delay, those who use capital for the wrong purpose, borrow money, and embezzle.