Risks are increasing and stock picking opportunities will become more differentiated.

(Baonghean) - During the week of September 17-21, 2018, the main indexes of global stock markets increased simultaneously thanks to information about the upcoming new round of trade negotiations between the US and China and the MSCI Emerging Markets Index of emerging markets increasing again after falling by 20% since January 2018.

All three major Wall Street indexes rose and approached record highs. Asian and European stock markets also rallied.

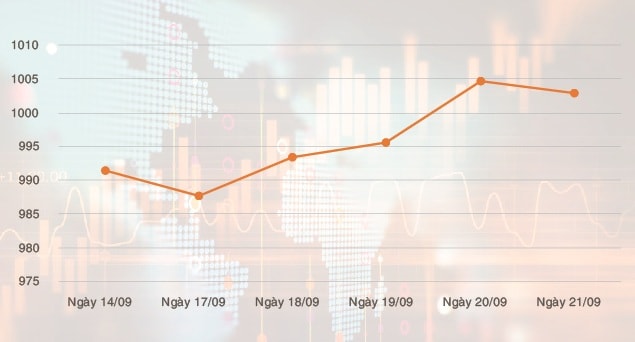

Positively impacted by the world stock market, the domestic market continued to record a week of increasing points last week despite many fluctuations with the closing session of derivative contracts and the restructuring of portfolios of two ETFs. At the end of the week, VNIndex surpassed the psychological mark of 1,000 points, closing the week at 1,002.97 points, recording an increase of 1.56% compared to the first session of the week. HNX Index also had a similar development with a more positive increase, recording 2.7%.

|

| VN-INDEX index fluctuations from September 17 to September 21, 2018. Source: VNDIRECT |

The market's growth was driven by stocks in the oil and gas, banking, securities, and some industries expected to benefit from the US-China trade war such as textiles and seafood. Market liquidity increased dramatically with the average trading value of the entire market reaching VND 7,993 billion/session. The above figure shows that the strength of domestic demand is quite stable against the selling pressure of 2 ETFs during the third quarter portfolio restructuring period. If excluding the impact of this move, liquidity last week still recorded a quite active trading week.

Observations last week showed that, besides the large-cap group, steel stocks: HPG, HSG, NKG, real estate stocks such as DXG, DIG, FCN, SCR, NLG, HBC, CTD are still increasing points, breaking out of the accumulation base with a very positive large volume, which is expected to be the driving force to help the market increase points next week. Hot stocks in industries such as textiles (TNG, TCM, VGT), seafood stocks such as VHC, MPC are all in the process of accelerating and are showing short-term correction signals, so buying should be considered in the new week.

In the derivatives market last week, total market liquidity decreased slightly by 23% to 378,264 contracts, when the 1809 contract expired on September 20, with the new OI contract volume reaching 72,232 contracts.

Ms. Nguyen Phan Cam Thuy, Senior Investment Consultant, Securities CompanyVNDIRECT, commented: “We continue to maintain an optimistic view on the market's growth prospects in the coming trading week. However, we believe that opportunities will become fewer and more selective. Risks are also gradually increasing as many stocks have surpassed this year's reasonable valuation zone and there are signs of a slowdown, indicating distribution activities in some stocks despite the index's growth. In addition, the information that China canceled trade negotiations with the US announced at the end of the week will have a negative impact on the global financial market. Vietnam is likely to be affected, so caution in trading plans for the new week should be a priority."