Mistakes can cause money in savings books to 'evaporate'

Saving money in banks is considered safe by most people. However, if you do not understand the basic mistakes in transactions, the money in your account can "evaporate".

According to bank tellers, many customers have used the bank's services for many years, but not everyone is careful about mistakes that can affect their own interests.

Pre-signed documents

Recently, 9 customers in Lao Cai said they asked a person named Le Thi Hue to deposit tens of billions of dong at Agribank Cam Duong branch (Lao Cai). Hue said she had a relationship with the bank and could deposit money at interest rates many times higher than the listed rate.

After gaining the trust of these people, Hue asked them to sign the deposit slip in advance. The amount of money Hue mobilized from each person was up to tens of billions of VND, but the amount of money Hue opened a savings book at the bank was only 1 million VND/book.

The amount of money recorded in the savings book that Hue handed over to the depositor showed signs of being erased, corrected, and the ink color was different from the ink color printed at the Agribank Cam Duong branch.

|

| Hue's fraud was only discovered when customers came to the bank to withdraw their savings. |

The incident only came to light when on April 24, a customer went to the Cam Duong branch to withdraw money and discovered that all the savings books that Hue had deposited money in had only 1 million VND in the bank account.

According to bank tellers, the number of customers who agree to sign the deposit slip in advance is not small. Sometimes, for work reasons, they delegate the authority to relatives and friends. However, by taking advantage of trust, many similar scams have occurred.

Do not open a savings book directly but ask someone else to deposit it for you

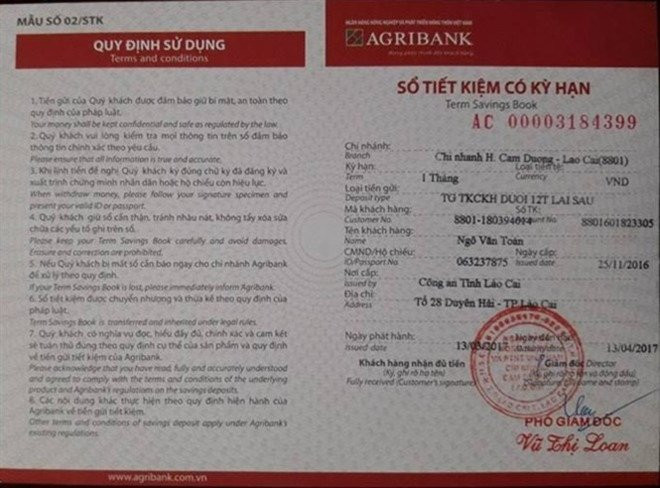

Also in the incident, 9 people were said to have been scammed out of hundreds of billions of dong in Lao Cai. According to Mr. Ngo Van Toan (a victim in the incident), he deposited 77.8 billion dong at Agribank Cam Duong branch through 11 savings books.

However, the actual amount of money in his bank account was only 11 million VND, not 77.8 billion VND as recorded in his savings book.

|

| The savings books that Mr. Toan sent through Hue did not match the actual amount of money in his bank account. |

When asked if Mr. Toan had deposited the money directly at the bank, Mr. Toan said that he had deposited the money directly once and had asked someone named Hue to deposit it for him once and this person had given him the savings book. Notably, the savings books he had deposited directly were all withdrawable.

VIP customers, no deposit at the counter

Ms. Huyen Nga, a teller at a bank branch in Tay Ho district, said that many VIP customers of the branch deposited money but did not come directly to the counter.

VIP customers often have worked with the bank for a long time, so they often trust and request employees to come to their homes, workplaces, or even cafes to open savings books. Because they do not want to offend VIP customers, bank employees have to follow the arrangements of their customers.

However, this case can easily cause risks to the money in the customer's account. If you encounter dishonest employees, hand over fake savings books or then do not return the money to the treasury or enter it into the system, the customer's money can easily be misappropriated.

In fact, bank employees all say they do this for their loyal customers and all transactions are safe to gain trust. However, it is not unheard of for such cases to happen.

In 2016, a customer of Eximbank Nghe An branch had all of his savings account money, totaling more than 48 billion VND, "drained" by the bank's employees. The reason was that the customer trusted the employees and did not deposit money directly at the transaction counter.

Deposit money first, receive the book later

Customers have worked with some close bank employees for a long time, so many customers subjectively deposit money to "owe" their savings books or deposit certificates. There have been many cases of property appropriation due to familiar employees being fired or fleeing and taking all of the customers' savings. For example, a former bank cashier in Quang Ninh, after quitting his job, took advantage of the trust of the people to mobilize tens of billions of dong and then fled.

Even when receiving a savings book, customers should carefully check the documents, have the bank's stamp and the signatures of the responsible people involved. This is the key to protecting customers when risks or disputes arise.

Change signature

Not too serious but according to the transaction staff, this is a common error and happens very often with many of their customers.

While the signature to open the savings book is one thing, when the customer comes to close the account, he signs another signature, making the reconciliation process difficult and time-consuming.

According to bank employees, maintaining the signature throughout the transaction process is very important, this is the security code that verifies customers' deposits and withdrawals.

“In banking transactions, every stroke of a customer's handwriting is very valuable, so consistency in signature is something customers need to pay attention to,” said Mr. Duy Ngoc, a transaction officer at a bank in Cau Giay district.

According to VNN

| RELATED NEWS |

|---|