After Brexit: If the EU economy weakens, Vietnam's exports will decrease sharply

According to the WB's forecast, after Brexit, if the EU's growth slows down, it may not have too big an impact on Vietnam's exports.

Assessing the impact of Brexit on Vietnam, the latest report of the World Bank in Vietnam just published predicts that Vietnam's exports to the EU will be greatly affected.

Specifically, Mr. Sebastian Eckardt, senior economist of the World Bank, said: The result of the referendum on the United Kingdom leaving the European Union (Brexit) has put more pressure on the already fragile and unstable global economic environment. On June 23, 2016, the British voters voted in the referendum on leaving the European Union and the "leave side" won a narrow victory.

|

| Mr. Sebastian Eckardt, WB economist, spoke at the report on Vietnam's macroeconomics on the afternoon of July 19, 2016. |

There is pressure on total public debt.

In the short term, Brexit exacerbates global financial market volatility, although major financial markets are showing signs of stabilisation. In the long term, this could weaken the economic growth prospects of the UK and the EU, which is expected to have a significant impact on global economic growth, trade and investment, said Sebastian Eckardt.

“Vietnam may be affected by Brexit through channels such as finance, trade and investment, but preliminary assessments show that these impacts are relatively small,” Mr. Sebastian Eckardt emphasized. Specifically, the immediate reaction of the financial market in Vietnam is quite similar to the global market. That is, the Ho Chi Minh City stock market lost 1.8% points on June 24, 2016, but bounced back, increasing continuously in the following trading sessions, and the VN Index has far surpassed the point loss on June 24.

Similarly, the dong depreciated by 0.13% immediately after the Brexit vote but has since stabilized. The uncertain global financial environment and the continued depreciation of the US dollar could trigger capital outflows, putting pressure on exchange rates and interest rates. However, compared to economies with deep financial linkages, Vietnam is expected to be less exposed to risks due to its limited market size and connectivity with external financial markets (including international credit flows).

In particular, a large part of Vietnam's foreign debt is in US dollars and Japanese yen, so when these currencies increase in value, it will create more pressure on total public debt, although the pressure on liquidity and repayment of Vietnam's foreign debt is not large because most of Vietnam's foreign debt is long-term and preferential.

The EU economic downturn has had a huge impact on Vietnam's exports.

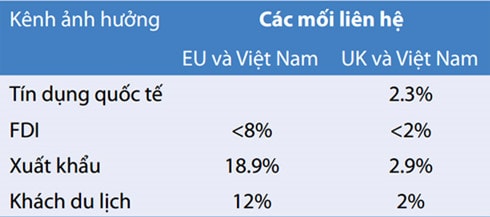

Regarding trade and tourism, Mr. Sebastian Eckardt said that Brexit could worsen the EU's growth prospects, thereby reducing the EU's import demand from outside, including Vietnam. Currently, the EU is the second largest and most important market - accounting for about 19.5% of Vietnam's total merchandise exports, of which the UK accounts for about 3%.

|

| Forecasting risks from Brexit to Vietnam (Source: WB) |

Vietnam's exports to the EU are mainly consumer goods such as clothing, footwear, phones, computers and some food products such as seafood. These items account for 70% of Vietnam's export turnover to the EU. In recent years, Vietnam's exports to the EU have been quite stable and not too affected by the developments and growth prospects of this region.

“This implies that the EU's slowing growth may not have too much of an impact on Vietnam's exports,” Sebastian Eckardt predicted.

Finally, foreign visitors from the EU and the UK only account for 12% and 2% of total arrivals to Vietnam, respectively. It is expected that the economic difficulties of the EU and UK will only have a moderate impact on the Vietnamese tourism industry in particular and the Vietnamese economy in general.

Vietnam must enhance economic resilience.

In addition, the World Bank forecasts that the impact of Brexit on FDI in Vietnam will be low. By the end of 2015, FDI from EU countries in Vietnam was about 25 billion USD - equivalent to 8% of the total FDI capital in effect in Vietnam. This is a relatively small number compared to the leading countries in direct investment in Vietnam such as Korea, Japan, Singapore and Taiwan (China). In particular, FDI from the UK only accounts for about 2% of the total FDI capital in Vietnam.

However, WB expert Sebastian Eckardt warned: Although the direct impact is assessed at a low level, the increasing risks of the global economic environment still require Vietnam to focus on strengthening the stability of macroeconomic balances to enhance the resilience of the Vietnamese economy to adverse external fluctuations. The appropriate combination of macroeconomic policies in this context is still maintaining a flexible exchange rate, gradually increasing foreign exchange reserves and continuing to consolidate the fiscal balance (to stabilize public debt and rebuild fiscal buffers)./.

According to VOV