Amendment of regulations on deduction of special consumption tax

The amount of special consumption tax (SCT) deducted corresponds to the SCT amount of raw materials used to produce goods subject to SCT for sale.

The Government has just issued Decree No. 14/2019/ND-CP amending and supplementing a number of articles of Decree No. 108/2015/ND-CP dated October 28, 2015 of the Government detailing and guiding the implementation of a number of articles of the Law on Special Consumption Tax and the Law amending and supplementing a number of articles of the Law on Special Consumption Tax.

In particular, Decree No. 14/2019/ND-CP amended and supplemented regulations on tax deduction.

The new Decree stipulates that taxpayers producing goods subject to special consumption tax using raw materials subject to special consumption tax are entitled to deduct the amount of special consumption tax paid on imported raw materials (including the amount of special consumption tax paid according to the tax assessment decision of the customs authority, except in cases where the customs authority imposes penalties for fraud or tax evasion) or paid on raw materials purchased directly from domestic production facilities when determining the amount of special consumption tax payable.

|

The amount of special consumption tax deducted corresponds to the amount of special consumption tax on raw materials used to produce goods subject to special consumption tax sold.

Particularly for bio-fuel, the deductible special consumption tax amount of the tax declaration period is based on the amount of special consumption tax paid or paid on a unit of raw materials purchased in the previous tax declaration period of mineral gasoline to produce bio-fuel.

For enterprises licensed to produce and blend bio-fuel, the declaration and payment of tax and deduction of special consumption tax are carried out at the local tax authority where the enterprise has its head office. The amount of special consumption tax that has not been fully deducted on raw mineral gasoline used to produce and blend bio-fuel (including the amount of tax that has not been fully deducted arising from the tax declaration period of January 2016) is offset against the amount of special consumption tax payable on other goods and services arising during the period.

In case after offset, there is still an amount of special consumption tax that has not been fully deducted on raw mineral gasoline used to produce and blend bio-fuel, it will be deducted in the next period or refunded.

Decree No. 14/2019/ND-CP also clearly states that special consumption tax payers on imported goods subject to special consumption tax are entitled to deduct the amount of special consumption tax paid at the import stage, including the amount of special consumption tax paid according to the tax assessment decision of the customs authority, except in cases where the customs authority imposes penalties for fraud and tax evasion when determining the amount of special consumption tax payable for domestic sales.

The deductible special consumption tax amount corresponds to the special consumption tax amount of imported goods subject to special consumption tax sold and can only be deducted up to the corresponding special consumption tax amount calculated at the domestic sales stage. The non-deductible difference between the special consumption tax amount paid at the import stage and the special consumption tax amount sold domestically, the taxpayer can account for it as an expense to calculate corporate income tax.

Conditions for deduction of special consumption tax are prescribed as follows:

a- In the case of importing raw materials subject to special consumption tax to produce goods subject to special consumption tax and in the case of importing goods subject to special consumption tax, the document used as the basis for deducting special consumption tax is the document of payment of special consumption tax at the import stage.

|

| Amendment of regulations on deduction of special consumption tax |

b- In case of purchasing raw materials directly from domestic manufacturers:

- Contract for sale of goods, the contract must include content stating that the goods are directly produced by the sales establishment; a copy of the Business Registration Certificate of the sales establishment (with signature and seal of the sales establishment).

- Bank payment documents.

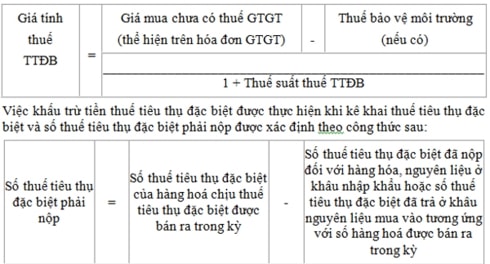

- The document used as the basis for deducting special consumption tax is the value-added tax invoice when purchasing goods. The amount of special consumption tax that the purchasing unit has paid when purchasing raw materials is determined = special consumption tax calculation price multiplied (x) special consumption tax rate; in which:

In case the amount of special consumption tax paid (or paid) for the amount of raw materials corresponding to the number of products consumed in the period cannot be accurately determined, the amount of special consumption tax deductible can be calculated based on the data of the previous period and will be determined based on the actual amount at the end of the quarter or year.

In all cases, the maximum amount of special consumption tax allowed to be deducted shall not exceed the amount of special consumption tax calculated for the raw materials according to the technical economic standards of the product./