Card account suddenly lost 30 million VND

Despite claiming to always keep the card with him, Mr. Nam's account still lost 30 million VND that same night.

Older brotherNguyen Thanh Namin Ho Chi Minh City said he has been using an international debit card - Visa debit of Vietcombank for more than 7 years now. The card has a balance of more than 30 million VND.

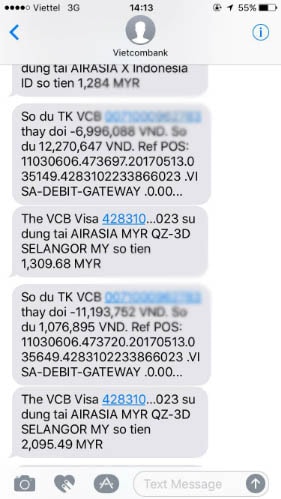

On the morning of May 13, after waking up, he discovered that there were many messages on his phone. When he opened it, Mr. Nam discovered thatThere were 7 withdrawal transactions notified via his phone between 3:42 am and 5:34 am on May 13. Of these, 5 were successful transactions, deducting a total of 30 million VND, and 2 transactions were not completed because the account did not have enough money.

|

7 withdrawal transactions were notified via Mr. Nam's phone. |

According to the text messages that Mr. Nam received on his phone, the above transactions were to pay for airline tickets from the website of AirAsia airline in countries such as Myanmar, Indonesia, and Singapore.

"When"I checked again and found that the card was still in my wallet and I have never revealed my personal password to anyone," he said, adding that he only used the card to make domestic online purchases and buy Vietnam Airlines tickets, but neverpay for air tickets of AirAsia or any foreign airlines.

After losing his money, Mr. Nam immediately contacted Vietcombank to request that his account be locked and to report the incident. Because it was the weekend, the bank told him to wait until Monday, May 15, to resolve the matter.

During the meeting on the morning of May 15, Mr. Nam was informed by Vietcombank that as soon as they received the notification on Saturday morning, the bank had worked with AirAsia and blocked 3 transactions, so they would recover the above amounts for Mr. Nam in the shortest time possible. Regarding the remaining two transactions, Vietcombank is still working with the relevant parties and will have the final results for Mr. Nam within 30 days.

A representative of Vietcombank said that in order to protect the legitimate rights of customers as well as the bank, the bank is actively coordinating with relevant parties to resolve the issue according to the correct procedures and trying to minimize the time to resolve complaints as well as asking for high-tech police support in the investigation.

Bank representatives recommend that, to limit risks when using cards, customers need to keep the card safe, keep the PIN secret, not lend or let others use the card, and promptly contact the Customer Care Center for timely support.

Mr. Nguyen Thanh Nam also said that the loss of money was beyond the wishes of both the card user and the bank, and what he was most concerned about was whether the bank's handling of the matter was quick, timely and professional. "And with Vietcombank's handling this time, I feel more satisfied and secure," he said.

At the same time, through this incident, Mr. Nam believes that most people, like him, always completely trust the security of the bank and forget about the issue of protecting their own information. "No matter which bank you use, you should be aware of that," he concluded.

Regarding the recent cases of customers losing money in their card accounts due to cybercrime attacks, experts say that this is a very normal incident that can happen in any financial system in the world. The recent cases of customers losing money are also isolated cases, criminals steal or defraud customers, obtain login information to electronic banking services or payment card numbers through parties outside the banking system...

On the other hand, as Vietnamese banks grow stronger and stronger, the number of customers increases, security will become more and more complex and stressful. Especially when cybercriminals are always running ahead, taking the lead in information technology.

According to VNE

| RELATED NEWS |

|---|