Why are oil prices negative but gasoline prices in Vietnam still high?

(Baonghean.vn) - Oil prices, or gasoline prices in Vietnam, are not affected by the US WTI oil price, but are still based on the Brent oil price. On April 21, Brent oil prices on the market were still trading at over 25 USD/barrel. On the other hand, gasoline prices imported to Vietnam also include many costs.

Vietnam's gasoline prices remain high

WTI stands for “West Texas Intermediate,” which is crude oil produced in the United States. It is also known as “Texas light sweet crude oil.” For the first time in history, WTI oil prices fell below zero: At the market close on April 20, 2020, WTI crude oil for May delivery was priced at minus $37.63/barrel and at one point dropped to minus $40/barrel on the night of April 20, 2020.

Currently, crude oil trading on the market includes 3 types: Futures market, options market and spot market. The negative oil price above belongs to the futures market, which is the price of the futures contract for delivery in May 2020.

|

| Illustration photo. Source: Internet |

According to PVN representative, April 21 is the closing date of the May 2020 futures contract. On this day, the buyer of this contract must decide whether to accept this batch of oil or not. If they accept, they must close the contract and receive the physical batch of oil, the buyer must perform the delivery and pay for the real goods, incur additional transportation and storage costs, etc. Therefore, some owners of this contract decided to "sell off" at any price in the last 2 seconds of the trading session and the matching price in the last 2 seconds is considered the closing price. Thus, in fact, the price (-) 37.63 USD/barrel is the price traded between traders on the exchange, not the transaction price between the crude oil producer and the end user (refinery). Furthermore, the amount of oil traded at (-) 37.63 USD/barrel is only about 600 thousand barrels, insignificant in the total world oil trading volume of about 100 million barrels/day on average. That is, the negative price does not reflect the real-time buying and selling price of the world oil market...

Oil prices, or gasoline prices in Vietnam, are not affected by the US WTI oil price, but are still based on the Brent oil price. On April 21, Brent oil prices on the market were still trading at over 25 USD/barrel. On the other hand, WTI oil prices do not directly affect product prices in Singapore, while domestic gasoline prices use the reference price from the Singapore market.

In addition, according to the Ministry of Finance - Ministry of Industry and Trade, the average price of finished RON 95 gasoline in the world 15 days before the adjustment period of March 29, 2020 was 25.668 USD/barrel. Thus, one liter of RON 95 gasoline imported to the port has an original price of 0.16 USD, equivalent to 3,827 VND/liter.

|

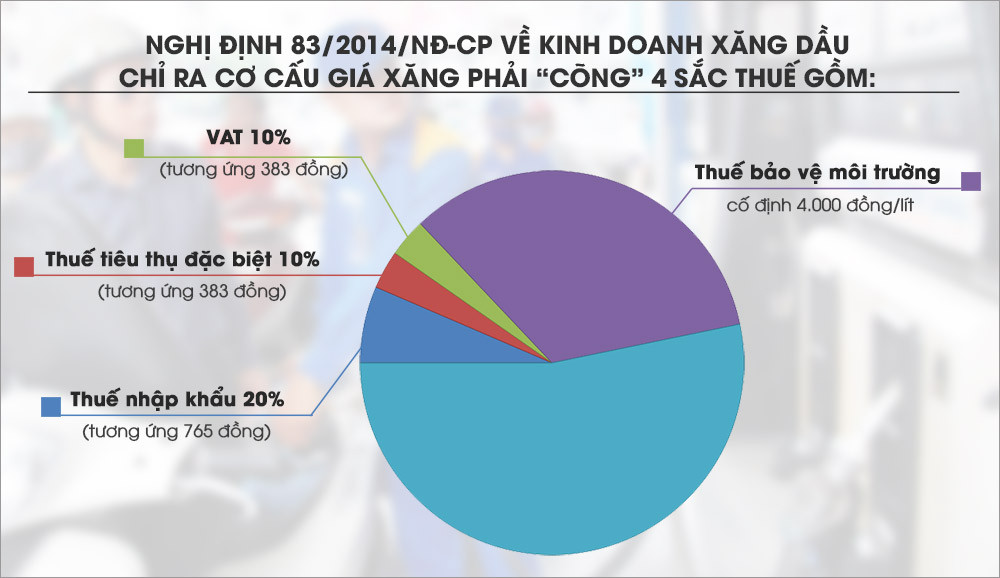

| Gasoline price structure subject to 4 additional taxes. Graphics: Lam Tung |

Decree 83/2014/ND-CP on petroleum trading indicates that the gasoline price structure must "carry" 4 taxes including import tax of 20% (equivalent to 765 VND), special consumption tax of 10% (equivalent to 383 VND), VAT of 10% (equivalent to 383 VND) and fixed environmental protection tax of 4,000 VND/liter.

In addition, each liter of gasoline must also include the standard business cost (VND 1,050/liter), standard profit (maximum VND 300/liter), the stabilization fund deduction (at the adjustment period of March 29, RON 95 gasoline is VND 1,150/liter) and the business's profit. The total of 4 taxes and fees is VND 8,031. Meanwhile, each liter of RON 95 gasoline currently has a retail price of VND 12,560 on the market. Thus, the total taxes and fees in the cost of a liter of gasoline account for about 64%, while taxes alone account for 44%.

|

| Oil prices, or gasoline prices in Vietnam, are not affected by US WTI oil prices. Illustrative photo |

Currently, the two domestic oil refineries, Dung Quat and Nghi Son, meet 70-80% of domestic demand. Dung Quat refinery processes crude oil from Bach Ho field - which has good quality and other domestic fields such as Rong, Chim Sao, Dai Hung, and a small amount of imported oil. Nghi Son refinery processes crude oil imported from Kuwait. Therefore, the above fluctuations in WTI oil prices do not greatly affect domestic gasoline prices. However, in the coming time, if demand does not improve and the epidemic is not pushed back, gasoline prices will remain low.

In general, world oil prices have gone through many ups and downs associated with economic crises or politicization. However, the current negative decline in world oil prices is due to the premonition that the gap between total supply and total demand in the world oil market will last long, and this is the result of the resonance of two pressures: the oil price war and the struggle for oil market share between the world's largest oil suppliers, OPEC, Russia (representing the oil supply source exploited by traditional technology) and the US (representing the new supply source from shale oil and gas exploitation technology); At the same time, this is also a direct consequence of a combination of border blockade measures, medical isolation, isolation and social distancing, freezing or narrowing of socio-economic activities associated with the Covid-19 pandemic, both nationally and internationally.

Petroleum prices have a direct and indirect impact on input costs and domestic price levels, as well as on inflation and consumer spending. Therefore, flexible management of petroleum prices is important in our country.

Consider stopping gasoline imports

Faced with the sharp decline in world oil prices, the Vietnam Oil and Gas Group (PVN) has just sent a petition to the Ministry of Industry and Trade and the Ministry of Finance proposing a number of solutions, including stopping the import of oil to reduce inventory at Dung Quat Oil Refinery and Nghi Son Oil Refinery; at the same time, removing products processed from crude oil from the group of goods subject to value-added tax when exported...

The proposal to stop importing petroleum needs to be cautious because the decrease in world oil prices is not a stable trend in terms of economic benefits. Moreover, the domestic retail price of finished petroleum products is much higher than the world price due to differences in composition and exploitation and processing costs as mentioned above. In particular, petroleum is a non-renewable resource, so priority should be given to importing when the price is cheap, instead of exploiting the scarce domestic resources and forcing consumers to consume at high prices.