Strengthening legal compliance to protect workers' rights

Social Insurance and Health Insurance policies play an increasingly important role in ensuring sustainable social security and ensuring the rights of employees in the event of occupational risks or illness, maternity, unemployment, retirement, etc. However, the situation of late payment and evasion of Social Insurance payment at some enterprises is still a painful problem, causing many consequences for employees, employers and management agencies.

A burning issue

The Social Insurance policy is one of the main pillars of the social security system, which has been of interest to the Party and the State and has been implemented since the country was founded. In particular, since the Social Insurance Law was enacted, the organization, implementation and settlement of social security policies have been more effective, the number of participants and beneficiaries of social policies has increased. However, up to now, the implementation of compulsory social insurance payment still has shortcomings, the situation of late payment and evasion of social insurance payment at some enterprises is a burning issue across the country.

There are many reasons for the delay in paying Social Insurance and Health Insurance, but the first and most basic reason is that employers' awareness of complying with the Social Insurance and Health Insurance laws is not good. In fact, there are cases where employers clearly understand the regulations on participation in Social Insurance and Health Insurance for employees but still deliberately do not pay or only register to participate in Social Insurance and Health Insurance for some employees to reduce costs. They even accept to pay late payment interest, abuse Social Insurance and Health Insurance contributions of employees to rotate capital.

In addition, the awareness of a part of employees about the Social Insurance and Health Insurance policies is not complete, so there are still cases where they agree with their employers to avoid paying or owe Social Insurance and Health Insurance. In cases where they understand the policies, due to work pressure, they do not dare to fight with their employers to protect their own rights. Some other cases are not really interested and do not grasp information about their own Social Insurance and Health Insurance payments, so there is no information about employers owing Social Insurance...

It is necessary to clearly define that good implementation of policies and laws on Social Insurance and Health Insurance will help employees feel secure in their work, stay committed and contribute to sustainable business development. In addition, employees need to be aware that participating in Social Insurance and Health Insurance is to protect their legitimate rights and interests. The Law on Social Insurance (amended) has dedicated a chapter to regulate the management of collection and payment of Social Insurance; clarifying the content and handling of late payment and evasion of Social Insurance. Accordingly, it aims to enhance compliance with the law and protect the legitimate rights and interests of employees.

Requires drastic participation of relevant departments and branches

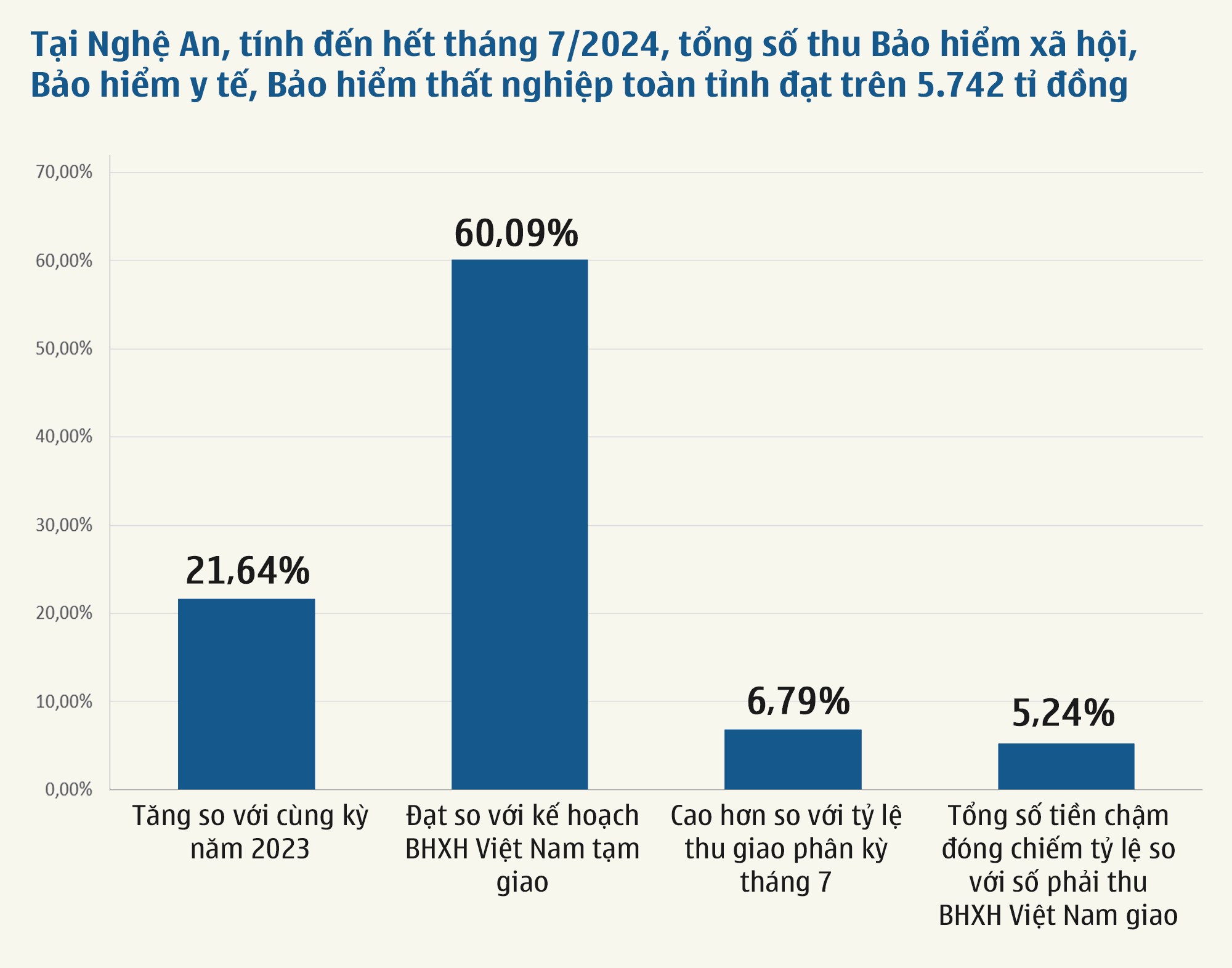

In order to contribute to raising the awareness of law compliance of the employers, thereby protecting the legitimate rights and interests of employees, in recent times, Nghe An Provincial Social Insurance has implemented many solutions to urge collection and reduce debt. In particular, strengthening the inspection and examination of the implementation of legal policies on Social Insurance, Health Insurance, and Unemployment Insurance at the employers.

Mr. Hoang Van Minh - Director of Nghe An Provincial Social Insurance said: In the first 6 months of 2024, the Provincial Social Insurance organized specialized inspections of 140 labor-using units; conducted surprise specialized inspections of 50 units; and conducted inspections of 22/30 labor-using units according to the assigned plan.

After the inspection, the Provincial Social Insurance proposed to handle the payment of Social Insurance, Health Insurance, Unemployment Insurance for 93 employees with the total amount of arrears (excluding arrears interest) being: 462.8 million VND; Arrears due to underpayment of prescribed level for 5 employees; Recovering to the Social Insurance fund due to incorrect payment of short-term Social Insurance regime for 74 employees with the amount of more than 137 million VND; Administrative sanctions against 7 employers for administrative violations in payment of Social Insurance, Health Insurance, Unemployment Insurance with the total fine amount required to be paid to the State budget being 106.7 million VND; total amount required to remedy the consequences being 390.9 million VND.

Coordinate and request credit institutions where the employer opens accounts to provide available balances as a basis for issuing 9 Decisions to enforce the Decision on administrative penalty with the amount of money forced to be enforced being 911.4 million VND; The amount of money successfully enforced is: 644.6 million VND (of which, the amount of administrative penalty paid to the State budget is: 197.8 million VND; the amount of money forced to remedy the consequences paid to the Social Insurance, Health Insurance, Unemployment Insurance funds is: 446.8 million VND).

To contribute to protecting the legitimate rights and interests of workers better and better, the Director of Nghe An Provincial Social Insurance recommends: State management agencies need to strengthen inspection and supervision of agencies, units and enterprises in the area in complying with the law on Social Insurance, Health Insurance and Unemployment Insurance; Grasp the business situation to have timely warnings; Strengthen coordination in inspection and examination of labor-using units showing signs of violations in collecting and settling Social Insurance, Health Insurance and Unemployment Insurance regimes; Strictly handle units, enterprises and individuals with violations of the law to ensure the legitimate rights and interests of participants in Social Insurance, Health Insurance and Unemployment Insurance. The police agency coordinates with the Social Insurance sector to monitor and grasp the implementation of policies and laws on Social Insurance, Health Insurance, and Unemployment Insurance in the area, promptly investigates, takes measures to prevent and handle violations, especially acts of fraud, profiteering, and evasion of payment of Social Insurance, Health Insurance, and Unemployment Insurance; Coordinates with the Social Insurance sector to promote propaganda and dissemination of violations of laws on Social Insurance, Health Insurance, and Unemployment Insurance so that people can understand and prevent, reflect, and denounce violations, while creating deterrence for violators.

In addition to the efforts of the authorities, each employee also needs to promote the role of supervising the obligation to pay Social Insurance, Health Insurance, and Unemployment Insurance of the employer, contributing to limiting the situation of evasion and late payment of Social Insurance by units and enterprises.

At the press conference on July 30, 2024 of the Ministry of Labor, War Invalids and Social Affairs, Mr. Nguyen Duy Cuong - Deputy Director of the Department of Social Insurance, Ministry of Labor, War Invalids and Social Affairs emphasized that the Law on Social Insurance (amended) has dedicated a chapter to regulate the management of collection and payment of social insurance; clarifying the content and handling of late payment and evasion of social insurance payment. With such a structure, the Law on Social Insurance (amended) aims to enhance compliance with the law, protect the rights and legitimate interests of employees. According to statistics of the Vietnam Social Insurance agency, the amount of late payment of social insurance, health insurance, and unemployment insurance by 2023 has reached over 13,000 billion VND (including late payment interest).