Increasing taxes on cigarettes brings many benefits

(Baonghean.vn) - Increasing special consumption tax on tobacco products will bring double benefits: reducing tobacco consumption and increasing state budget revenue.

|

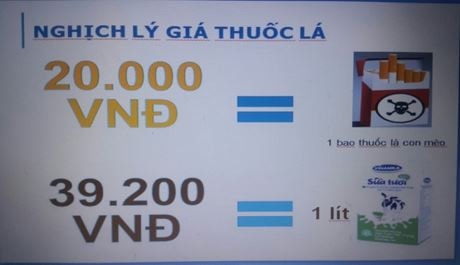

| Cigarette prices in Vietnam are the cheapest in the world. Photo: Internet |

Vietnam's cigarette prices are among the cheapest in the world.

The price of cigarettes in Vietnam is quite cheap. A pack of cigarettes is about 8,000 - 10,000 VND. For those who smoke better cigarettes, a pack of cigarettes costs about 20,000 VND. The price of cigarettes is sometimes cheaper than a meatloaf. Many people are willing to give up a loaf of bread to have a pack of cigarettes. Compared to other countries in the Southeast Asian region, Vietnam's cigarette taxes and prices are among the cheapest and lowest in the world.

There are two reasons why cigarette prices in Vietnam are cheaper than in other countries in the world:

Firstly, we are collecting tobacco tax as a percentage of the factory price. However, the problem here is that it is very difficult to determine the true value of the factory price. Manufacturers tend to create low prices to pay low taxes. Therefore, when converted to retail prices of cigarettes, tobacco tax (including special consumption tax and VAT) accounts for only 35% of the retail price. This is much lower than the world average of 56%. And the recommendation of the World Health Organization is that the tobacco tax rate should account for 70% or more of the retail price of cigarettes.

Second, the cigarette tax has increased in recent years, causing retail prices to increase, but the increase in cigarette prices has not kept up with the 4.7-fold increase, while the price of cigarettes has only increased 22 times. To be more specific, in 2005, we spent 9% of our income to buy 100 packs of Vinataba cigarettes, but in 2006, we only had to spend 4% of our income. Thus, cigarette prices are getting cheaper compared to the increase in average income of Vietnamese people.

These two reasons make Vietnam's cigarette prices among the cheapest in the world. Therefore, the Ministry of Health is proposing to increase the cigarette tax by a fixed amount per unit of the product. Specifically, the tax will increase to 2,000 VND or 5,000 VND per pack of cigarettes from 2020.

Increasing tobacco taxes brings many benefits

|

| Increasing tobacco tax reduces smokers and increases the state budget. Photo: Internet |

This view is incorrect because: In 2015, we spent 31,000 billion VND to buy cigarettes. In addition, we have to spend an additional 24,000 billion VND each year on medical treatment, loss of labor capacity, and early death caused by smoking. Thus, if we cannot reduce the rate of smokers and the amount of cigarette consumption, we will lose about 55,000 billion VND each year while the tax collected from the tobacco industry is only 1/3 of the amount we lose.

And experience from many countries in the world, including two neighboring countries, the Philippines and Thailand, shows that increasing tobacco taxes will reduce the number of smokers because they have to consider their budget. And more importantly, it will help prevent some people from starting to smoke, especially teenagers. Many studies show that a 10% increase in tobacco prices reduces the smoking rate among minors by 10% or more.

To reduce tobacco consumption, it is necessary to increase tobacco tax higher than the increase in income. This way, when buying a pack of cigarettes, people will have to consider more. Therefore, tobacco tax must increase steadily over the years to keep up with our people. Vietnam has only increased tobacco tax 3 times in 2006, 2008, 2016, so currently the price of tobacco is cheaper compared to our income. Reduce smokers, reduce the number of cigarettes consumed, reduce tobacco-related diseases. Ultimately, it will reduce the above losses.

Increasing tobacco taxes will have two benefits that have been proven worldwide: Reducing the number of smokers, preventing minors from starting to smoke, reducing costs due to tobacco-related illnesses and deaths; and increasing state budget revenue.

.jpeg)