Focus on budget collection from the first days and months of 2025

In 2024, the Nghe An Finance sector, one of the core members of which is the Provincial Tax Department, has implemented the political task of budget collection in a difficult context but has exceeded the assigned plan. Since January 2025, budget collection has been determined to achieve the assigned plan.

Deliver revenue targets from the first day of the first month of the year

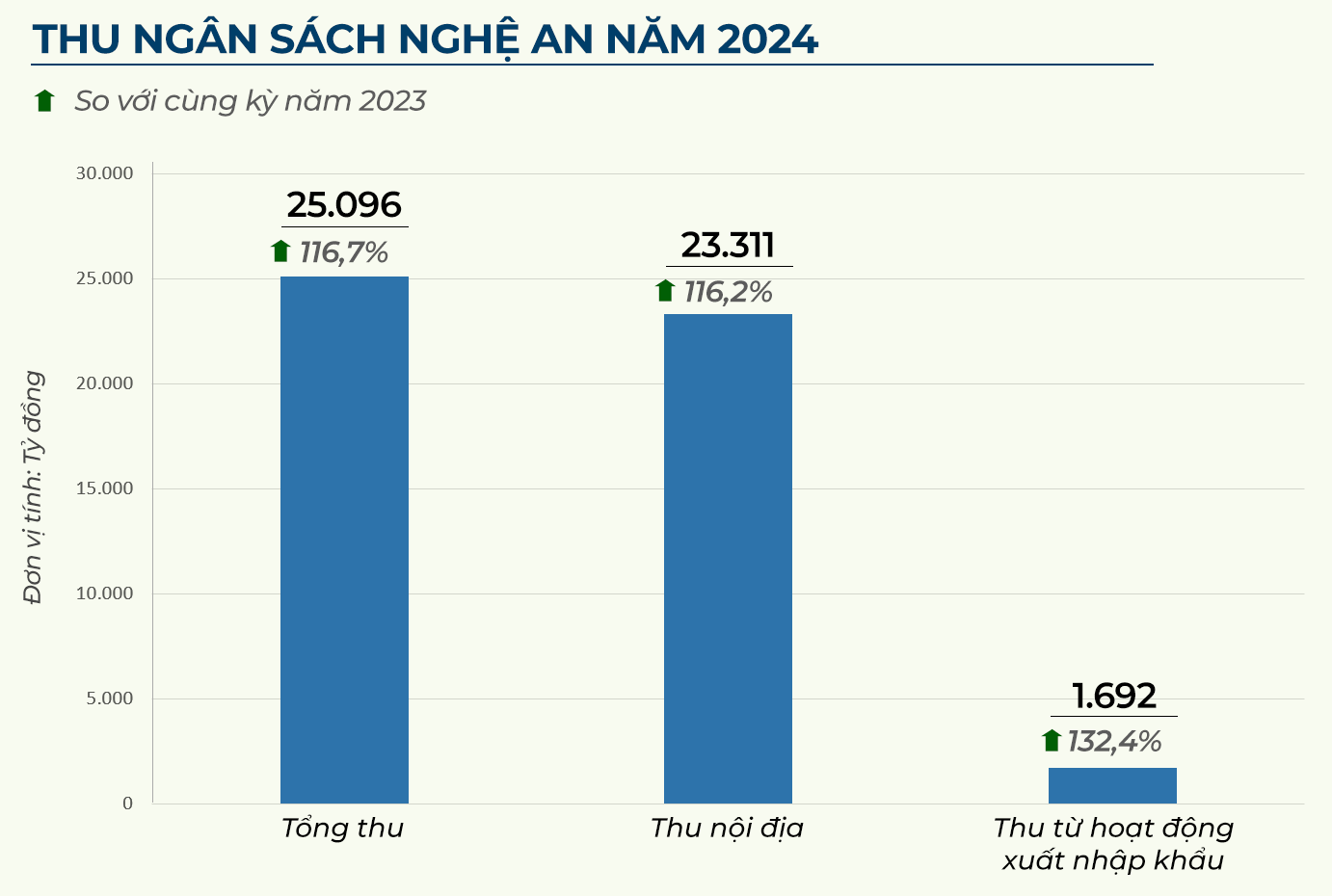

The leader of the Propaganda and Support Department of Nghe An Tax Department said: The scale of Nghe An's budget revenue ranked 14th out of 63 provinces and cities. This is a very impressive result, for 3 consecutive years, the total budget revenue of Nghe An province reached over 20,000 billion VND and has an increasing trend each year, contributing to the completion of the province's socio-economic development goals.

To complete the budget collection plan right from the first month and first quarter, Nghe An Tax Department propagates and urgently, flexibly and promptly deploys policies to support people and businesses; promotes administrative reform, and effectively implements the Tax System Reform Strategy until 2030.

Since the beginning of the year, Nghe An Tax Department has proactively implemented many appropriate tax management solutions while ensuring support for businesses in overcoming difficulties.

At tax offices, workload targets are assigned to teams from the beginning of the year. Teams for synthesis, estimation, declaration, debt management, tax debt enforcement, registration fees and other revenues, and tax inspection all have plans to perform their tasks well.

In addition, the tax sector strengthens discipline and internal discipline, rectify and improve the sense of responsibility of cadres and civil servants in performing public duties, effectively implements the work of preventing and combating corruption, practicing thrift and combating waste. The Provincial People's Committee assigns the Tax sector to closely monitor and evaluate the collection progress compared to the assigned estimate and the same-period collection to have solutions to increase revenue suitable for each locality; provincial departments, branches, sectors, People's Committees of districts, cities and towns strictly implement directives, plans and budget collection targets.

The solutions are: Expanding and strictly managing revenue sources, promoting e-commerce tax collection management, strictly implementing regulations on electronic invoices, especially in the fields of retail business of gasoline, oil and food services, restaurants, etc.

Besides, improving the investment and business environment, removing difficulties for people and businesses; enhancing decentralization and delegation of power; cutting administrative procedures; reducing compliance costs for people and businesses.

Regarding budget expenditures, the Finance sector and localities, departments, branches and sectors strengthen financial budget management discipline, strictly manage revenue sources; save regular expenditures, cut down on expenditures and spending tasks that are not really necessary. Proactively review and report to competent authorities on saving an additional 10% of regular expenditures to increase the 2025 budget compared to the 2024 budget according to the Government's direction in Resolution No. 233/NQ-CP. In addition, based on the guidance of the Ministry of Finance, advise competent authorities on the plan to use funds from the source of saving 5% of regular expenditures of the State budget in 2024 to eliminate temporary and dilapidated houses in the province.

To create jobs and revenue, localities and units must resolutely accelerate the disbursement of public investment capital, implement three national target programs, speed up the construction progress of works and projects, and further promote the role and responsibility of leaders.

In addition, strengthen the examination, review, and direction of final settlement of completed projects according to regulations. Investors coordinate with the State Treasury and relevant agencies to ensure payment sources for projects; promptly make payment for completed volumes for projects as soon as the required documents are complete, and promote payment through the State Treasury's online public services.

Ensure smooth operations

Pursuant to the guidance of the Ministry of Finance in Official Dispatch No. 13749/BTC-NSNN dated December 14, 2024, the official organizational structure arrangement model has been decided by the competent authority. The sectors, units and localities subject to the arrangement are responsible for developing a plan to hand over and receive assets, finance and the State budget.

Accordingly, the Finance sector noted that when implementing the 2025 budget, local units must discuss collectively and agree on implementation methods so that after the reorganization, all activities of the State apparatus can be carried out smoothly, stably and effectively. Absolutely do not let the loss of assets, finance and State budget occur when implementing the reorganization.

The 2025 State budget expenditure estimates of sectors, units and localities after being rearranged within the scope of the 2025 State budget expenditure estimates have been decided by the Provincial People's Council, and the Provincial People's Committee has assigned the departments, sectors, units and localities before the arrangement (without changing the total amount and each field of State budget expenditure that has been decided by competent authorities). In addition, the departments, sectors, units and localities subject to the arrangement are fully responsible for financial issues, assets, State budget in 2023, 2024 and the proposal of the 2025 budget estimates that have been assigned.

According to Circular No. 88/2024/TT-BTC regulating the organization of implementation of the State budget estimate for 2025: Ministries, central agencies, People's Committees of provinces and centrally-run cities shall assign the task of collecting the State budget for 2025 to affiliated units and lower-level authorities to ensure that it is at least equal to the State budget estimate assigned by the Prime Minister.

The assignment of the 2025 State budget revenue estimates to agencies, units and lower-level authorities must be based on a full review, analysis and assessment of revenue sources and budget collection results in 2024; based on policies and laws on budget collection; forecasting the economic growth rate of each industry and field, and the production and business situation of taxpayers in the area.

The Ministry of Finance notes that the provinces and centrally run cities: Based on the development investment expenditure estimates assigned by the Prime Minister, localities shall allocate resources corresponding to the surplus revenue of the provincial budget (if any) to repay the principal of local budget loans due in 2025 (in which, priority shall be given to repaying all principal of overdue local budget loans); the remaining capital shall be allocated to works and projects, in which sufficient capital shall be arranged and balanced for projects and programs partially supported by the central budget to implement the prescribed goals.

In 2024, the Tax Department achieved remarkable results. Mr. Nguyen Dinh Duc - Director of Nghe An Provincial Tax Department said that 2024 is a year in which all revenues are completed in terms of nature, and in terms of each district, they are also completed. Domestic revenue is 23,311 billion VND (reaching 160.4% of the estimate and equal to 116.2% of the same period in 2023). Of which, land use fee collection is 9,964 billion VND, reaching 218.5% of the estimate and equal to 118.4% compared to the same period in 2023. Excluding land use fee collection and lottery collection, domestic revenue is 13,301 billion VND (reaching 133.8% of the estimate and equal to 114.5% of the same period in 2023). The total budget revenue of the whole province exceeds 25,000 billion VND.