The stock market corrected as predicted.

(Baonghean) - The market in the first week of September 2018 experienced a short correction after reaching the 1,000 mark as predicted, so it did not cause too much surprise for investors.

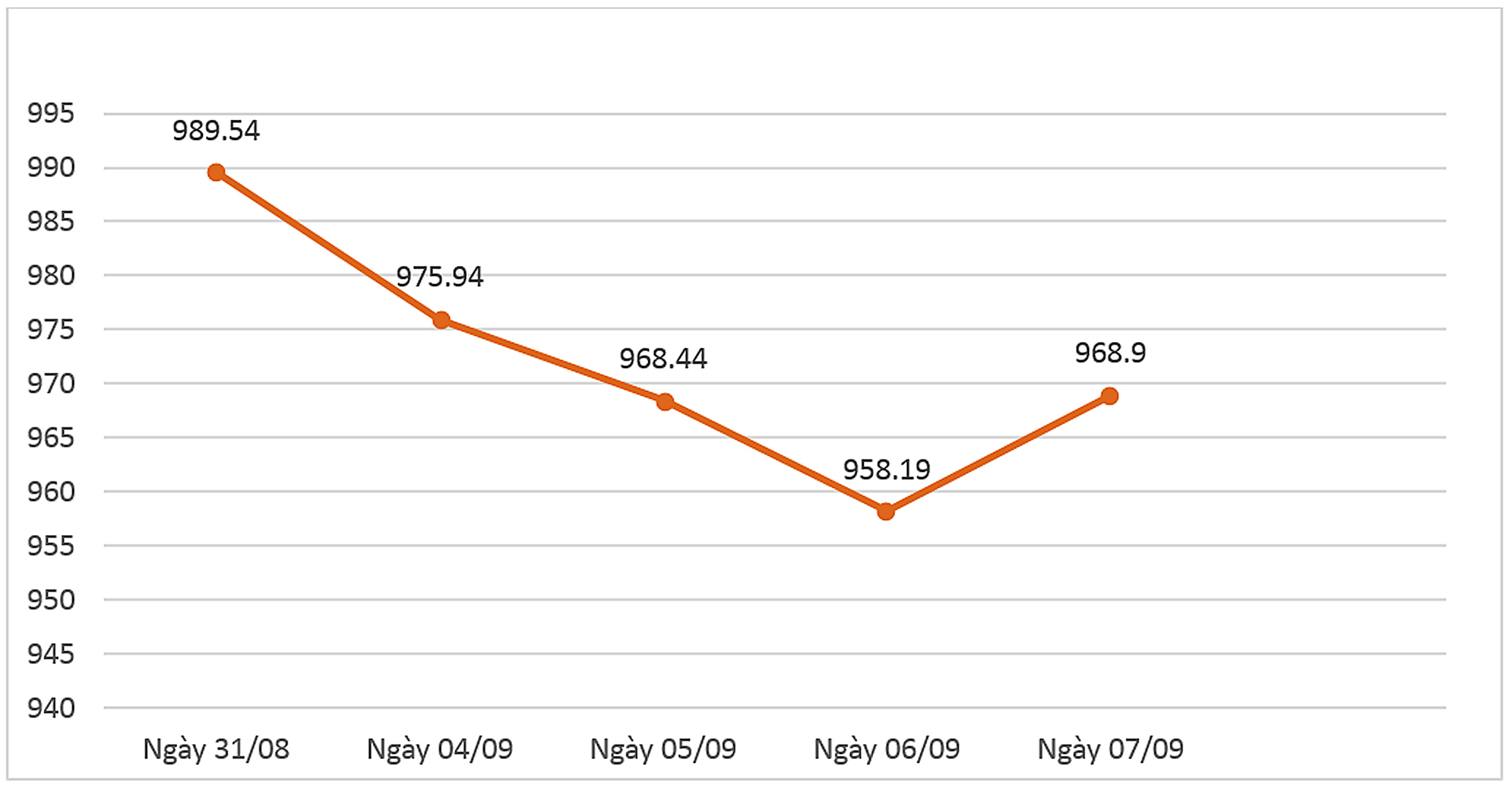

VnIndexClosing the week at 968.9 points, although up 10.71 points compared to the previous session, the index still recorded a decrease of 0.72% for the whole week. Meanwhile, the HNX Index still maintained a slight increase of 0.42% compared to the closing price of the first session of the week. Trading volume of the whole market dropped sharply by nearly 40% in transaction value compared to the previous week, reaching an average of only 4,582 billion VND/session.

The decline in both liquidity and scores was more negative than expected as the market was affected by the downward adjustment of global stocks, as well as the international capital flow continuing to withdraw from emerging markets, putting great pressure on the domestic market. This created a state of net selling by foreign investors during the week with more than 59 billion VND in selling value.

|

| Index fluctuationsVN-INDEXWeek of September 4 - September 7, 2018. Source: VNDIRECT |

The global financial market had a rather cautious and not very positive development this week when the US-China trade tension returned. The main indexes of the world market all recorded a week of decline. On Wall Street, the Dowjones Index and S&P500 both recorded a decrease of 0.19% and 1.03% compared to the first session of the week. In the European market, the main indexes in the region such as DAX30, CAC40 and FTSE 100 all had a decrease of more than 2.5% points during the week. And Asian stocks were not out of the correction, the main indexes in the Chinese and Japanese markets both decreased by 1.76% and 1.72% respectively.

Stock market September: Continue to accumulate in an upward trend

(Baonghean) - The Vietnamese stock market closed the last trading session of August at 989.54 points, up 0.25% compared to the previous week.

In the coming trading week, the support level around 960 points of VNindex is effective in creating a balance point for the market and at least triggering buying sentiment when it is maintained by the belief in the continued recovery trend that has not been erased. The market will enter the third quarter portfolio restructuring of large ETFs from September 10 to September 21 and normally the market will tend to be sideways while waiting for the restructuring.VNDIRECTI think that at least after the last session of the week, the market has found a balance again and the cash flow is still moving quite well internally. Therefore, selective opportunities with attractive fundamentals and strong enough stories will have the opportunity to separate from the group to continue to go up in this period.

With the desire to provide useful stock investment knowledge to investors, Securities CompanyVNDIRECTorganized the program "Zero-cost education" in Vinh City with the topic "Skills in choosing the time to buy/sell and risk management in stock investment".

Time: 9am - 5pm September 15, 2018.

Location: Beijing Hotel, 110 Mai Hac De Street, Vinh City.

Register to participate at:https://goo.gl/TD1irT