The market corrected as predicted.

(Baonghean) - After a rather volatile trading week before, the domestic stock market officially adjusted down in the first week of October, closing the week with a sharp decline with many large stocks closing at the lowest price of the session, bringing negative sentiment to the entire market.

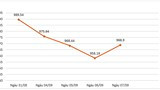

VnIndex closed the week at 1,008.39 points, down 0.44% compared to the first session of the week, while HNX Index recorded a decrease of 0.74%. Market liquidity, if excluding the sudden deal transaction of more than VND 16,328 billion of MSN, which was mainly the handover of this stock by foreign investors, the average trading value still increased slightly to VND 7,932 billion/session. In the derivatives market last week, total market liquidity decreased slightly compared to the previous week when only 274,580 contracts were traded, with the new OI contract volume reaching 76,855 contracts.

|

| VN-INDEX index fluctuations week 01.10 – 05.10.2018_ Source:VNDIRECT |

Pressure from domestic market developments continued to come from international financial markets as key markets in Asia, Europe and even the US market recorded a week of declines. The MSCI Frontier Market Index of frontier markets and MSCI EM Markets of emerging markets also fell 1.1% and 2.1% respectively during the week. The USD continues to strengthen and the 10-year US government bond yield has surpassed 3% to 3.2%, the highest level since 2013. Clearly, these are putting great pressure on the stock markets of many emerging and frontier countries because the net selling trend has been reactivated, and the Vietnamese market is no exception as it happened in the second quarter. The risk and selling pressure from foreign investors will increase along with the increase of the USD Index. If it surpasses this year's peak of 97 points in mid-August 2018, in addition to selling pressure from foreign investors, macro variables such as exchange rates, interest rates, inflation, etc. will have a negative impact on the stock market.

Trade tensions ease, global stocks recover

(Baonghean) - The global financial market in the week of September 10-14, 2018 witnessed a recovery in most continents when the Sino-US trade tension temporarily eased.

The stock market corrected as predicted.

(Baonghean) - The market in the first week of September 2018 experienced a short correction after reaching the 1,000 mark as predicted, so it did not cause too much surprise for investors.

The market began to adjust more clearly under psychological pressure from international financial markets and strong net selling pressure from foreign investors. Ms. Nguyen Phan Cam Thuy, Senior Investment Consultant, Securities CompanyVNDIRECTcommented that “From a technical analysis perspective, we believe that the support zone of VNIndex will revolve around 990 points. If this zone is maintained, the indices will have a chance to continue to increase in the short term. In theory, this is also a completely normal adjustment period and in the scenario that has been predicted, the candlestick is not too surprising. The index, after increasing well in the past time from the bottom of around 890 points to the current level, also needs time to adjust again. Moreover, the cash flow is still maintained well and the level of differentiation is still strong. Therefore, chasing is not necessary for stocks that still have attractive fundamental valuations this year”.