Budget revenue from import and export decreased by 37%, many key products decreased sharply

(Baonghean.vn) - The world and domestic economies are facing many difficulties, key export markets are shrinking, and import-export taxes in Nghe An have decreased sharply. Accordingly, the target of collecting import-export taxes in 2023 is full of challenges...

Imports and exports decreased

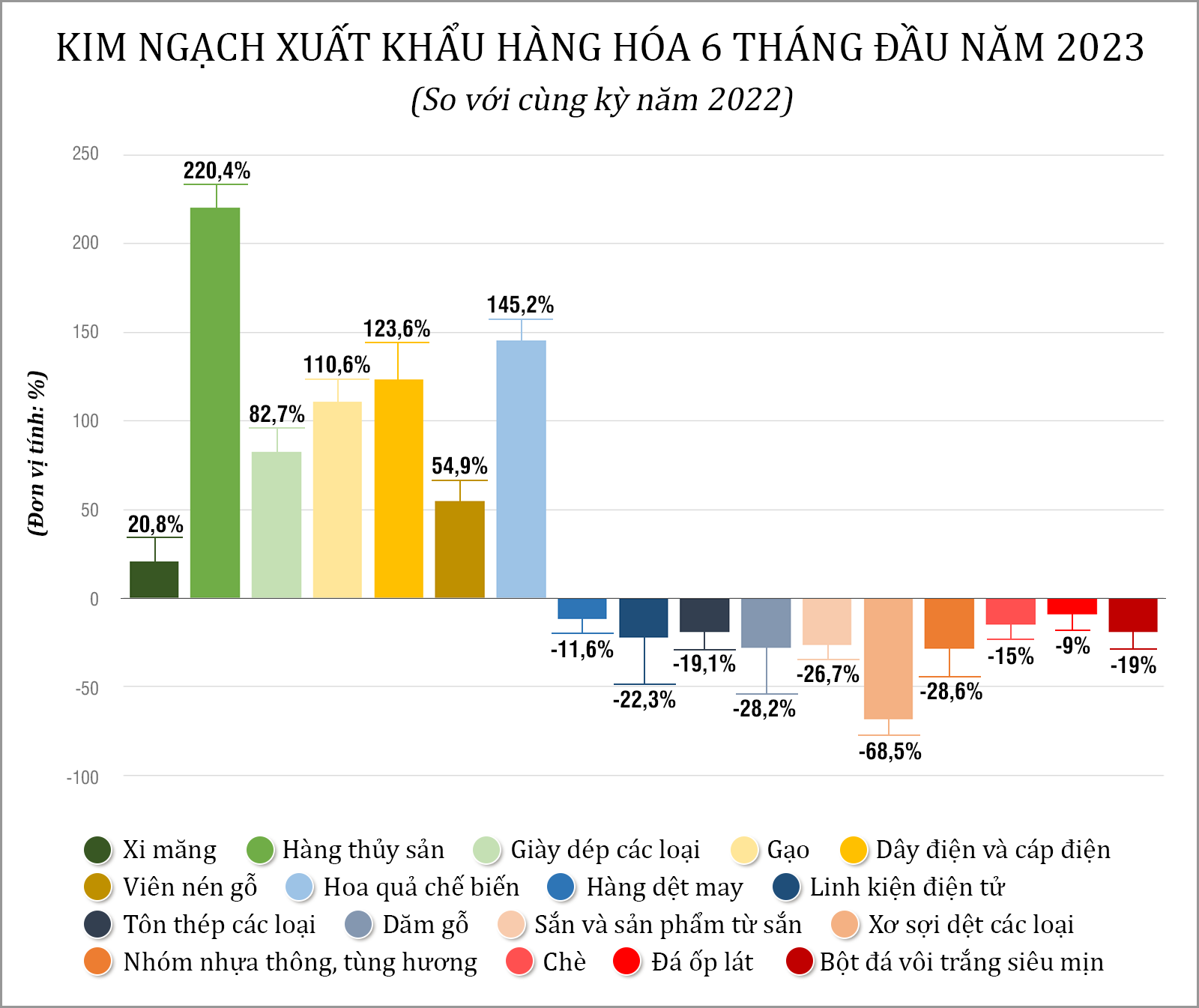

In the first months of 2023, the economy still has many fluctuations, the global supply chain is interrupted and broken, leading to many consequences for import-export activities and economic growth... Tight monetary policies in many countries have reduced consumer demand of major trading partners, leading to a relative decrease in export activities in some key markets such as China, the US, the EU, Korea... Lack of orders, the decline in commodity prices makes the export turnover of goods in the first 6 months of 2023 estimated at 1.086 billion USD, down 2.11% over the same period in 2022.

The decrease in export turnover has also led to a sharp decrease in tax revenue from this activity. In 2023, the Ministry of Finance and the People's Committee of Nghe An province assigned the revenue target from import-export activities in Nghe An province to be 1,250 billion VND, but the revenue as of July 17 was 606.7 billion VND, reaching 48.54% of the legal target, down 37.18% over the same period.

Many items that account for a large portion of total revenue at Nghe An Customs Department are currently experiencing a sharp decline. For example, revenue from wood chips decreased by 70.89%, spare parts decreased by 32.43%, steel of all kinds decreased by 53.63%; plastic beads and electronic components decreased...

The unit's main budget revenue is from VAT on imported steel products, accounting for about 61.58% of total budget revenue. In the first 6 months of 2023, due to difficulties in production and business, and few orders from partners, steel import enterprises for production decreased sharply compared to the same period last year, greatly affecting revenue in the first 6 months of 2023 (equal to 56.54% compared to the same period in 2022).

Meanwhile, regarding import activities, enterprises importing steel and aluminum for production materials are facing difficulties. Enterprises such as Hoa Sen Group Joint Stock Company, Vuong Steel Company Limited, Kim Quoc Steel Company Limited, BSE Vietnam Company Limited, cannot export products, so the import volume in the first 6 months of 2023 decreased significantly compared to the same period in 2022, greatly affecting the budget revenue.

Regarding petroleum products, Thien Minh Duc Group Joint Stock Company is an enterprise that annually contributes a large amount to the local budget; in 2022 alone, this enterprise accounted for 32% of the budget revenue of Nghe An Customs. However, the fact that energy prices are still high and the Russia-Ukraine war has affected the petroleum import and export activities of Thien Minh Duc Group Joint Stock Company. In the first 6 months of 2023, the revenue from diesel was 16.7 billion VND, accounting for 11.3% of the revenue in the first 6 months of 2023 and only 15.7% compared to the enterprise's revenue in the same period last year.

Find solutions to overcome difficulties and increase budget revenue

Currently, the world situation is still complicated, such as war, economic recession, etc., affecting the import and export of enterprises; it is forecasted that in the coming years, there will be difficulties in collecting the state budget.

For example, the price of imported diesel is higher than the domestic price, so businesses are considering importing, and from now until the end of 2023, businesses still have no plans to import more. Or for steel, steel manufacturing enterprises often bring large budget revenues to the province, but it is expected that in the last 6 months of the year, export orders of steel enterprises will still face many difficulties, so steel imports for production materials cannot increase sharply.

Exporting businesses are also facing many difficulties. This is the case of Trung Do Joint Stock Company, which started producing bricks at the time when the market was frozen, so although the products met export standards, the company had a hard time finding customers. According to Mr. Nguyen Duy Hien, Director of Trung Do Slab Stone factory, the production line was not operating at full capacity, while inventory accounted for 60% of output. Currently, the company is actively looking for export customers.

Therefore, to overcome difficulties and increase budget revenue, in addition to strengthening administrative procedure reform, focusing on customs procedures, it is necessary to regularly monitor and grasp the situation, closely follow the import-export plans of enterprises with large revenues. From there, analyze and evaluate influencing factors, promptly remove difficulties and obstacles, facilitate import-export activities and accompany enterprises.

Mr. Tran Dinh Sy - Deputy Head of Vinh Customs Branch said that in addition to the difficult economic situation, Nghe An's logistics services have not yet developed, many businesses choose to do customs procedures right at the border gate to reduce time and costs, so the number of declarations registered at Vinh Customs Branch has decreased compared to the same period. As a unit that performs customs procedures outside the border gate, in the coming time we will strengthen solutions to attract businesses to do procedures at the Branch, ensuring the completion of the budget collection target.

A problem that has been reported by many businesses at many conferences and forums but has not yet been resolved is that although the infrastructure of border gates, seaports and airports has been upgraded, it is still generally limited. Therefore, Nghe An's goods are not completely imported and exported through Nghe An's border gates but must also go through a number of ports such as Hai Phong, Nghi Son - Thanh Hoa, Vung Ang - Ha Tinh. This has caused a significant decrease in Nghe An's import and export tax revenue, which needs to be discussed further by the province and related sectors to find a solution soon.

The decrease in import-export tax revenue is a major challenge to the completion of the 2023 collection task of the Customs sector in particular, and the province's budget collection task in general. To achieve the budget collection target this year, it requires all levels and sectors to be proactive in implementing measures to support businesses in production and business as well as finding and expanding export markets.

Faced with this reality, to achieve the goal of completing the task of collecting import and export taxes for the whole year of 2023, the Customs Department has been implementing a series of solutions. Mr. Chu Quang Hai - Director of Nghe An Customs Department said that the unit continues to proactively advise and propose to the Provincial People's Committee solutions to increase budget revenue, especially solutions to stabilize old revenue sources and attract new revenue sources; coordinate with departments, branches, sectors, and local authorities to review investment projects to proactively guide and support investors in importing machinery, equipment, and materials for the project. Along with that, drastic measures are taken to prevent revenue loss through price, quantity, and origin of goods right at the customs clearance stage. At the same time, strengthen the fight against smuggling, trade fraud, and counterfeit goods, focusing on areas that are vulnerable to violations of the law...

Implementing the tariff reduction roadmap that Vietnam has committed to in free trade agreements (FTAs), at the end of 2022, the Government issued 17 preferential import and export tariffs to implement 17 FTAs in the period of 2022 - 2027. Thus, in 2023, many imported goods with high tax rates will have their taxes cut and will be reduced even more in the following years. Enterprises operating in the form of export processing enterprises that are subject to tax exemption when carrying out import and export procedures at the Nghe An Provincial Customs Department tend to increase. Therefore, the total import and export turnover increased but the state budget revenue did not increase accordingly.