The truth about the investor mortgaging assets, the bank seizing debt from more than 80 households

(Baonghean.vn) - In recent days, 84 households living in the PVNC2 - CT01 apartment building were confused when they suddenly received a notice from ACB bank stating that their apartments were mortgaged by the investor and the bank would proceed to handle all mortgaged assets to recover the loan debt. What is the truth of this issue?

People worry about losing their homes

Present at PVNC2 - CT01 apartment building (address at No. 6, Nguyen Quoc Tri Street, Hung Binh Ward, Vinh City), the reporter recorded the confusion and anxiety from all residents living here.

The building is invested by Thanh Vinh Investment, Production and Trade Joint Stock Company (under Nghe An Petroleum Construction Minerals Corporation), currently has 13 floors with 84 apartments. It is known that according to the planning, the building has 14 floors, but during the construction process, due to some requirements on ensuring technical safety, the building was only built with 13 floors. Currently, the documents still record the building as 14 floors.

|

| Residents of the PVNC2 - CT01 apartment complex are worried because they do not have a certificate of apartment ownership and have received a debt collection notice from the bank. Photo: PT |

The residents said that the purchase and handover of the apartments were carried out since June 2015, but so far they have not received any action regarding the issuance of a certificate to prove ownership of the apartment. Mr. Le Ngoc Minh (apartment 303) expressed his frustration: "To have money to buy a house, we also have to borrow from the bank, many people even mortgage their parents' houses and fields in the countryside to buy an apartment to live in the city. The investor is slow in making the certificate, which greatly affects our rights."

While waiting, on October 17, the households suddenly received a notice from Asia Commercial Joint Stock Bank (ACB), Vinh Market Transaction Office, stating that their apartments were mortgaged by the investor and the bank would proceed to process all mortgaged assets to recover the loan debt. This information again made the people confused, worried that the house they had saved up and saved money to buy would be seized by the bank, and would be a debt burden for others?

|

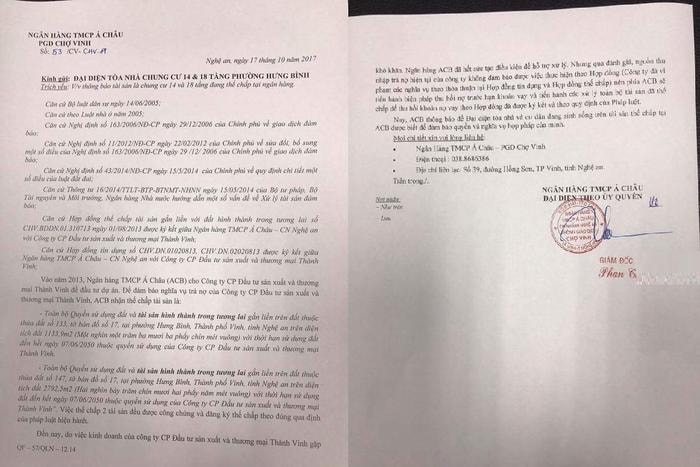

| Notice from ACB bank sent to the apartment building representative about handling all mortgaged assets. Photo: PT |

This notice clearly states ''In 2013, Asia Commercial Joint Stock Bank (ACB) granted Thanh Vinh Investment, Production and Trade Joint Stock Company to invest in the project. To ensure the debt repayment obligation of Thanh Vinh Investment, Production and Trade Joint Stock Company, ACB accepted the mortgage of the following assets:

- All land use rights and future assets attached to land belonging to plot number 133, map sheet number 17....on a land area of 1133.9 m2...

- All land use rights and future assets attached to land belonging to plot number 147, map sheet number 17...on a land area of 2792.5 m2.....

Up to now, due to the difficulties in the business of Thanh Vinh Investment, Production and Trade Joint Stock Company, ACB Bank has made every effort to support the settlement. However, through assessment, the company's current source of income to repay the debt does not ensure the implementation of the Contract (the company has violated the obligations under the agreement in the Credit Contract and Mortgage Contract), so ACB will take measures to recover the debt before the loan term and handle all mortgaged assets to recover the loan debt....''.

Thus, the PVNC2 - CT01 apartment building where 84 households are living is located on an area of 480 m2, on plot 147, map sheet number 17 - is 1 of 2 assets that Thanh Vinh Company is mortgaging at the bank.

Feedback from investors and ACB bank

On the investor side, Mr. Nguyen Canh Nhan - Director of Thanh Vinh Investment, Production and Trade Joint Stock Company admitted that up to now, the residents of the apartment complex have not had certificates of apartment ownership.

Mr. Nhan also did not avoid the fact that the company is currently mortgaging assets related to households at ACB bank. The two most important issues for households in the 14-storey apartment building to have a title are to fully pay land use tax and release the title. Regarding tax obligations, the company has paid 4 billion 555 million VND out of a total of 9.7 billion VND for both plots of land, of which the land plot where 84 households in the apartment building are living has paid full tax.

Mr. Nguyen Canh Nhan - Director of Thanh Vinh Investment, Production and Trade Joint Stock Company:"We are trying to complete the procedures so that by the second quarter of 2018 at the latest, we will have apartment ownership certificates for the residents of the 14-storey apartment building." |

The second issue is about the mortgage release of the mortgaged cover at ACB bank. Mr. Nhan said that on October 17 - the time the bank sent the notice to the building representative - it was because the company was late in paying the principal and interest due.

Currently, the company has paid the full amount, ACB bank also requires the company to pay 3.5 billion VND to release the mortgage and withdraw the cover to make a certificate of apartment ownership.

''The company will try to pay the full amount of 3.5 billion VND to ACB in the first quarter of 2018, so by the second quarter of 2018 at the latest, the company will complete the issuance of apartment ownership certificates to the people'', Mr. Nguyen Canh Nhan affirmed.

|

| PVNC2 Apartment Building - CT01. Photo: PT |

On the side of ACB Bank, Mr. Phan Thanh Vinh - Director of Vinh Market Transaction Office, ACB Bank said that on August 1, 2013, ACB Bank and Thanh Vinh Company signed a contract to mortgage assets attached to land formed in the future. According to this contract, Thanh Vinh Company mortgaged 2 assets with 2 separate covers, in which 1 cover is the land planned to be a theoretical + practical school building and a company office building, 1 cover is a dormitory area combined with a motel and hotel.

Afterwards, Thanh Vinh Company changed the purpose of using both of these assets, in which the dormitory combined with motel and hotel was built into the current 14-storey apartment building. This change of purpose of use was approved by the Provincial People's Committee in Decision No. 5342/QD.UBND-XD.

According to Mr. Vinh, the bank also did not make it difficult for the company to use the land for the wrong purpose initially. However, in the third quarter of 2017, Thanh Vinh Company was late in paying the principal and interest due, violating the contractual obligations, so the bank sent a notice to the representative of the apartment complex.

Mr. Vinh said, "Up to this point, Thanh Vinh Company's total outstanding debt at the bank is 16.8 billion VND. After the working process between the two parties, the company has also paid the principal and interest on time, and at the same time proposed feasible measures and plans to maintain the loan and arrange financial resources as soon as possible to make land titles for apartment residents."

'Fortunately, the land with the 14-storey building was separated into a separate parcel and up to now, the outstanding debt is not much so Thanh Vinh company is able to proceed with the mortgage release,' Mr. Vinh added.

Obviously, mortgaging a project to borrow capital for project investment is a normal activity of enterprises and investors and is permitted by law. However, when the related assets are mortgaged at the bank but are put up for sale, the most at-risk subject is the buyer. With the responsibility of the investor, Thanh Vinh Company needs to quickly release the mortgage of the assets in accordance with the law, ensuring the rights of the residents of the apartment building.

Dr. Lawyer Nguyen Trong Hai - Trong Hai and Associates Law Office: ''Pursuant to Clause 7, Article 26 of the 2014 Housing Law, it is stipulated that: Within 50 days from the date of handing over the house to the buyer or from the time the lessee has fully paid the agreed amount, the procedure must be carried out to request the competent state agency to issue a certificate to the buyer or lessee of the house, except in the case where the buyer or lessee voluntarily carries out the procedure to request the issuance of a certificate. However, up to now, after more than 2 years of handing over the houses to the households, the investor has not yet carried out the procedures to issue apartment ownership certificates to the households. On the other hand, Thanh Vinh Company sells apartments while the assets currently have many legal issues that have affected the rights of customers. The cause of this problem comes from the lack of transparency. Therefore, to ensure their legitimate rights and interests, households need to ask investors to come up with the most optimal solution." |

Phuong Thao