Business license tax converted into fees, budget revenue increased by nearly 1,000 billion VND

It is expected that from July 1, 2017, the business license fee will replace the previous business license tax and is expected to increase the state budget revenue by nearly 1,000 billion VND/year.

The Ministry of Finance has just announced a draft Decree regulating the collection rates, collection, payment and management of business license fees. Accordingly, from July 1, 2017, business license fees will replace the previous business license tax and the collection rate of business license fees will increase sharply.

Amending business license policy, increasing budget revenue by nearly 1,000 billion VND

According to the explanation of this Ministry, at the 10th session of the 13th National Assembly, the Law on Fees and Charges was passed, effective from January 1, 2017, replacing the Ordinance on Fees and Charges, in which the business license tax was changed to business license fees. Therefore, the issuance of the Decree regulating business license fees is necessary, creating a complete and synchronous legal framework with detailed regulations and instructions for implementing the Law on Fees and Charges.

|

| According to the new regulations, it is expected that business households with revenue under 100 million VND/year will not have to pay business license fees (Illustration photo: KT) |

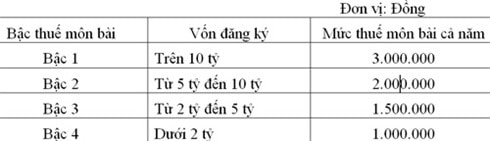

According to current regulations, business organizations pay business license tax in 4 levels, based on the registered capital stated in the business registration certificate or investment license. Specifically:

|

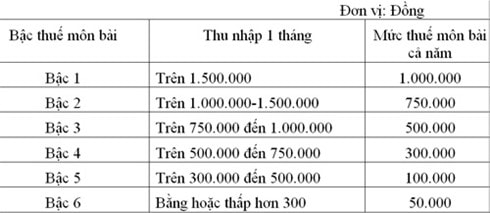

Individual business households pay business license tax in 6 levels based on monthly income as follows:

|

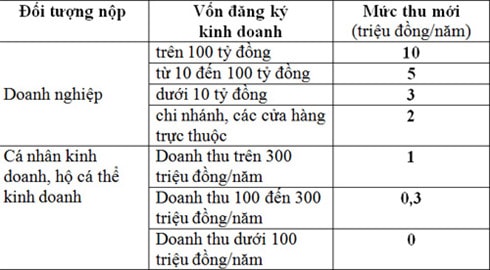

According to the draft Decree on business license fees, when applying the new regulations, business license fees will be collected from businesses, with 4 levels, while for individual businesses and individual business households, only 2 levels will be collected:

|

The Ministry of Finance believes that the new collection rate will ensure fairness and be consistent with the taxpayer's ability to contribute. Specifically, for businesses divided by the scale of registered capital: the collection rate is higher for businesses with large registered capital and the collection rate is lower for businesses with small registered capital; As for households and individuals doing business, the distinction is based on revenue, consistent with the ability to contribute.

If the business license tax is collected according to current regulations, the state budget revenue from the business license tax is about 1,700 billion VND/year. When applying the new regulations on collecting business license fees, the expected revenue is about 2,685 billion VND/year, ensuring an increase in state budget revenue compared to the current one.

The Ministry of Finance proposes to regulate that the agency collecting business license fees must pay 100% of the total collected fees to the state budget according to the State Budget Directory.

The current business license tax rate is outdated compared to... salaries.

According to the analysis of the Ministry of Finance, in the process of implementing the business license tax policy in the past, there have been many shortcomings and problems. For example, for individual business households, most of them pay taxes by the lump-sum method, do not fully implement the system of books, invoices and documents, and cannot account for production and business results, the business license tax rate is regulated to include 6 levels based on monthly income. Every year, tax authorities have to spend a lot of time investigating sales, and collection costs are high.

In essence, the business license tax is a fee to check and control the number of establishments with business activities during the year. However, the business license tax for households includes 6 levels depending on the average monthly income, causing many difficulties for both taxpayers and tax authorities in determining the payment level, leading to tax omissions and not being able to fully utilize the function of checking the number of business establishments.

According to the provisions of the Law on Personal Income Tax, individuals with an income of less than 9 million VND/month do not have to pay personal income tax. If they have 2 dependents, then an income of less than 16.2 million VND/month does not have to pay personal income tax. Meanwhile, according to the current business license level, a business household with an income of 300,000 VND must also pay business license tax. Thus, the current regulations on income levels to classify business license levels of business households are no longer suitable to the actual situation.

In addition, the current business license tax level when built based on the minimum wage in 2002 was 290,000 VND/month. Currently, the minimum wage has increased to 1,150,000 VND (from 1/5/2016 to 1,210,000 VND). Therefore, the determination of the current business license tax level is not consistent with the change in salary.

The above-mentioned shortcomings are an important basis for the Ministry of Finance to submit to the Government a Decree on adjusting the business license tax rate and switching to collecting business license fees in accordance with the provisions of the Law on Fees and Charges./.

According to VOV.VN

| RELATED NEWS |

|---|