Busan Summit Brings Temporary Calm

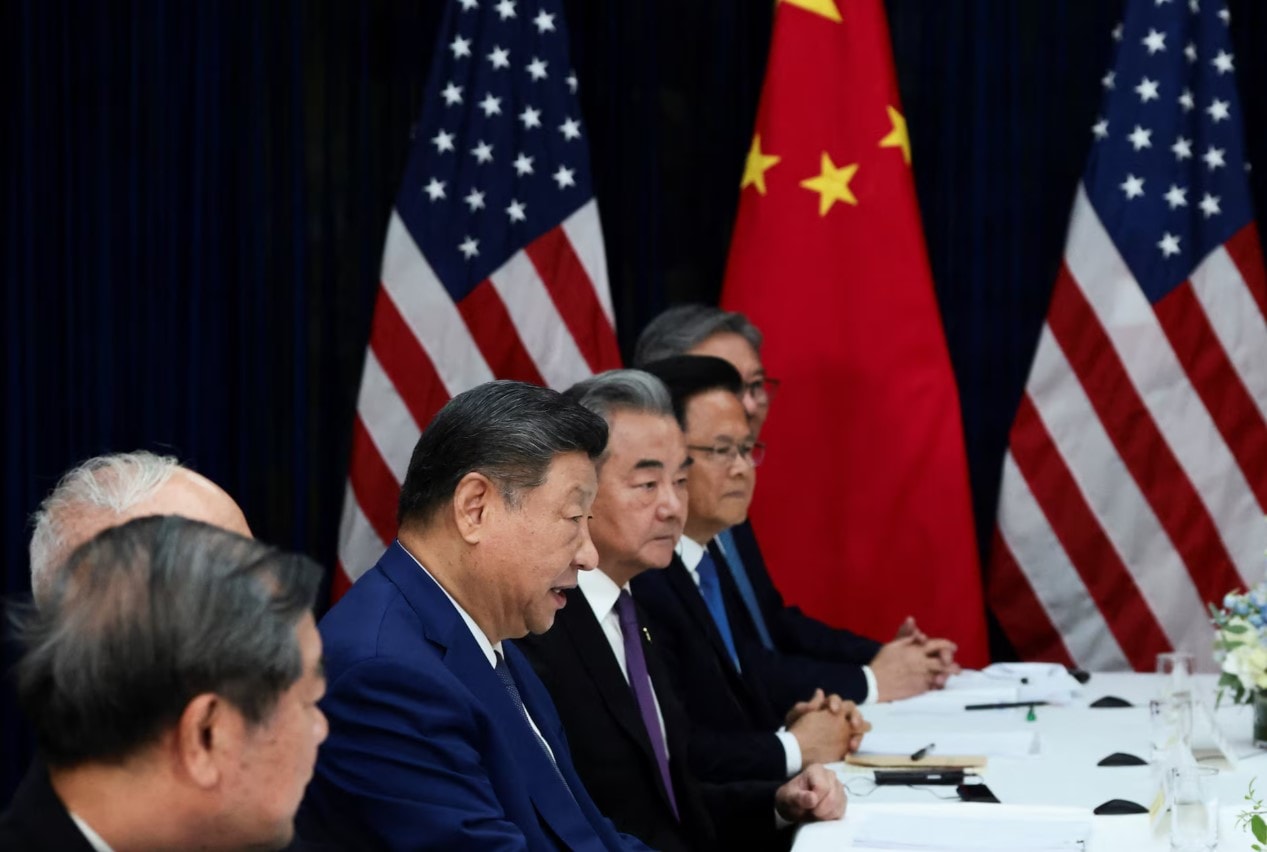

This week, the summit between US President Donald Trump and Chinese President Xi Jinping took place in Busan (South Korea). There were clear signs of de-escalation: Mr. Trump praised the meeting as "12 out of 10" and Mr. Xi spoke of "important consensus," but analysts remained cautious. There was no joint statement, and core strategic issues remained. Many opinions said that this was just a transactional agreement, a temporary "ceasefire agreement"...

De-escalation

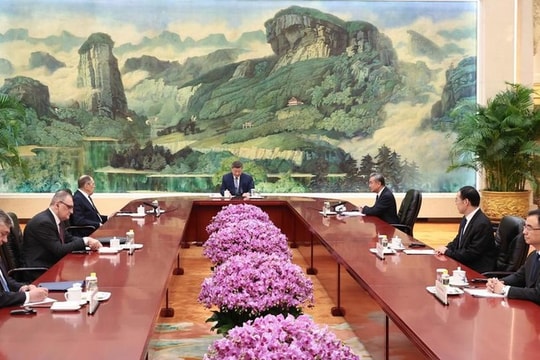

The first face-to-face meeting in six years between the leaders of the world's two largest economies lasted about 100 minutes, ending sooner than expected. The immediate result was a clear signal of de-escalation of tensions, which had been pushed to a climax by retaliatory tariffs and disputes over rare earths. President Trump announced that he would visit China in April 2026. For his part, President Xi Jinping called this a step towards "an important consensus". Although there was no joint statement, both sides avoided making any statements that could be seen as weak. According to observers, the brevity of the meeting showed that preparatory work on key issues had been completed in advance. Most likely, a "very substantial agreement framework" was shaped at the meeting on October 25 in Kuala Lumpur (Malaysia) between US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lapfeng.

The agreement reached in Busan was a series of clear “reciprocal” commitments focused on easing the most pressing economic hot spots. On the Chinese side, the commitments were specific. Beijing pledged to do more to stem the flow of precursor chemicals used to produce fentanyl, a deadly synthetic opioid that is a top priority for the Trump administration in addressing the public health crisis. In addition, China agreed to suspend restrictions on exports of critical minerals, including rare earths, to the United States for a year, removing an economic lever Beijing had wielded. Another key commitment was to resume purchases of American soybeans. This was a big “win” for Mr. Trump, because China’s earlier import cuts had severely damaged his rural voter base. China has pledged to buy 12 million tons of soybeans by January 2026 and 25 million tons annually for the next three years, according to US Treasury Secretary Scott Bessent. Finally, China's Ministry of Commerce said it would work with the US to "properly resolve issues related to TikTok," suggesting a deal on US ownership of the app could be imminent.

In return, the US also made important concessions. The biggest concession was the reduction of tariffs, with President Trump agreeing to reduce tariffs on Chinese goods by 10 percentage points, bringing the effective average tariff from 57% to 47%. Specifically, the 20% tariff related to the fentanyl issue was halved to 10%. In addition, the US will suspend the Section 301 investigation into China's maritime and shipbuilding activities, easing legal pressure on this key industry of Beijing. Another notable move is that Washington will suspend for 1 year new restrictions on the "Entity List", which makes it difficult for Chinese companies to use affiliates to buy banned US technology.

In addition to the major commitments, the two sides also agreed to suspend tit-for-tat port fees. Mr. Trump also posted on the social network Truth Social that China had agreed to buy oil and gas from Alaska, although official sources later said that Mr. Xi had only “expressed interest” in participating in a new LNG pipeline there. The silence on some other strategic issues reinforced the perception that the Busan meeting was mainly focused on managing a short-term economic crisis, rather than resolving fundamental geopolitical disagreements.

"1 year" silence?

The global financial markets reacted mutedly to the details, suggesting that investors had anticipated a limited deal and did not believe it would fundamentally alter the trajectory of the US-China relationship. Analysts were quick to point out the transactional nature of the deal. "Tariff cuts in exchange for a promise to crack down on fentanyl provide a temporary reprieve, but it is transactional relief, not a structural reset," Craig Singleton, senior China expert at the Foundation for Defense of Democracies (FDD), told Reuters. "Nothing has fundamentally changed, and the cycle of mutual coercion will continue as soon as one side feels disadvantaged."

Meanwhile, the CNN article commented that the current agreement in Busan is essentially just a "rough draft" and nothing has been officially signed. Washington's basic position is still to see China as a threat to its global dominance. Beijing, on the other hand, is still dissatisfied with the US's tariff and containment strategies. Both sides seem to agree on only one point: They cannot afford a full-scale confrontation, whether on trade or anything else, at this time.

Further analysis by economists shows that even if fully implemented, the Busan agreement is unlikely to solve the internal economic problems facing both countries. For the US, the agreement to resume soybean purchases is considered "too little, too late". The peak harvest season in the US has already taken place, and many farmers may have sold their deficit at lower prices. Therefore, the positive impact on agricultural voters may not be as great as Mr. Trump expected. More importantly, the US labor market is clearly weakening. Recent data shows a significant slowdown in hiring. Mr. Trump's unpredictable tariff policies have increased uncertainty, making businesses reluctant to hire. Now, US companies are even starting to lay off workers. For the first time in many years, there are more unemployed people than available jobs. The advancement of Artificial Intelligence (AI) is also contributing to the wave of layoffs. Federal Reserve officials warn that if AI creates a structural shift in labor demand, monetary policy (such as interest rate cuts) will no longer be an effective tool. For China, the impact of a 10% tariff reduction is seen as insignificant compared to domestic problems. Louise Loo, head of Asia economics at Oxford Economics, estimates that the deal “will add at most 0.2% to China’s growth forecast next year.”

Ultimately, the “friendly atmosphere” in Busan cannot hide the fact that this is only a temporary “ceasefire.” The actions in the run-up to the summit, such as Trump’s green light for the Pentagon to resume nuclear testing, have made that clear. Strategic competition and deep mistrust between the US and China remain the main currents.

The Trump-Xi meeting in Busan succeeded in achieving its minimum objective: preventing a full-blown trade war. It provided a “one-year” break for the world’s two largest economies to focus on resolving pressing internal issues. Both Washington and Beijing have “bought” time, but the clock is still ticking on unresolved structural disagreements.