iFan-style multi-level virtual currency: The world stays away, Vietnamese villages fall into the trap

Taking advantage of the rise of the concept of cryptocurrency, many multi-level marketing organizations disguised as virtual currency issuance projects have flooded into Vietnamese villages.

Ponzi schemes, or simply called multi-level marketing schemes, have become very popular recently under the guise of initial coin offerings (ICOs). Hiding under the guise of bold, potential business projects that are selling shares in the form of cryptocurrency to raise capital, many multi-level marketing schemes have been exposed and boycotted by the cryptocurrency community.

Most of these projects quickly became "dead coins", no one traded them anymore and were abandoned by the disguised multi-level marketing groups.

Graveyard of "dead coins" disguised by multi-level marketing

According to Coinmarketcap statistics, there are hundreds of virtual currencies with market capitalizations under 1 million USD and most of them are currently “dead coins” and “trash coins”. These virtual currencies have in common that they draw bold, new business ideas, aiming at a fertile market. However, all of them are just excuses for the development team to collect investment money.

|

The virtual currency iFan, which has just been accused by many Vietnamese investors of defrauding 15,000 billion VND, is a typical example of this model. iFan calls itself a "blockchain 4.0 technology application", helping to manage the income of artists in Vietnamese showbiz and has collaborated with many famous Vietnamese artists.

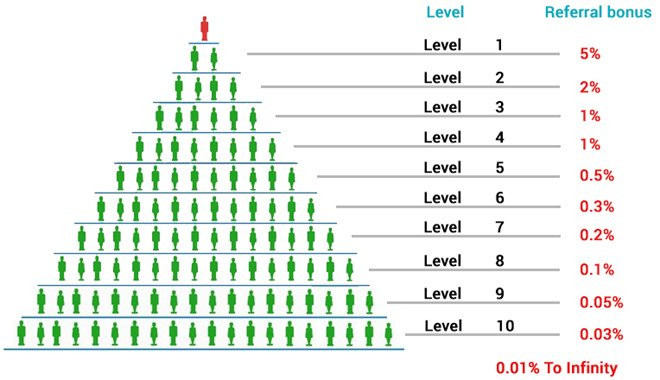

However, under the above cover, iFan is essentially just a meaningless virtual currency operating under a disguised multi-level marketing model, taking money from later investors to pay earlier investors, a scam that is all too common in Vietnam.

Before iFan, there were many similar projects in the world. There was a project that wanted to “revolutionize the adult film industry” by issuing virtual currency to help transactions in the industry between producers, viewers and actors be untied by virtual currency. In fact, this was just a drawing to collect investment money. Quickly, investors around the world realized the trap that these ICOs set and stayed away. The virtual currency named Titcoin quickly became a dead coin, with a trading volume of less than 200 USD per day.

The most famous of the virtual currencies operating as Ponzi models is Bitconnect. This is one of the algorithmic currencies that the world community has firmly affirmed as a disguised multi-level model throughout 2017. However, this currency is still widely promoted and thriving in Vietnam.

|

| Le Ngoc Tuan, who called on many investors to participate in the iFan project, was accused of fraud by many people. |

The outcome was predictable, in early 2018, Bitconnect announced its closure. Many Vietnamese investors lost hundreds of millions of dong when their assets in the form of virtual currency that were being lent to Bitconnect at high interest rates became worthless.

Bitconnect’s modus operandi was to lure new investors with lucrative interest rates of up to 40% per month and then use the money from later investors to pay back earlier investors. With only about $4,000 in daily trading volume, Bitconnect is listed in the “dead coin graveyard”, as a reminder to the global cryptocurrency community that the high-interest cryptocurrency lending model has no other definition than a disguised pyramid scheme.

Get-rich-quick traps

The later multi-level virtual currencies still maintained the same model that Bitconnect applied. Advertisements on many channels continuously filled the heads of gullible investors with concepts such as 1-5% profit per day, committed profit of over 40% per month, investors are participating in a “revolution that contributes to promoting the industry”. However, it was all just a dream.

Following Bitconnect, Lendconnect is even more generous when it commits to a 160% profit in a month with an 8% bonus for each new investor that participants invite. In addition, Lendconnect's operating model is completely no different from Bitconnect.

|

| Bitconnect's scam model is old in the world, but still new in Vietnam. Photo: Medium. |

Although this virtual currency is still paying interest to investors, but with the lesson from Bitconnect, the world's virtual currency investment community has cautiously stayed away from this project. It is not surprising that each day there is only about 120 USD of Lendconnect transaction volume, a number that shows that this currency is officially "dead".

Another more cautious name is HomeBlockCoin. The virtual currency operates in the same form as Bitconnect with a lower interest rate, only about 10% per month. However, this is still much higher than bank interest rates and the commission for inviting new investors is still 8%, making this virtual currency more viable than Lendconnect when the daily transaction volume is up to about 10,000 USD.

These virtual currencies use old tricks in the world, but are still very new in Vietnam, especially in the countryside. That is why iFan has swindled up to 15,000 billion VND from many classes of Vietnamese investors, including students, office workers, and people in the countryside with "investment training" courses that explain in detail how to participate. With attractive "investment packages", many people have devoted all their assets to these disguised projects.

Currently, Modern Tech, the legal entity of the fraudulent cryptocurrency systems, remains silent about the accusation of "fraud of 15,000 billion" in Vietnam. According to people in the group that took to the streets on April 8, this number is an estimate, there are no exact statistics, but the actual amount of money lost could be higher.