Convenience when paying pension via ATM card

(Baonghean) - In the digital age, using an ATM account is not too strange for the majority of workers and brings many benefits to users. Since June 2019, Nghe An Social Insurance has coordinated with the Provincial Post Office and commercial banks to open free ATM accounts for pensioners and social insurance beneficiaries.

Convenient for people

In early June 2019, the Bank for Investment and Development of Vietnam directly sent staff to the wards and communes of Truong Thi, Quan Bau, Doi Cung, Hung Dong, and Dong Vinh to propagate and guide people about the benefits of this service.

For a long time, I have heard a lot about paying pensions via ATM cards. For us elderly people, it is quite difficult to use this service at first. But I think it will only take one or two times to get used to it. Moreover, if we have an ATM card, it will be more convenient for us to receive and transfer money with our children and grandchildren in the family because they all use electronic money transfer transactions via ATM accounts."

|

| Instructions for people to participate in social insurance. Photo courtesy of Duc Anh |

Vinh City is the locality chosen by commercial banks in the province to implement this content. To facilitate the implementation, commercial banks, based on the zoning of propaganda areas, have directed their affiliated units and branches in the same system in Nghe An province to organize propaganda and mobilize card opening in each ward and commune in appropriate districts and cities, ensuring the most convenience for pensioners and social insurance beneficiaries.

“Through propaganda, we see that people are very excited about the service of paying pensions via ATM cards. Therefore, although there are still some concerns, we have promptly answered questions so that people understand the benefits of this service, which is fast, accurate payment, saving time for beneficiaries. For the convenience of people, banks are currently free to make cards for all beneficiaries with simple and quick procedures and people will have the card in just 3-5 days.”

|

| People come to receive social insurance benefits at the People's Committee of Xuan Lam commune (Nam Dan). Photo: Thanh Thuy |

As of the April 2019 pension payment period, the number of people receiving pensions and social insurance benefits via ATM accounts in the whole province was 15,497 people, with an amount of 76,312 million VND. Although this rate reached 9.6% of the number of people and 12.5% of the total monthly pension payments, according to the assessment of the provincial Social Insurance, the payment rate via ATM cards is still low and most of the beneficiaries were paid via cards while still working in the units.

“Although the payment method via ATM card accounts for a small proportion, it has initially achieved important results. From there, it has contributed to changing awareness, customs, habits as well as raising awareness of the benefits of a part of the population in non-cash payments.”

Expanding service audience

On February 23, 2018, the Prime Minister issued Decision No. 241/QD-TTg approving the Project to promote payment via banks for public services with the aim of promoting payment for public services and social security payments via banks; contributing to the development of e-Government, improving access to banking services in the economy and developing non-cash payments.

In order to save waiting time, reduce travel costs and ensure cash safety for pensioners and social insurance beneficiaries, from June 2019, Nghe An Social Insurance cooperated with commercial banks with branches in the province (Vietnam Joint Stock Commercial Bank for Foreign Trade; Vietnam Bank for Agriculture and Rural Development; Vietnam Joint Stock Commercial Bank for Investment and Development; Vietnam Joint Stock Commercial Bank for Industry and Trade; Ho Chi Minh City Housing Development Joint Stock Commercial Bank) to open free ATM accounts for pensioners and social insurance beneficiaries at pension and social insurance benefit payment points.

|

| Retirees will not have to bring their books to receive their salaries. Photo courtesy |

According to Mr. Le Truong Giang - Director of the Provincial Social Insurance, payment via ATM card will create conditions for people to receive monthly pensions and social insurance benefits. Thanks to that, instead of having to go to payment points and wait to receive pensions and social insurance benefits, pensioners and social insurance benefits will receive their pensions and social insurance benefits via ATM card before the 4th of each month. Receiving pensions and social insurance benefits via ATM card will also save time and travel costs for beneficiaries and especially ensure the safety of the received money.

For effective implementation, the provincial Social Insurance has organized work with the provincial Post Office and commercial banks to unify the contents and methods of introducing pension and social insurance benefits payment through accounts.

At the same time, the units have also stepped up propaganda and encouraged beneficiaries to open ATM cards to receive pensions through their accounts at cash payment points during the June 2019 pension payment period. In the coming time, to help people understand this issue, the Social Insurance will have an "Open Letter" on receiving pensions through personal accounts to pensioners and monthly social insurance regimes at payment points.

|

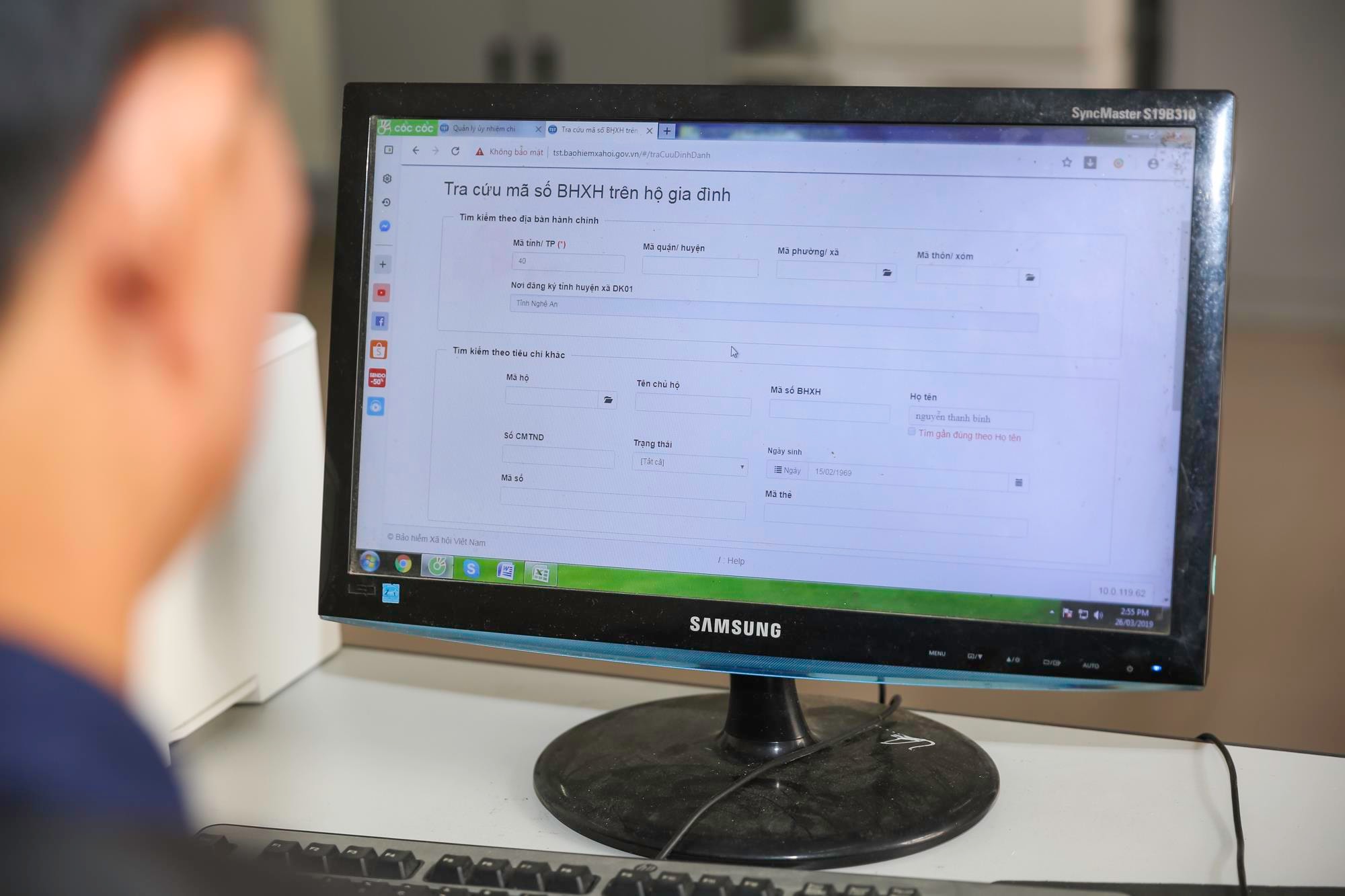

| The software system regularly updates social insurance participants. Photo courtesy of Duc Anh |

Currently, in the first month, although the pilot program has just been implemented in Vinh city, hundreds of people have registered to change the method of receiving pensions and social insurance benefits from cash to ATM cards. This is also the basis for Nghe An to strive to achieve the target of 20% of social security payments being made through banks by 2020.

![[Infographics] BHXH Nghệ An: Nỗ lực triển khai Đề án 06 đem lại nhiều tiện ích cho người dân, doanh nghiệp [Infographics] BHXH Nghệ An: Nỗ lực triển khai Đề án 06 đem lại nhiều tiện ích cho người dân, doanh nghiệp](https://bna.1cdn.vn/thumbs/540x360/2024/12/19/uploaded-thanhthuybna-2024_03_30-_bna-nguoi-dan-co-the-tra-cuu-thong-tin-bhxh-ngay-tai-bo-phan-1-cua-cua-bhxh-tinh-anh-dinh-tuyen-7433.jpg)