Policy credit effectively supports poverty reduction programs

(Baonghean.vn) - Nghe An is the province with the 4th largest source of policy capital in the country, policy credit growth continues to achieve high results. Thanks to policy capital, thousands of policy beneficiaries in the province have been able to access increased income, gradually improving their lives.

Giving "fishing rods" to change lives

Together with the staff of the Social Policy Bank of Nam Dan district, we visited the family of Ms. Ton Thi Vinh in Hamlet 5, Nam Thanh commune. In 2015, after her husband passed away, Ms. Vinh's family fell into poverty and deadlock when the family of four only relied on Ms. Vinh's labor and a few acres of contracted rice fields.

Ms. Vinh said: “Luckily, at that time, the Nam Dan District Social Policy Bank lent me 20 million VND. I used the loan to buy a breeding cow, then worked hard to take care of it so that it would give birth to calves quickly. Part of the remaining money was used to build a cow barn. Luckily, the cow gives birth once a year, so by 2028, I will have paid off all my bank debt and still have 2 cows as capital.”

Thanks to the first loan and hard work, Ms. Vinh's family escaped poverty, and she continued to borrow under the near-poor household category with 30 million VND to buy 2 more cows. Each year, each cow gives birth to a litter, and she has money from selling cows to invest in buying more breeding chickens. To date, Ms. Vinh has paid off all her bank debt and her family now has 4 breeding cows and a flock of more than 200 chickens. The family's economy is stable, she has the conditions to take care of her elderly mother and 2 children's education.

Also rising from a poor household to a well-off household thanks to a loan from the Social Policy Bank is Ms. Pham Thi Yen's family in Hong Son hamlet, Kim Lien commune. Previously, her family was only familiar with farming, the income of the whole family of 6 people depended on more than 1 hectare of rice field. "In 2020, I applied for a policy loan to buy a cow in 2020. After the cow gave birth, I paid off all the debt. In early 2023, I continued to borrow 50 million VND to buy breeding animals including pigs and chickens and used a part to build a biogas tank to ensure environmental hygiene for raising animals, while taking advantage of the gas source for cooking to serve family needs, saving costs" - Ms. Yen said.

Currently, Ms. Yen's pig herd has 8 pigs for meat and 2 sows that have just given birth. It is expected that after the piglets are sold, she will be able to pay off most of the bank debt and have capital to continue developing the economy.

Mr. Nguyen Sy Hai - Director of Nam Dan District Social Policy Bank said: "We have always maintained a loan source higher than the average level of the province, mobilizing nearly 16 billion VND in savings deposits in the first 9 months of 2023. This is thanks to the branch early advising the commune representative boards to coordinate propaganda and find customers to deposit savings at the commune transaction points.

Nam Dan district is building a new model rural area, so the Party Committee and the government pay great attention to investing in economic development and helping people access loans. The loan group representatives are also actively promoting their effectiveness.

In Quynh Nghia commune (Quynh Luu), there are currently many households that borrow capital from the Social Policy Bank to invest in their children's education and agricultural production, and many households also borrow to invest in deer farming. For example, Ms. Truong Thi Lien in village 2, Quynh Nghia commune, in 2022 borrowed 100 million VND from the Social Policy Bank's employment source, she spent all of it to buy breeding deer, the average price of each breeding deer is about 13 million VND. After 1 year of care, her herd of 12 deer has been harvesting deer antlers quite regularly.

Seeing the effectiveness of preferential loans, more and more households in Quynh Nghia commune have registered for loans. Currently, the total outstanding loan balance of Quynh Nghia commune's Social Policy Bank is about 4 billion VND; most of the households that borrowed the loans have made good use of the loan, paid interest on time and have no bad debts.

According to the assessment of the Representative Board of the Social Policy Bank of Quynh Luu district, in the first 9 months of 2023, social policy credit capital has supported investment capital for production and business, creating jobs for more than 1,300 workers; helped 154 students in difficult circumstances borrow capital for studying; built nearly 7,000 clean water and rural environmental sanitation works; 22 social housing units for policy beneficiaries; disbursed loans to 13 households to buy computers and online learning equipment for students. Along with the growth of outstanding loans, improving credit quality is focused on implementation.

Outstanding debt continues to increase significantly.

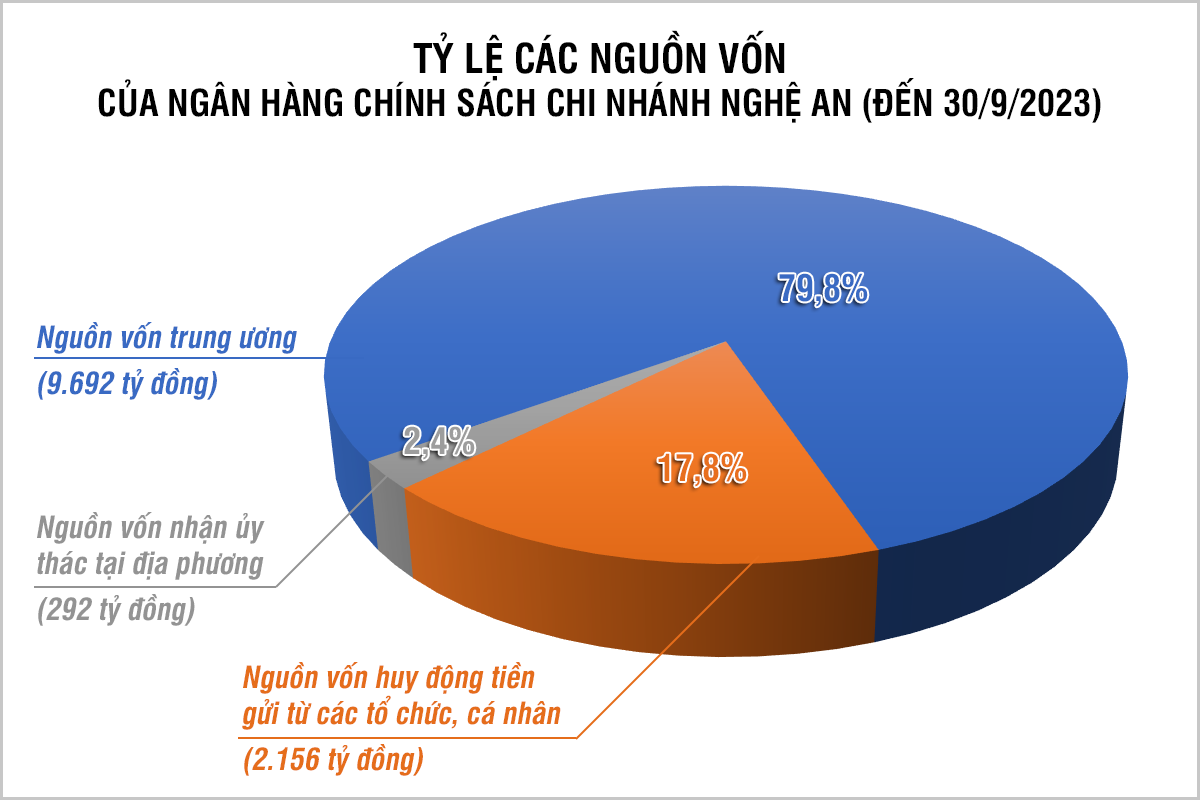

By September 30, 2023, the total capital for implementing policy credit programs reached VND 12,140 billion, the fourth highest in the country, with a growth rate of 11.6%. Nghe An's total outstanding policy credit balance reached over VND 12,126 billion, with a growth rate of 11.61%, 2.64% higher than the same period last year. There are 10 credit programs with outstanding debt growth compared to the beginning of the year. The growth rate of outstanding debt is equivalent to the growth rate of capital, which proves that the management of capital sources and disbursement of capital sources is very good and timely, without leaving capital stagnant.

The entrusted associations and organizations have supervised the savings and loan groups to ensure transparency and the right subjects; guided the preparation of documents and procedures, and coordinated with the bank to organize timely disbursement to each household at the commune transaction point. The growth rate of outstanding loans managed by the 4 associations is relatively even and all achieved an increase of over 10%.

In the first 9 months of 2023, Nghe An has provided preferential credit capital to 60,417 poor households and other policy beneficiaries to borrow capital for production, business, renovation of clean water tanks, sanitation works, purchase of social housing, purchase of learning equipment for children to serve their studies...

Vice Chairman of the Provincial People's Committee, Head of the Board of Directors of the Provincial Social Policy Bank - Mr. Bui Thanh An said that in recent times, the activities of the Social Policy Bank continued to achieve good results, with many bright spots; lending was quite high in the context of low credit growth in the entire banking sector; the digitalization of mobile banking was deployed to guide customers in using the service... Social policy credit continued to make important contributions, contributing to the completion of the socio-economic development targets of the province in the first 9 months of 2023.

In addition to the achieved results, in fact, since the beginning of the year, many localities in the province have been severely affected by natural disasters, such as heavy rains causing floods, flash floods, landslides, etc., causing serious damage to people, property and people's lives; at the same time, affecting the loan capital of policy credit programs. Some loan programs for residential land, production land, value chain loans and planting precious medicinal plants have encountered difficulties because there is no approved list of beneficiaries to have a basis for proposing capital arrangement and timely disbursement, while the duration of these programs is not much left.

To successfully complete the annual plan, Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank said: The Provincial and District Board of Directors are continuing to advise districts and towns to promptly arrange budget sources to supplement loan capital in 2023 and 2024; review beneficiaries of credit programs according to Decree 28/ND-CP of the Government, districts promptly approve the list to request additional capital and timely disbursement. The District Social Policy Bank, entrusted organizations and related units effectively implement preferential credit policies and guidelines in the area, promptly disburse capital; closely monitor capital sources to ensure loans to the right subjects, use capital for the right purposes, and promote efficiency.

We also pay special attention to implementing the loan program for people who have completed their prison sentences according to the Prime Minister's policy; consider handling risky debts due to objective reasons during the recent floods in the province. Continue to promote the provision of Mobile Banking services to customers; promote the service so that people know and use it, contributing to increasing benefits for customers in general and policy beneficiaries in particular...".