Policy credit creates 'leverage' to solve employment in Nghe An

The job creation loan program of Nghe An Social Policy Bank has created a lever to support people in starting businesses, expanding production scale, developing business, contributing to the goal of sustainable poverty reduction.

Workers have jobs from credit capital

With the desire to develop the family economy as well as create jobs and increase income for local people, in 2021, Mr. Duong Van Toan in Hong Thap hamlet, Nghia Loc commune, Nghia Dan district boldly borrowed capital from the Social Policy Bank to grow oyster mushrooms. From the capital of more than 100 million VND from the Social Policy Bank's job creation program, he invested in building a mushroom growing facility and developing the family economy. This is the first mushroom growing model in the commune. The main raw materials for growing mushrooms are sawdust and agricultural by-products such as leaves, tree trunks, straw... all of which are environmentally friendly, especially without the use of pesticides.

Mr. Toan said: The locality is a mountainous commune, about 19km from the center of Nghia Dan district, people's lives still face many difficulties, therefore, young people borrowing policy capital to implement economic development models are always encouraged to replicate. This is a green economic model, taking advantage of by-products in production to create clean, environmentally friendly products. Growing oyster mushrooms is a sustainable direction when it has stable output and income, creating jobs for local people.

For Ms. Pham Thi Mui in Nam Giang commune (Nam Dan), growing and taking care of flower gardens and ornamental plants is not only a job but also a passion since childhood. In 2020, Ms. Mui's family, through the Commune Women's Union, received a loan of 100 million VND from the National Fund for Employment Support from the Social Policy Bank (CSXH) of Nam Dan district to develop the family economy. With this capital, Ms. Mui imported flowers and ornamental plants to care for and do business. Up to now, her family's economy has stabilized, paid off all bank loans, the couple has regular jobs, stable income, and the quality of life is increasingly improved.

Nghi Dong (Nghi Loc) is a commune located in the Southeast Economic Zone, with N5 road and the North-South expressway passing through, facilitating socio-economic development. However, the current economy is mainly agricultural production and some small-scale service businesses.

Identifying the important role of social policy credit, in recent years, Nghi Dong commune leaders have coordinated with the Social Policy Bank to effectively implement credit programs in the area. In particular, special attention is paid to allocating capital sources, evaluating loan subjects, strengthening inspection and supervision of borrowers' capital use process. Every year, focusing on directing the review of poor and near-poor households and policy subjects in the area to invest capital sources to help develop production, business and create jobs for people.

Currently, the commune is implementing 9 social policy credit programs. The total outstanding debt is 17,808 billion VND, with 10 savings and loan groups, 344 households with outstanding loans (as of June 30, 2024). The loan models are operating effectively, typically the cow breeding and fruit tree growing model of Mr. Hoang Huu Chung's household, the restaurant business investment model of Ms. Hoang Thi Trinh's household, the mechanical goods business model of Mr. Nguyen Dinh Son's household...

Currently in Nghi Loc, the outstanding policy credit balance has reached 643,653 billion VND, of which the job creation program is 63,799 billion VND. People's income has gradually increased, the face of the countryside has become more prosperous.

Contribute to sustainable poverty reduction

Nghe An province has 45,333 poor households, accounting for 5.19%; 50,063 near-poor households, accounting for 5.73%; poor households and near-poor households are mainly concentrated in 4 poor districts: Ky Son, Tuong Duong, Que Phong, Quy Chau; in 76 extremely disadvantaged communes and ethnic minority areas. The poor still face many difficulties in life and need stronger, more effective and practical help and support from the Party, the State and the whole society, especially resources to develop production, increase income and better access to basic social services such as health care, education, housing, clean water and sanitation, and access to information.

Since the Secretariat issued Directive No. 40-CT/TW dated November 22, 2014 on strengthening the Party's leadership over social policy credit work; the Department of Labor, War Invalids and Social Affairs has coordinated with the Provincial Fatherland Front Committee, departments, branches, members of the Board of Directors of the Provincial Social Policy Bank and localities to advise on the effective implementation of poverty reduction policies of the Central and the province.

Mr. Dang Van Tam - Chairman of Nghi Dong Commune People's Committee said: In the period of 2014 - 2024, Nghi Dong Commune has joined hands with the Bank for Social Policies to invest over 40 billion VND for over 1,350 poor households, near-poor households, newly escaped poverty households and other policy beneficiaries to borrow capital to develop production and business; helping over 560 households escape poverty and near-poverty sustainably. Thereby, the rate of poor households decreased from 8.2% in 2014 to 1.48% at the end of 2023 (a decrease of 6.72%). The capital has encouraged people to actively exploit the potential and advantages of the locality to develop the economy.

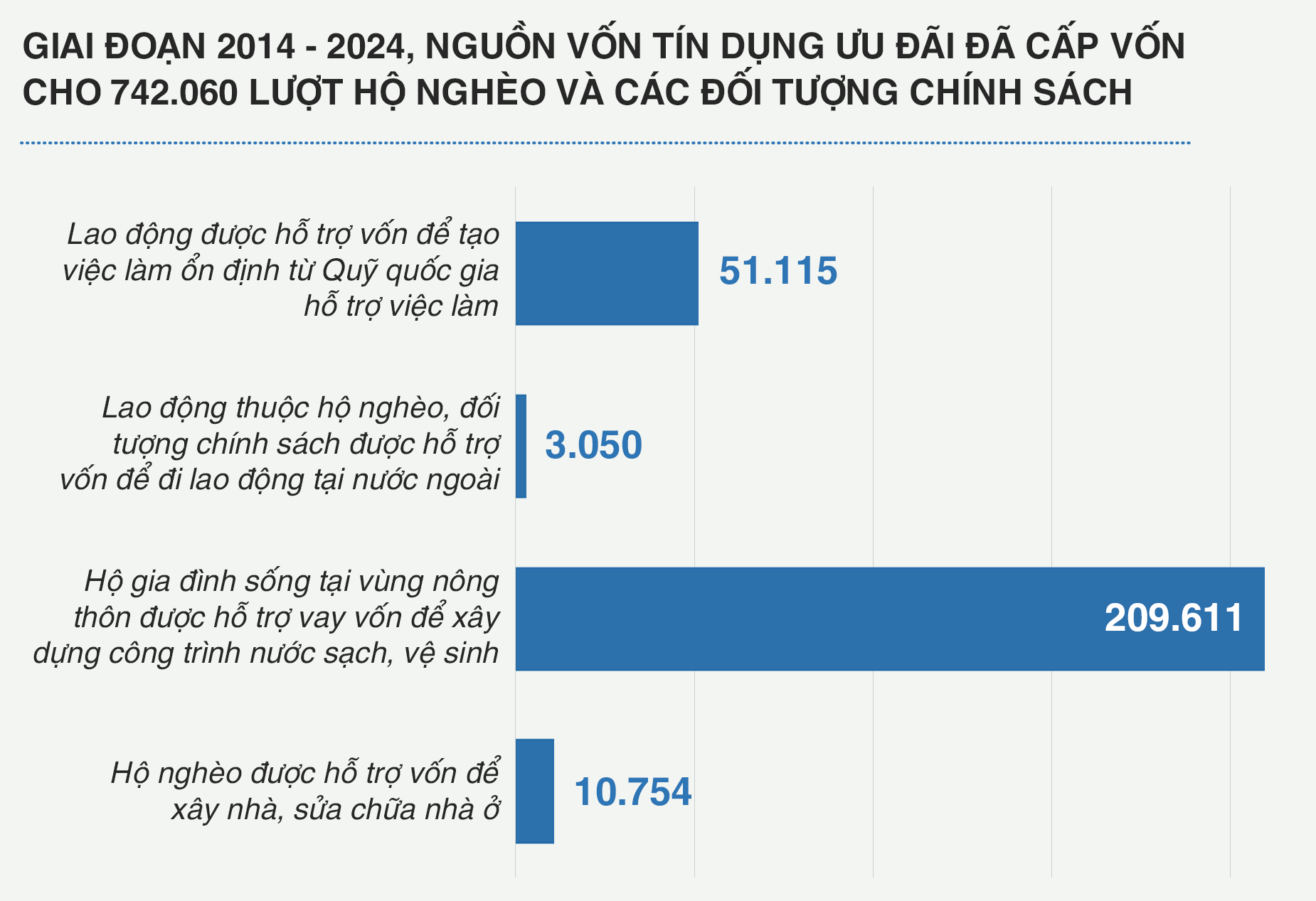

According to the synthesis from the Provincial Social Policy Bank, in the period of 2014 - 2024, preferential credit capital has provided capital to 742,060 poor households and policy beneficiaries in the whole province, of which 51,115 workers received capital support to create stable jobs from the National Employment Support Fund; 3,050 workers from poor households and policy beneficiaries received capital support to work abroad; over 209,611 households living in rural areas received capital support to build clean water works and sanitation works; 10,754 poor households received capital support to build and repair houses...

Mr. Vi Ngoc Quynh - Deputy Director of the Department of Labor, War Invalids and Social Affairs said: Policy credit capital has truly become an important solution to help the province successfully implement the goals and tasks of sustainable poverty reduction, job creation in the province, actively contributing to the implementation of National Target Programs on poverty reduction, new rural construction and socio-economic development of localities across the country.

“In order to create a more stable legal basis for social policy credit activities, to achieve the economic development goals and ensure social security of the Party and the State, it is proposed to add households with average living standards to the credit programs of the Vietnam Bank for Social Policies. At the same time, supplement local capital sources to entrust loans to the poor and policy beneficiaries in the area,” the leader of the Department of Labor, Invalids and Social Affairs emphasized.