Black credit: Old scenario, new victims

Black credit, with its attractive promises of high interest rates, has become a dangerous trap for many people in Nghe An over the past decade, creating a lasting pain for the community. It is worth mentioning that despite being warned many times by the press and media, this tragedy continues to happen, raising urgent demands for stricter and more effective management measures.

STRICT MANAGEMENT MEASURES

Over the past 5 years, Nghe An province has continuously witnessed debt defaults related to black credit, causing much pain to the community, typically:

The nearly 100 billion VND debt default in Cua Lo and Nghi Loc towns (2017): Two sisters, Tran Thi Oanh and Tran Thi Xuan, mobilized capital from local people at high interest rates.

The incident at Hung Thao gold shop, Con Cuong town (2020): Hung Thao gold shop in Con Cuong town declared bankruptcy, with the amount involved up to tens of billions of dong. Hundreds of people were affected when they deposited money in the hope of receiving high interest rates.

Incident in Quynh Long commune, Quynh Luu district (October 18, 2024): Hundreds of people gathered in front of the house of Mrs. Bui Thi Nhung, one of the major capital mobilizers in the locality, with the promise of high interest rates.

The above cases are clear evidence of the terrible consequences of black credit. Although they occurred at different times, they all have the same scenario: mobilizing capital from people with the promise of high interest rates, then declaring bankruptcy when unable to maintain the source of money to pay interest.

Black credit not only causes financial losses but also leaves mental scars for the whole community. Lenders, from households to individuals, are facing the loss of all their assets, leading to a severe psychological crisis. Many people have lost their life savings, even mortgaged assets such as land certificates and borrowed more to have enough money to invest in these lines.

The consequences are not only the loss of money but also the breakdown of family and friendship relationships due to financial stress. Many people have to leave their hometowns to find other jobs, trying to rebuild their lives. Others are stuck, living in fear and pressure of debt collection from other black credit organizations. This situation has caused many families to fall into misery and society to become unstable.

LEGAL GAPS THAT NEED TO BE FIXED

The debt defaults related to illegal credit in Nghe An not only reflect the lack of financial management knowledge of the people, but also point out the legal loopholes in controlling underground credit activities. Many scammers take advantage of people's trust, organizing unofficial credit activities, with interest rates far exceeding the law.

Civil Code 2015: Article 468 stipulates that the loan interest rate must not exceed 20%/year of the loan, unless otherwise provided by law. Black credit lending at interest rates higher than this level is a violation of the law.

Penal Code 2015 (amended and supplemented in 2017): Article 201 stipulates the crime of "Lending at high interest rates in civil transactions" if the illegal profit is from 30 million VND or more, can be punished with imprisonment from 6 months to 3 years.

Decree 144/2021/ND-CP: Regulates administrative sanctions for violations such as usury and illegal capital mobilization, with fines ranging from 20 to 100 million VND.

Underground credit activities often take place secretly, are difficult to detect and are often hidden under legal transactions such as property purchase and lease contracts. Along with that, many people lack legal knowledge and are attracted by high interest rates without clearly recognizing the potential risks. This creates opportunities for black credit to thrive, causing many serious consequences for society, such as debt, loss of property, and economic instability in the community.

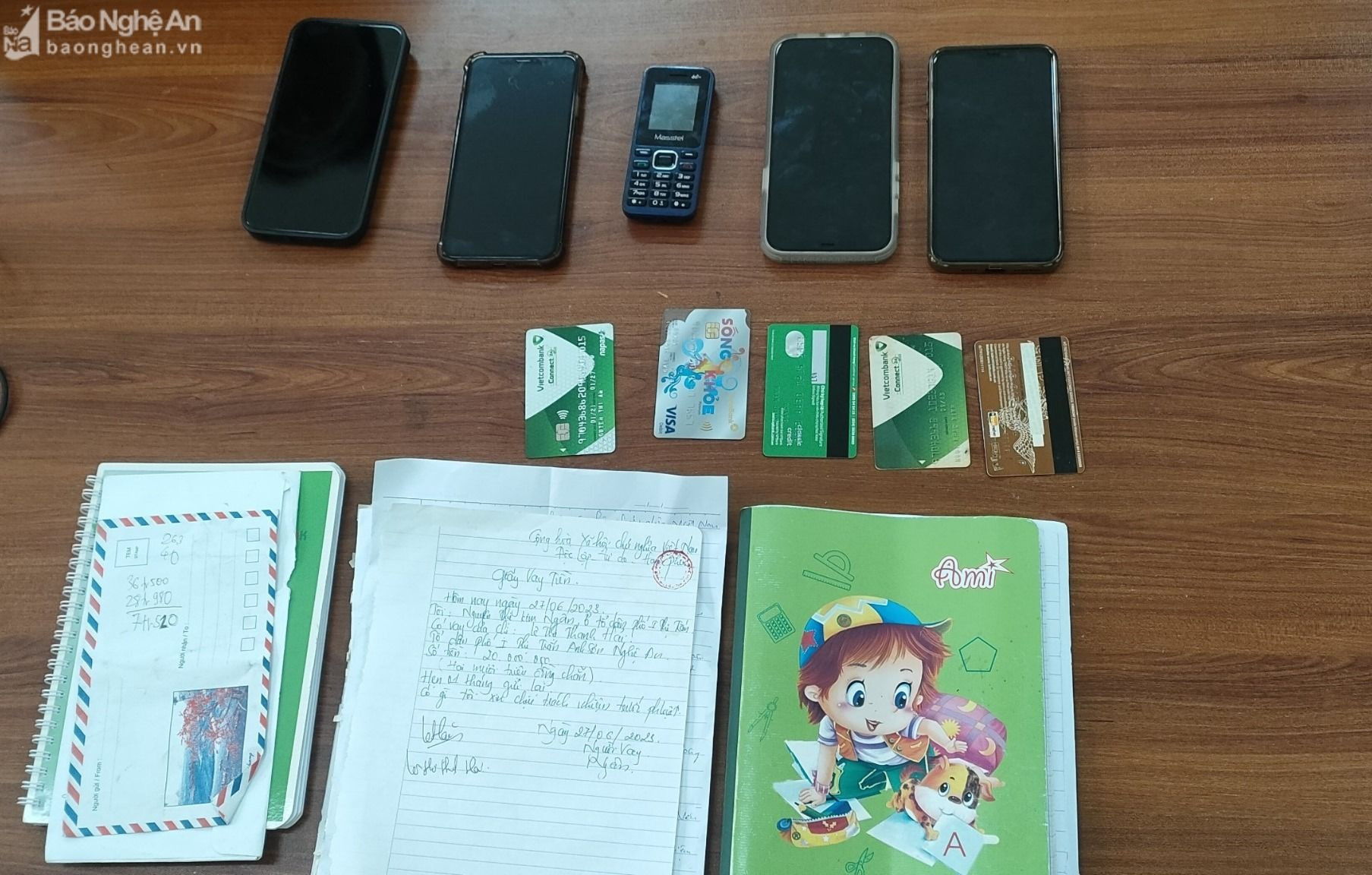

The lack of close coordination between authorities also makes the investigation and handling process slow and complicated. Black credit operators often use sophisticated tricks such as taking interest in advance (about 10 days), keeping the borrower's identity documents, making it difficult for authorities to prove the loan sharking behavior.

COOPERATION IS REQUIRED FROM THE GOVERNMENT AND FINANCIAL INSTITUTIONS

1. Monitoring and handling of violations:Authorities at all levels must improve the effectiveness of supervision, ensuring that usury is detected and handled promptly. This requires close coordination between functional agencies such as the police, judicial agencies and local authorities, to implement preventive measures from the root. This not only protects people from financial risks but also deters usury, reducing the development of black credit.

2. Propaganda on media channels:This is a key factor in helping people become aware of the risks of black credit. Therefore, the government needs to organize seminars and communication programs to provide information on legal forms of lending, signs of fraud and how to protect their rights. This helps people, especially in rural areas, have a clearer view, thereby limiting fraud and finding safer lending solutions.

3. Expanding official credit channels:Formal financial institutions need to play their role well in providing safe credit products with reasonable interest rates, while minimizing complicated procedures for people to easily access. Expanding loan channels from banks or social credit funds helps people not to have to resort to black credit when facing financial difficulties. This not only helps people stay away from black credit but also creates long-term economic stability for the community.

4. Developing financial support programs for rural and mountainous areas:For areas with limited access to financial services, bringing loan support programs closer to the people is very important. Banks and financial institutions should cooperate with local authorities to implement micro-credit programs, helping people to borrow small loans at preferential interest rates. This not only creates opportunities for sustainable economic development but also reduces the risk of people being lured into illegal credit lines.

The incidents of default from black credit are not only a simple financial issue, but also a lesson in strict control and raising people's awareness of financial risks. By implementing synchronous legal measures and support from financial institutions, we aim to build a healthier economic environment, so that tragedies like black credit have no chance to recur.