The situation of life insurance fraud in Nghe An is increasingly complicated.

(Baonghean.vn) - In Nghe An recently, there have been many individuals and organizations deliberately violating regulations in insurance business for personal gain.

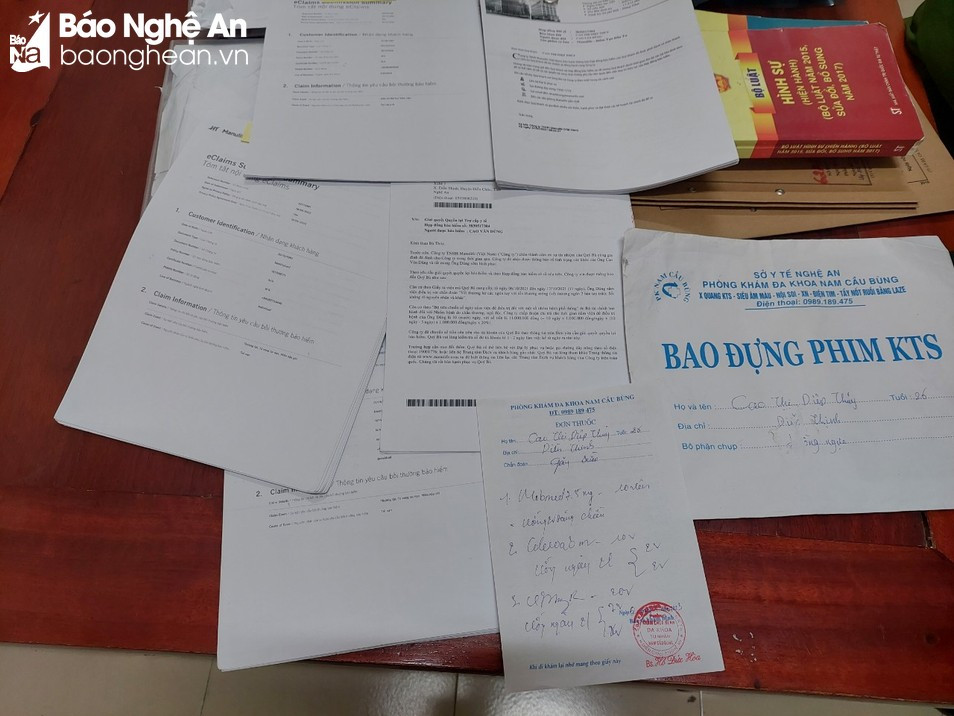

Swapping patient names, falsifying records

At the end of December 2023, Dien Chau District Police prosecuted 5 subjects for their behavior.“Fraud in insurance business”, profiting more than 1.1 billion VND. The above subjects all reside in Dien Chau district, including: NTH - Dien Xuan commune; CTDT - Dien Thinh commune; NTM - Dien Thap commune (all 3 subjects work at Dien Xuan Private Internal Medicine Clinic and are insurance agents of Manulife Vietnam Company Limited). Also prosecuted are LTP residing in Truong Thi ward - Vinh city, working at the High-quality Medical Examination and Treatment Center, No. 157 Nguyen Phong Sac street - Vinh city and NVH residing in Dien Ky commune - Dien Chau, working at Nam Cau Bung General Clinic. In which, NTH is considered the leader of this line.

As an agent of Manulife Vietnam Co., Ltd., NTH realized that the process of paying insurance benefits to customers with broken bones was quite easy, so he came up with the idea of falsifying medical records for personal gain. Therefore, H. colluded with the remaining 4 subjects to commit the crime. Accordingly, when discovering that a patient came to the hospital or clinic for examination and treatment with a broken bone, the subjects proactively approached and suggested using another name for the patient to examine and treat the patient (using the name of the person who purchased health insurance). After that, the subjects kept the medical records to request Manulife Vietnam Co., Ltd. to pay insurance benefits (each medical record with a broken bone will be paid from 30 million to 150 million VND).

When there were no actual patients, the subjects colluded with some staff working at hospitals and clinics with X-ray functions to edit film images and sign fake documents. These medical examination records were carried out under the form of fee collection, without using health insurance to avoid inspection and supervision by the Social Insurance agency of Nghe An province.

Initially, the police determined that the subjects had created 15 sets of fake medical records and made 22 requests for insurance benefit payments to Manulife Vietnam Company Limited, with a total amount paid of more than 1.1 billion VND.

Previously, on July 24, 2023, the Investigation Police Agency of Nghe An Province also issued a Decision to prosecute the case, prosecute the defendants to investigate and clarify the acts of fraud to appropriate property, forgery in work, fraud in health insurance to profit from life insurance money, causing damage to health insurance occurring at a number of hospitals and medical examination and treatment facilities in the province, initially arresting 5 related subjects.

Specifically, LTHA residing in Block 2, Quan Bau Ward; NTQA residing in Nghi Kim Commune (Vinh City) and TTM residing in Block 4, Tan Ky Town (Tan Ky District), colluded with NQV residing in Block 3, Tan Ky Town, an X-ray technician at Tan Ky District Medical Center, to falsify medical records of broken bones for people who needed to make medical records to request payment of life insurance benefits.

After obtaining the fake medical records, the subjects transferred them to those who needed to make records to pay for insurance with the amount of 300 to 400 million VND/set of medical records. For each case paid by the insurance company, LTHA benefited from 100 million to 200 million VND.

Expanding the investigation, the police discovered that LTHA also colluded with T.D.L. residing in Trung Hoa block, Ha Huy Tap ward (Vinh city), a doctor of the Cardiology Department, Vinh University of Medicine and Pharmacy Hospital, to create fake medical records to fraudulently pay for insurance money.

Through investigation, it was found that the subjects had created hundreds of fake medical records to appropriate life insurance money and profit from health insurance, totaling a large sum of about 10 billion VND.

Regarding the case of LTHA and his accomplices colluding to profit from 10 billion VND, it is known that before the Nghe An Provincial Police Department issued a decision to prosecute the case and prosecute the accused, the Police Department had sent a document requesting Nghe An Social Insurance to coordinate in providing payment and settlement data of 268 patients with health insurance cards whose medical records were established and issued by Vinh Medical University Hospital in violation of regulations, with the amount of health insurance payment being over 483.8 million VND. Regarding this case, Tan Ky District Medical Center also established 10 medical records in violation of regulations, but these records were not paid under the health insurance regime.

Alarming situation

The representative of Nghe An Provincial Social Insurance said that on July 25, 2023, the Provincial Social Insurance sent an official dispatch to the directors and heads of health insurance examination and treatment facilities requesting compliance with the provisions of the law, preventing abuse and profiteering of the health insurance fund. The Provincial Social Insurance also emphasized that the crime of health insurance fraud has been stipulated in Article 215 of the Penal Code. At the same time, some acts of social insurance and health insurance fraud are also guided in Resolution No. 05/2019/NQ-HDTP dated August 15, 2019...

Ms. Le Tran Lan Phuong - Sales Director of Nghe An 2 region, Manulife Vietnam Co., Ltd., said: In addition to death benefits, life insurance businesses now tend to expand the scope of insurance benefits such as hospitalization, mild disability, terminal illness... to meet the increasing defense needs of customers, aiming for the most comprehensive protection value. However, this is a loophole for some subjects to commit fraudulent acts.

As a unit that suffered losses in the profiteering case that was discovered by the Dien Chau district police at the end of December 2023, Ms. Phuong said that the amount of profiteering in this case could be much larger. Because the subjects know that the insurance terms for accidents, injuries, and broken bones are paid out at a high rate, they often aim to profit from insurance in these cases. In addition, the subjects also aim to profit through the number of days of hospitalization, because each day of hospitalization will be paid by insurance 500,000 VND, so many subjects are willing to create documents to request insurance payment.

According to Ms. Phuong, when the act of profiteering is successful, the ones whose rights are violated are other genuine insurance customers, because the insurance fund operates on the principle of mobilizing the majority to compensate for the unfortunate few. The insurance company is only the unit that manages the insurance fund on behalf of the customers.

Not to mention, the act of profiteering also affects other genuine insurance participants. Because currently, insurance agencies have made stricter requirements for localities where profiteering occurs frequently. In particular, some medical examination and treatment facilities in Nghe An have been put on the "blacklist", patients who go to these facilities for examination and treatment when applying for insurance will be required to provide some other types of documents such as: detailed bedside list, daily bedside examination form, detailed medical records, and in some cases, they will even be required to take another X-ray or re-examine (for broken bones).

Even some localities with many cases of profiteering and consultants with high insurance payout rates will also be restricted from selling products with hospital benefits. This will also affect cases that really need to participate in life insurance.

“In the face of the current situation of increasing insurance fraud, we hope to receive support from the authorities and local governments, especially in educating people to understand that insurance fraud is a violation of the law. Because Article 213 of the Penal Code also mentions the crime of fraud in insurance business. Especially supporting insurance companies in recovering the stolen money. After all, insurance companies are also victims of this behavior,” Ms. Phuong emphasized.