'Savings and Loan Group' - a model with widespread influence in the work of 'Skilled Mass Mobilization'

Through savings and loan groups, many poor households and policy beneficiaries in Nghe An have the conditions to develop production, increase income, and escape poverty.

"Midwife" of the poor

Savings and loan groups are established by the People's Committee at the commune level, operating in the village with a minimum of 5 members and a maximum of 60 members. The group operates on the principle of collective, majority voting under the direction of the group management board. Members of the savings and loan group management board coordinate, urge, and supervise each other to complete the tasks assigned by the Social Policy Bank through the authorization contract.

Since its inception, savings and loan groups have become an indispensable part of the policy credit implementation model. Based on the requirements of professional tasks, through assessment and experience from practical operations, in 2022, the Provincial Social Policy Bank chaired the scientific research topic: "Solutions to improve the quality of savings and loan groups in a sustainable direction, associated with community activities at the Nghe An Provincial Social Policy Bank branch".

The project has been accepted and recognized as excellent by the Vietnam Bank for Social Policies (according to Decision No. 4451/QD-NHCS dated June 10, 2022). Based on the research project, the Nghe An branch of the Vietnam Bank for Social Policies has developed a project and plan to implement the construction of a network of savings and loan groups in a sustainable manner associated with community activities.

The savings and loan group in Lang Xieng village, Mon Son commune, Con Cuong district, led by Ms. Ha Thi Mo, has 49 members. It is a group built in a sustainable direction associated with community activities according to the branch's pilot project from 2022. The needs of households mainly need capital to serve agricultural and forestry production, livestock development, etc. The group's current total outstanding debt is nearly 3.6 billion VND.

To ensure that the capital is used for the right purpose and effectively, Ms. Ha Thi Mo regularly checks and supervises the use of capital; urges borrowers to pay interest on time, and actively encourages borrowers to save on spending and form the habit of saving. From the loan capital, many households have used policy credit capital effectively, contributing to increasing income and stabilizing life.

Ms. Ha Thi Huong, a member of the group, shared: Since accessing the loan, she has invested in raising buffaloes and cows, planting acacia trees, and community tourism. From a near-poor household, her family now has a stable income and additional savings. Her community tourism business model has also attracted and created jobs for 4 workers who are local people.

Practical effectiveness from a practical perspective

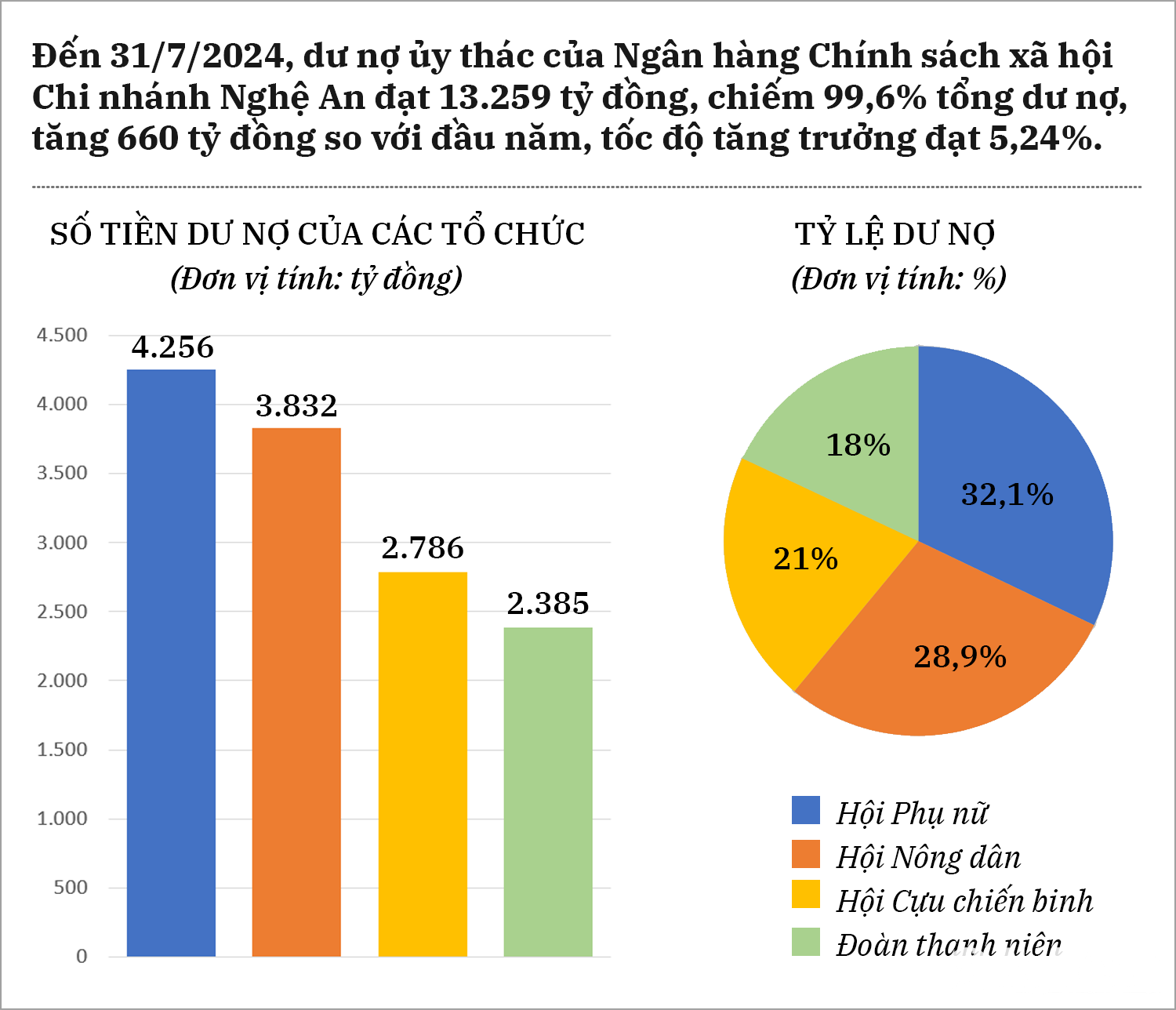

From changes in thinking and working methods of grassroots mass mobilization, the quality of operations of the network of entrustment and delegation; credit quality and performance evaluation indicators of the entire Nghe An province branch have changed dramatically compared to previous years.

As of July 31, 2024, the whole province currently has 6,135 groups (of which, there are 261 sustainable savings and loan groups associated with community activities, including: 93 Farmers' Association groups, 92 Women's Association groups, 40 Veterans Association groups, 36 Youth Union groups). Average outstanding debt reached 2,169 million VND/group, an increase of 118 million VND compared to the beginning of 2024. Evaluation and classification results: good 5,998 groups (accounting for 97.77%); good 108 groups (accounting for 1.42%), average 28 groups (accounting for 0.33%), weak 1 group (0.02%).

The activities of the groups have really brought about great effectiveness and significance in mountainous districts, remote areas, and extremely difficult areas. Propaganda and mobilization work at the grassroots level has been carried out persistently, synchronously, comprehensively, and continuously, bringing about very positive results. From 2022 to now, there have been almost no petitions or letters from people to the next level regarding loans, negative issues have almost completely decreased, and other arising problems have been detected and resolved promptly.

Mr. Hoang Son Lam - Deputy Director of the Provincial Social Policy Bank said: After conducting a field survey of a number of savings and loan group models, the Social Policy Bank, in coordination with the entrusted organizations of Nghe An province, issued Plan No. 122/NHCS-UT dated February 6, 2024 on "Building a network of savings and loan groups in a sustainable direction, associated with community activities in Nghe An province by 2030".

The implementation of the plan has received high consensus from provincial-level organizations, attention from local Party committees and authorities at the grassroots level, and positive response from the people. As a result, phase I of the implementation of the pilot model of sustainable savings and loan groups has exceeded the set target.

Savings and loan groups are considered as an “extended arm” in the process of implementing policy credit, contributing to the timely disbursement of policy credit capital to beneficiaries. At the same time, it reduces costs and time for borrowers and increases access to social policy credit for the poor and other policy subjects. Thereby, helping people have conditions to invest in production development, increase household income and gradually escape poverty sustainably.

The implementation of the sustainable savings and loan group model associated with community activities has contributed to making the quality of savings and loan group network operations, the quality of trust activities, and the credit quality of the Social Policy Bank branch in Nghe An province safe and strong...

Comrade Ngo Dinh Vien - Deputy Secretary of the Party Committee of Nghe An Province's Business Bloc said: The savings and loan group was registered by the Party Committee of the Provincial Social Policy Bank to build a model, a typical example of "Skilled Mass Mobilization" from 2022. Although it is only piloting phase 1, practical operations show that the model of sustainable savings and loan groups associated with community activities demonstrates creativity, uniqueness, and has a strong influence in the province.

The model's performance has gradually improved the effectiveness of policy credit activities in the area, contributing to the successful implementation of national target programs on sustainable poverty reduction, new rural construction and socio-economic development in ethnic minority and mountainous areas.

The Party Committee of the Social Policy Bank is one of 39 outstanding collectives and individuals in studying and following Ho Chi Minh's ideology, morality and lifestyle; implementing the emulation movement "Skilled mass mobilization" and a bright spot in the grassroots democracy regulations for the period 2021-2023, which was commended by the Standing Committee of the Provincial Business Bloc Party Committee in Hanoi in June 2024.